Palantir Technologies Inc (PLTR) Sustains Profitability with Strong Q4 and FY 2023 Results

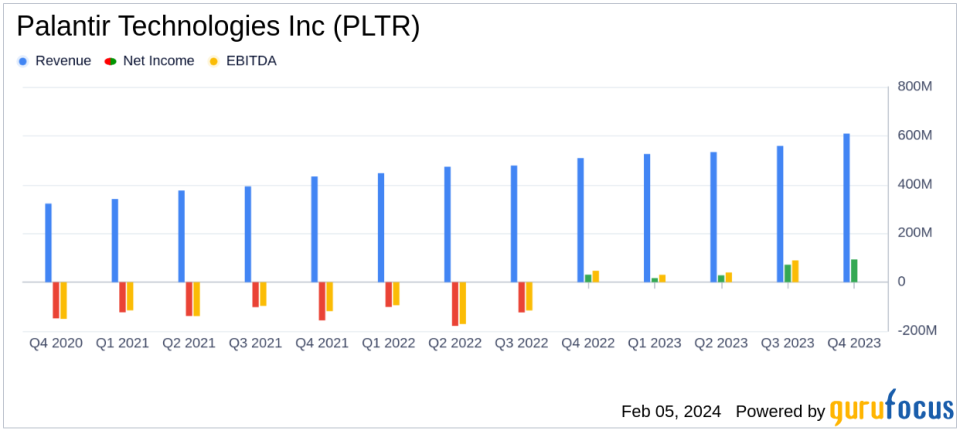

Q4 Revenue Growth: Palantir's revenue increased by 20% year-over-year to $608 million.

Annual Revenue Uplift: FY 2023 revenue rose by 17% compared to the previous year, reaching $2.23 billion.

GAAP Net Income: The company reported a GAAP net income of $93 million in Q4, marking its fifth consecutive quarter of GAAP profitability.

Adjusted Free Cash Flow: Palantir achieved a 50% margin in both Q4 and FY 2023, with $305 million and $731 million, respectively.

Commercial Sector Expansion: U.S. commercial revenue grew by 70% year-over-year, with a significant increase in customer count and total contract value.

On February 5, 2024, Palantir Technologies Inc (NYSE:PLTR) released its 8-K filing, revealing a continuation of its profitability streak with robust fourth-quarter and full-year financial results for the period ending December 31, 2023. The analytical software company, known for its Foundry and Gotham platforms serving commercial and government clients, has demonstrated significant growth in revenue and profitability, emphasizing its strong position in the software industry.

Financial Performance and Challenges

Palantir's financial achievements in the fourth quarter include a 20% year-over-year revenue growth, reaching $608 million, and a 15% GAAP net income margin, resulting in $93 million in net income. This performance is particularly important as it represents the fifth consecutive quarter of GAAP profitability, underscoring the company's ability to sustain growth while maintaining profitability.

However, challenges remain as the company navigates an evolving market landscape. The importance of maintaining this growth trajectory is critical, as any slowdown could impact investor confidence and the company's valuation. Palantir's focus on expanding its U.S. commercial sector has paid off, with a 70% year-over-year revenue increase in this segment, but the company must continue to innovate and capture market share to fend off competition and justify its investments.

Key Financial Metrics

Palantir's financial achievements are underscored by several key metrics. The company's adjusted income from operations stood at $209 million for Q4, with a margin of 34%, and $633 million for the fiscal year, with a 28% margin. Cash from operations was robust, at $301 million for the quarter and $712 million for the year, representing margins of 50% and 32%, respectively. These metrics are crucial as they reflect the company's operational efficiency and its ability to generate cash, which is vital for funding growth initiatives and potential investments.

Furthermore, Palantir ended the year with a strong balance sheet, boasting $3.7 billion in cash, cash equivalents, and short-term U.S. treasury securities. This financial stability provides the company with ample resources to pursue strategic opportunities and weather any potential market downturns.

Outlook and Commentary

Looking ahead, Palantir anticipates Q1 2024 revenue to be between $612 - $616 million and adjusted income from operations of $196 - $200 million. For the full year 2024, the company expects revenue to range between $2.652 - $2.668 billion, with U.S. commercial revenue expected to grow by at least 40%, reaching over $640 million. Adjusted income from operations is projected to be between $834 - $850 million, with adjusted free cash flow of $800 million to $1 billion.

Palantir CEO Alex Karp's annual letter, available on the company's website, provides further insights into the company's strategic direction and the broader industry context.

Palantir's continued profitability and revenue growth are a testament to its strategic focus and operational execution. The company's ability to expand its commercial customer base while maintaining strong margins is indicative of its competitive positioning in the software industry. As Palantir looks to the future, its robust financial health and strategic investments position it well to capitalize on emerging opportunities and navigate potential challenges.

For a deeper dive into Palantir Technologies Inc (NYSE:PLTR)'s financials and strategic outlook, investors and interested parties can access the earnings webcast and investor presentation on the company's Investor Relations website.

Explore the complete 8-K earnings release (here) from Palantir Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance