PACCAR (PCAR) Q4 Earnings & Revenues Top Estimates, Down Y/Y

PACCAR Inc. PCAR has reported earnings of $1.53 per share for fourth-quarter 2019, beating the Zacks Consensus Estimate of $1.50, mainly aided by higher income and revenues from the company’s parts unit. However, the reported figure came in lower than the prior-year quarter’s $1.65.

Consolidated revenues (including trucks and financial services) came in at $6.12 billion, outpacing the Zacks Consensus Estimate of $5.55 billion. The top-line figure, however, came in lower than the year-ago quarter’s $6.28 billion.

During the reported quarter, the company recorded total pre-tax income of $687.8 million, reflecting a decline from the prior-year quarter’s $752.4 million. The company’s net income fell to $531.3 million from the $578.1 million reported in fourth-quarter 2018.

SG&A expenses during fourth-quarter 2019 rose 8.3% to $148 million from the $136.6 million incurred in fourth-quarter 2018. R&D expenses flared up 3.9% to $83.6 million in the December-end quarter from the fourth-quarter 2018 number of $80.5 million.

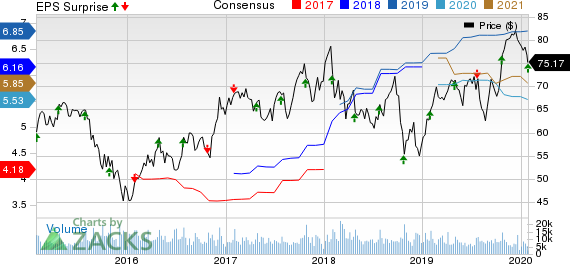

PACCAR Inc. Price, Consensus and EPS Surprise

PACCAR Inc. price-consensus-eps-surprise-chart | PACCAR Inc. Quote

Segmental Performance

Revenues from trucks, parts and others totaled $5.71 billion in the fourth quarter, up from the prior-year quarter’s $5.93 billion. The segment’s pre-tax income decreased to $599.6 million from the $645.3 million recorded a year ago.

Revenues in the financial services segment increased to $406.3 million from the year-earlier quarter’s $347 million. Pre-tax income declined to $68.1 million from the $87.2 million reported in the year-ago quarter.

Share Repurchase & Cash Position

During 2019, the company repurchased 1.68 million shares of its common stock for $110.2 million. As of Dec 31, 2019, it had shares of $430.5 million remaining for repurchase under the current $500-million program.

PACCAR’s cash and marketable debt securities amounted to $5.17 billion as of Dec 31, 2019, compared with $4.30 billion as of Dec 31, 2018.

Outlook

Retail unit sale for Class 8 trucks in the United States and Canada is anticipated to be 230,000-260,000 for 2020.

For the ongoing year, capital expenditures are projected at $625-$675 million, and research and development expenses are estimated in the $310-$340 million band.

Zacks Rank & Stocks to Consider

PACCAR currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Auto-Tires-Trucks sector include Gentex Corp. GNTX, Tesla, Inc. TSLA and SPX Corp. SPXC, each carrying a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Gentex has an estimated earnings growth rate of 7.32% for 2020. The company’s shares have appreciated 34.6% in a year’s time.

Tesla has a projected earnings growth rate of 6,460% for the ongoing year. Its shares have surged 87.6% over the past year.

SPX has an expected earnings growth rate of 8.09% for the current year. The stock has rallied 74% in the past year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report

SPX Corporation (SPXC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance