So You Own Algonquin Stock: Is It Still a Good Investment?

Written by Kay Ng at The Motley Fool Canada

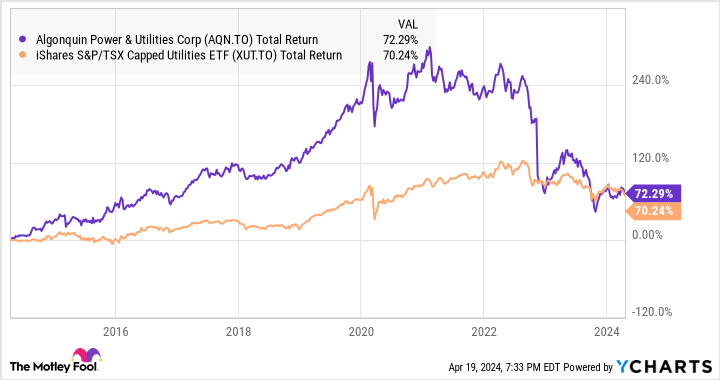

It’s an understatement to say Algonquin Power & Utilities (TSX:AQN) stock has been a disappointment. The stock lost about half of its value from mid-2022. Investors who still own Algonquin from the high levels may be undecided on whether to hold, buy more shares, or sell out of the position.

At the end of the day, investing is forward looking. So, it comes down to whether the utility stock is still a good investment today.

Is Algonquin stock’s dividend safe?

A big portion of Algonquin stock’s returns come from its dividend. At $8.17 per share at writing, the utility stock offers a dividend yield of close to 7.3%. This is a high yield versus the industry, suggesting that the stock has higher risk. Using the iShares S&P/TSX Capped Utilities Index ETF as an industry proxy, the industry yield is approximately 4.2%.

AQN Total Return Level data by YCharts

It would be a bad idea to buy or hold Algonquin stock because it offers a big dividend, especially if the dividend turned out to be in danger. On further investigation, Algonquin’s payout ratio is estimated to be about 84% of its adjusted earnings this year. This provides a bit of a buffer to protect the dividend.

Recall that Algonquin’s 2022 payout ratio was about 103% of adjusted earnings. And as a result, management subsequently cut the dividend by 40% in the first quarter of 2024. Namely, growth did not play out as interest rates rose in 2022 and the company had to lower its debt levels as it had above-average leverage entering into the interest rate hike cycle. (Notably, in earlier years, the low interest rate environment and its higher leverage allowed the relatively small utility stock to grow at a higher rate than the industry, as shown in the graph above.)

Currently, its long-term debt-to-capital ratio is about 58%. However, it is still awarded an investment grade S&P credit rating of BBB.

Algonquin’s big dividend should be safe with a sustainable payout ratio as long as its earnings remains stable.

Increased near-term uncertainty

A lot of changes are coming to Algonquin. As Scotia Capital analyst, Robert Hope, wrote in the March report on Algonquin stock, “Starboard Value LP, Algonquin’s largest shareholder at about 9%, informed the company that they would be delivering a notice to nominate three director candidates at the upcoming Annual General Meeting on June 4. In its letter, Starboard expressed support of: 1) the sale process of its unregulated business, 2) its ongoing chief executive officer (CEO) search, and 3) the interim-CEO… It appears that both Starboard and Algonquin have a common goal that would see the company sell its renewable business and use proceeds to reduce leverage and buy back shares.”

Generally, it’s a good thing to have new management who come with fresh ideas to help improve the business. It would also be a good idea for Algonquin to continue reducing its debt levels, as its trailing-12-month interest expense is double 2020 levels, while the debt-to-asset and debt-to-equity ratios are 62% and 2.3 times, respectively, versus 2020’s 55% and 1.4 times.

As well, the stock is slightly undervalued – a 14% discount from the analyst consensus price target. So, it would be a reasonable move to buy back shares at current levels.

Investor takeaway

Let’s say your Algonquin position is down. Try not to be emotional about it. What you should do depends on what your alternative investments are, including the top Canadian utility stocks to own. If you see safer alternative investments that can deliver similar or better returns, it could make sense to sell out to switch to those investments. Otherwise, holding doesn’t seem to be a bad idea here.

The post So You Own Algonquin Stock: Is It Still a Good Investment? appeared first on The Motley Fool Canada.

Should you invest $1,000 in Algonquin Power and Utilities right now?

Before you buy stock in Algonquin Power and Utilities, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Algonquin Power and Utilities wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $15,578.55!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 3/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance