Paragon 28 (FNA) Expands Syndesmotic Repair Line With New Launch

Paragon 28, Inc. FNA, a leading innovator in orthopedic solutions, has unveiled its latest breakthrough — the Grappler R3INFORCE Extraosseous Repair System.

This system is set to advance syndesmotic injury repair, marking significant progress for Paragon 28 in terms of improving patient outcomes.

Addressing Syndesmotic Instability

The Grappler R3INFORCE System is specifically designed to restore stability to the anterior and posterior ligaments surrounding the ankle during fibula fracture repairs and high ankle sprains. This addresses a critical need in the field, as up to 25% of all ankle fractures and unstable high ankle sprains require implants for soft tissue healing.

Superior Efficiency

One of the key features of the Grappler R3INFORCE System is its Dynamic Anchor, which allows for micromotion in the repair, replicating the mechanics of native tissue. This dynamic functionality sets it apart from traditional static repair systems, offering surgeons a more physiological and anatomical reconstruction option.

Additionally, the system is highly synergistic with Paragon 28's existing offerings, such as the Grappler Knotless Sutures, providing surgeons with multiple configurations to tailor syndesmotic repair according to their treatment philosophies.

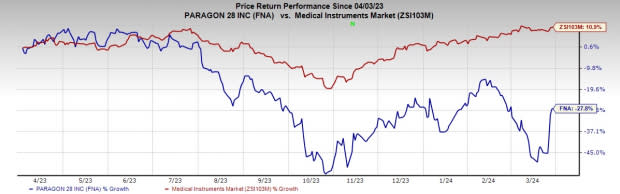

Image Source: Zacks Investment Research

Reduced Waste and Complexity

The sterile-packed system includes all necessary instrumentation in multiple configurations, reducing waste and intraoperative complexity. This streamlined approach enhances surgical efficiency and patient outcomes.

With this latest addition, Paragon 28 is poised to expand its footprint in the syndesmotic injury repair market, further solidifying its position as a leader in orthopedic solutions.

Industry Prospects

Per a recent LinkedIn report, the global syndesmosis implant systems market is poised for significant upside, with a projected CAGR of 5.3% from 2021 to 2027.

Share Price Performance

Over the past year, shares of FNA have declined 27.8% against the industry’s 10.9% growth.

Zacks Rank and Key Picks

Paragon 28 currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita DVA, Cardinal Health CAH and Stryker SYK. While DaVita sports a Zacks Rank #1 (Strong Buy) at present, Cardinal Health and Stryker carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for DaVita’s 2024 earnings per share have moved up from $8.97 to $9.23 in the past 30 days. Shares of the company have surged 69% in the past year compared with the industry’s 23.4% rise.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 35.6%. In the last reported quarter, it delivered an earnings surprise of 22.2%.

Cardinal Health’s stock has surged 45.8% in the past year. Earnings estimates for Cardinal Health have risen from $7.28 to $7.29 for fiscal 2024 and from $8.03 to $8.04 for fiscal 2025 in the past 30 days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 15.6%. In the last reported quarter, it posted an earnings surprise of 16.7%.

Estimates for Stryker’s 2024 earnings per share have remained constant at $11.86 in the past 30 days. Shares of the company have moved 24.4% upward in the past year compared with the industry’s rise of 5.8%.

SYK’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 5.1%. In the last reported quarter, it delivered an earnings surprise of 5.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Paragon 28, Inc. (FNA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance