Panasonic (PCRFY) to Sell Majority Stake in PAS to Apollo

Panasonic Holdings Corporation PCRFY has inked an agreement with Apollo Global Management, Inc. APO to sell its majority stake in Panasonic Automotive Systems Corporation (“PAS”) for an aggregate enterprise value of ¥311 billion.

The transaction is expected to be completed by the end of the first quarter of 2025, subject to customary closing conditions, including regulatory approvals.

Per the agreement, a newly formed company (indirectly owned by the funds managed by Apollo) will acquire all of the shares of PAS from Panasonic. It will then become the parent organization of PAS.

Panasonic will then acquire 20% of the shares of the newly formed entity. PAS’s entire operations will now be jointly managed by Panasonic and Apollo. PAS will continue to be a member of the Panasonic Group.

Panasonic was looking for a partner (in terms of cutting-edge expertise and ample financial resources) to boost the growth of PAS amid secular changes taking place in the automotive industry (like the rise of electric vehicles, software development and electrification).

PAS is a tier 1 company that operates on a global scale, providing advanced technologies such as infotainment systems to automakers. It boasts 30,000 employees spread across 22 countries and regions around the world.

The collaboration is likely to address the growing demand for secure and more connected driving experiences backed by advanced in-vehicle technologies and industry expertise.

Panasonic is a global supplier of cutting-edge solutions ranging from consumer electronics, housing, automotive, industry, communications and energy sectors. It boasts a diverse portfolio of innovations in the design and manufacture of in-vehicle systems, including infotainment, connectivity and safety features. It generated revenues of ¥8,378.9 billion in the previous year.

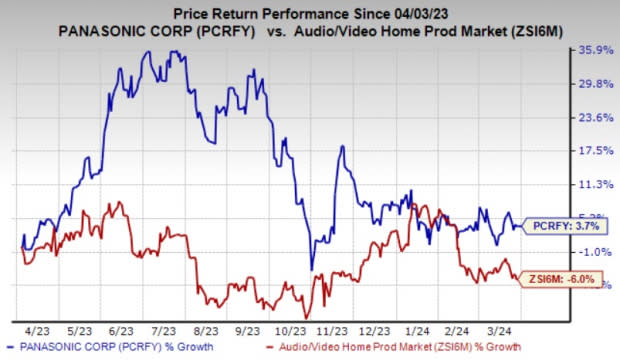

Panasonic currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 3.7% year to date against the sub-industry’s decline of 6%.

Image Source: Zacks Investment Research

Key Picks

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1 (Strong Buy), delivered a trailing four-quarter average earnings surprise of 20.18%. In the last reported quarter, it delivered an earnings surprise of 13.41%. You can see the complete list of today’s Zacks #1 Rank stocks here.

NVDA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to AI-based solutions that support high-performance computing, gaming and virtual reality platforms.

Pinterest PINS, carrying a Zacks Rank #2 (Buy) at present, delivered a trailing four-quarter average earnings surprise of 37.42%. In the last reported quarter, PINS pulled off an earnings surprise of 3.92%.

The company is increasingly establishing a unique value proposition to advertisers that could provide a competitive advantage in the long haul. Through various innovations, it continues to dramatically improve the advertising platform, which presently appears to be one of the best ad platforms for consumer discretionary brands looking for new ways to reach customers and stretch smaller ad budgets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Apollo Global Management Inc. (APO) : Free Stock Analysis Report

Panasonic Corp. (PCRFY) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance