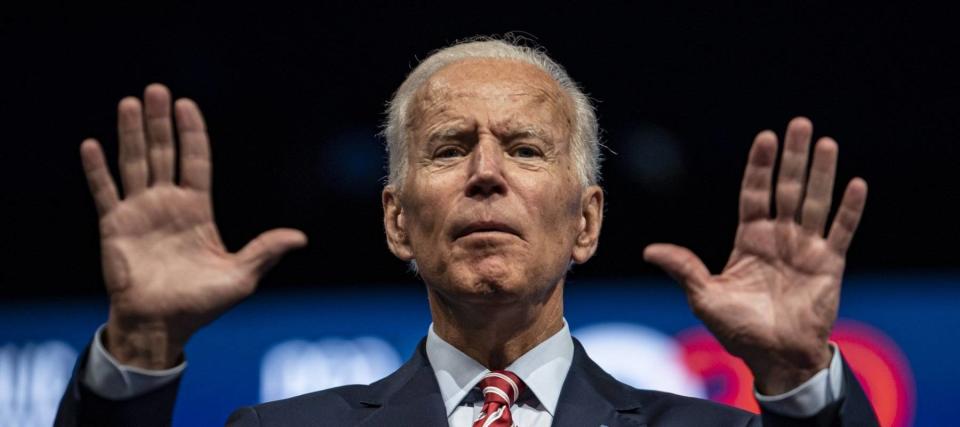

‘The pandemic is over’: President Biden says coronavirus is still a problem, but everybody seems to be in ‘good shape’ — here are 3 top reopening stocks to revisit

It’s been two and half years since the World Health Organization declared the COVID-19 outbreak a global pandemic. But now, according to the leader of the free world, that pandemic has come to its end.

“The pandemic is over,” President Joe Biden tells 60 Minutes. “If you notice, no one's wearing masks. Everybody seems to be in pretty good shape, and so I think it's changing, and I think [the resumption of the Detroit auto show] is a perfect example of it.”

Don't miss

Mitt Romney says a billionaire tax will trigger demand for these two physical assets — get in now before the super-rich swarm

You could be the landlord of Walmart, Whole Foods and Kroger (and collect fat grocery store-anchored income on a quarterly basis)

What do Ashton Kutcher and a Nobel Prize-winning economist have in common? An investing app that turns spare change into a diversified portfolio

Still, he acknowledges that we are not done dealing with the virus yet.

“We still have a problem with COVID. We're still doing a lot of work on it. But the pandemic is over.”

The COVID-19 pandemic has changed a lot of things — including how investors structure their portfolios. But given President Biden’s recent proclamation, it might be time to double down on so-called “reopening” stocks.

Here are three potential opportunities.

Disney (DIS)

Media and entertainment giant Walt Disney hasn’t exactly been a market darling of late. Shares are down 31% in 2022 and a whopping 40% over the last 12 months.

But its business is moving in the right direction.

In the fiscal quarter ended July 2, Disney generated $21.5 billion of revenue, marking a 26% increase year over year.

The COVID-19 pandemic severely impacted Disney’s theme park business. But as society opens up, guests are starting to visit the iconic castles again.

For the quarter, revenue from Disney’s Parks, Experiences, and Products segment totaled $7.4 billion, up 72% from the year-ago period.

The company’s streaming services are enjoying strong momentum as Disney+ gained 14.4 million subscribers. That brought the service’s total subscriber base to 152.1 million. Total subscriptions across Disney’s direct-to-consumer product offerings now exceed 221 million when factoring in ESPN+ and Hulu.

JPMorgan analyst Philip Cusick has an ‘overweight’ rating on Disney and a price target of $160. Since the company currently trades at $107.80 per share, the price target implies a potential upside of 48%.

Airbnb (ABNB)

Known for its online platform for vacation rentals, Airbnb has survived the worst of the pandemic. And its financials are now on the rise.

In Q2 of 2022, the company reported 103.7 million nights and experiences booked. That was up 25% year over year.

Revenue totaled $2.1 billion for the quarter, up 58% year-over-year and was 73% higher compared to Q2 of 2019.

In other words, Airbnb is already pumping out substantially more revenue than even compared to pre-pandemic levels.

But those numbers weren’t able to cheer up investors as the stock tumbled 31% year to date.

Wells Fargo analyst Brian Fitzgerald sees a rebound on the horizon. The analyst has an ‘overweight’ rating on Airbnb and a price target of $185 — roughly 54% above where the stock sits today.

Restaurant Brands International (QSR)

Restaurant Brands International came into existence in 2014 through the merger of Burger King and Canadian coffee chain Tim Hortons. Then in 2017, the company added Popeyes Louisiana Kitchen to its portfolio.

Like most restaurant stocks, Restaurant Brands shares plunged during the pandemic-induced market sell-off in early 2020. But the stock has made a strong recovery, backed by substantial improvements in the company’s business.

According to the latest earnings report, comparable sales — a key measure of a restaurant chain’s health — increased 12.2% at Tim Hortons, 10.0% at Burger King, and 1.4% at Popeyes Louisiana Kitchen.

The company also offers a healthy annual dividend yield of 3.7%.

Deutsche Bank analyst Brian Mullan recently reiterated a ‘buy’ rating on Restaurant Brands and raised his price target to $70 — implying a potential upside of 20%.

What to read next

Sign up for our MoneyWise investing newsletter to receive a steady flow of actionable ideas from Wall Street's top firms.

Warren Buffett likes these 2 investment opportunities outside of the stock market

A Wells Fargo study shows that nearly half of Americans are leaning on their credit card rewards to help offset some of the costs of everyday purchases

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance