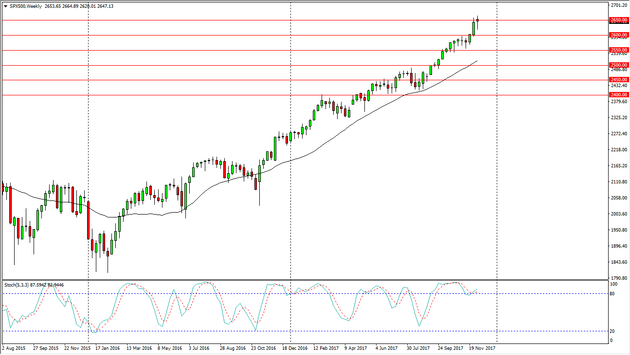

S&P 500 Price Forecast for the Week of December 11, 2017, Technical Analysis

The S&P 500 initially fell during the week but found enough support later to turn things around and form a hammer at the 2650 handle. A break above the top of the candle should send this market to the upside yet again, as I think the market will go looking towards the 2700 level above. A breakdown below the bottom of the candle would be very negative, perhaps looking towards the 2600 level next. A breakdown below there should send the market much lower and towards the 2550 handle. Ultimately, this is a market that is bullish, and you certainly can’t sell, and it almost looks as if it’s ready to go into more of an impulsive move. This would line up with the “Santa Claus rally” that we will quite often see, as money managers try to pad their results for the last 12 months.

S&P 500 Video 11.12.17

If we did break down at this point, that would be a very big surprise, as it typically doesn’t happen, and of course, the jobs number in America was relatively decent. I think this remains a “buy on the dips” situation going forward, and I certainly don’t have any interest in shorting the S&P 500 as it has been so relentless, and it’s moved to the upside. In general, I believe the stock markets around the world are going to go higher in the S&P 500 will march right along with the rest of them. It looks as if the rally continues over the next several weeks.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance