Has Parex Resources Inc (TSE:PXT) Got Enough Cash?

Mid-caps stocks, like Parex Resources Inc (TSE:PXT) with a market capitalization of CA$3.92b, aren’t the focus of most investors who prefer to direct their investments towards either large-cap or small-cap stocks. Despite this, the two other categories have lagged behind the risk-adjusted returns of commonly ignored mid-cap stocks. Today we will look at PXT’s financial liquidity and debt levels, which are strong indicators for whether the company can weather economic downturns or fund strategic acquisitions for future growth. Don’t forget that this is a general and concentrated examination of Parex Resources’s financial health, so you should conduct further analysis into PXT here. Check out our latest analysis for Parex Resources

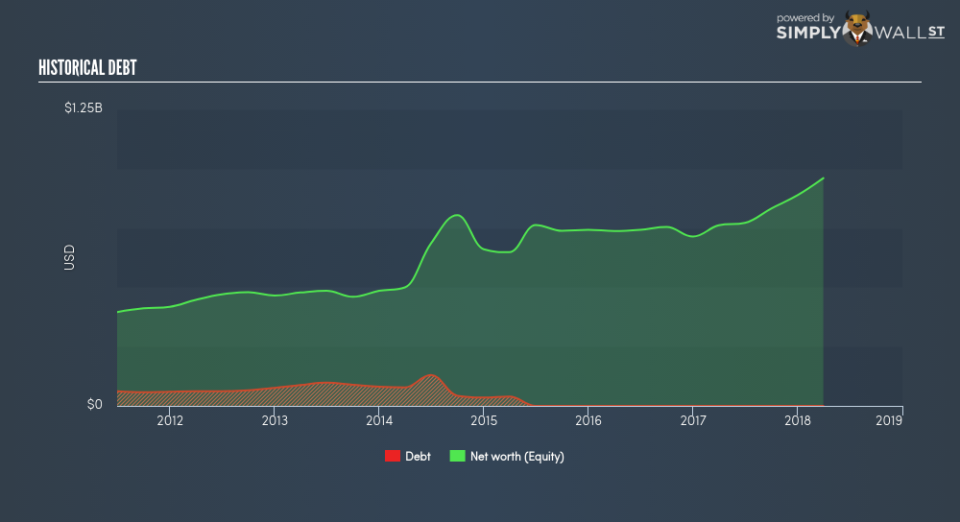

Does PXT face the risk of succumbing to its debt-load?

Debt-to-equity ratio standards differ between industries, as some are more capital-intensive than others, meaning they need more capital to carry out core operations. Generally, mid-cap stocks are considered financially healthy if its ratio is below 40%. The good news for investors is that Parex Resources has no debt. This means it has been running its business utilising funding from only its equity capital, which is rather impressive. Investors’ risk associated with debt is virtually non-existent with PXT, and the company has plenty of headroom and ability to raise debt should it need to in the future.

Does PXT’s liquid assets cover its short-term commitments?

Given zero long-term debt on its balance sheet, Parex Resources has no solvency issues, which is used to describe the company’s ability to meet its long-term obligations. However, another measure of financial health is its short-term obligations, which is known as liquidity. These include payments to suppliers, employees and other stakeholders. With current liabilities at CA$155.66m, it seems that the business has been able to meet these obligations given the level of current assets of CA$319.06m, with a current ratio of 2.05x. Generally, for Oil and Gas companies, this is a reasonable ratio since there is a bit of a cash buffer without leaving too much capital in a low-return environment.

Next Steps:

PXT has no debt as well as ample cash to cover its short-term liabilities. Its safe operations reduces risk for the company and its investors, however, some degree of debt could also ramp up earnings growth and operational efficiency. Keep in mind I haven’t considered other factors such as how PXT has performed in the past. You should continue to research Parex Resources to get a better picture of the stock by looking at:

Future Outlook: What are well-informed industry analysts predicting for PXT’s future growth? Take a look at our free research report of analyst consensus for PXT’s outlook.

Valuation: What is PXT worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether PXT is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance