Owens & Minor Inc (OMI) Reports Q1 2024 Earnings: Adjusted EPS Outperforms Estimates, ...

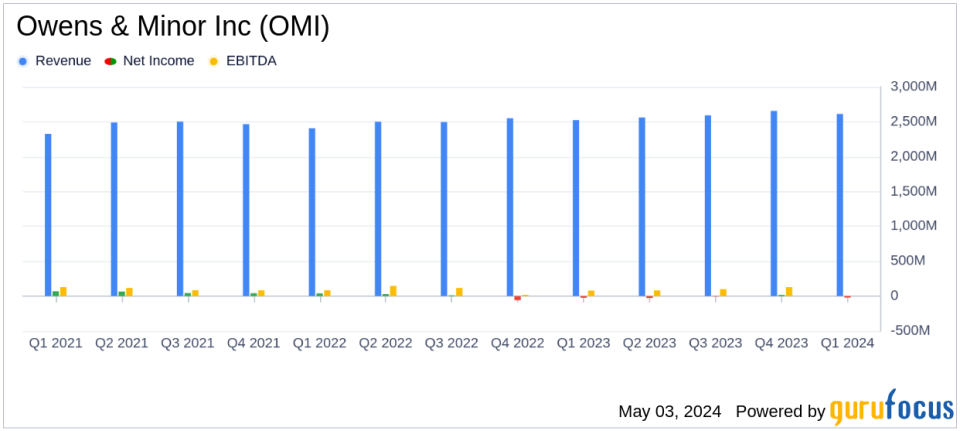

Revenue: $2,613 million, up from $2,523 million in Q1 2023, exceeding estimates of $2,609.58 million.

Adjusted EPS: $0.19, nearly quadrupling from $0.05 in Q1 2023, surpassing estimates of $0.18.

Net Loss (GAAP): $(21.9) million, an improvement from a net loss of $(24.4) million in Q1 2023, better than a net loss of $(22.3) million.

Gross Margin: Expanded by 79 basis points compared to Q1 2023.

Adjusted Net Income: $14.9 million, significantly up from $3.6 million in Q1 2023, exceeding estimates of $14.03 million.

Investments: Ahead of plan as outlined in the 2023 Investor Day, focusing on long-term growth.

Adjusted EBITDA: $116.3 million, an increase from $108.7 million in Q1 2023.

Owens & Minor Inc (NYSE:OMI), a global healthcare solutions company, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its recent 8-K filing. The company reported a revenue of $2,613 million, slightly surpassing the analyst's projection of $2,609.58 million. Adjusted EPS was noted at $0.19, marginally above the estimated $0.18, showcasing a robust performance against a backdrop of strategic investments aimed at long-term growth.

Owens & Minor Inc operates primarily through two segments: Products & Healthcare Services and Patient Direct. The former focuses on manufacturing and sourcing medical surgical products, while the latter delivers disposable medical supplies directly to patients and home health agencies. The majority of the company's revenue is generated from the Products & Healthcare Services segment.

Financial and Operational Highlights

The company's revenue saw an increase from $2,523 million in Q1 2023 to $2,613 million in Q1 2024. Despite a challenging economic environment, Owens & Minor achieved a gross margin expansion of 79 basis points and nearly quadrupled its adjusted EPS from the previous year, although it reported a GAAP EPS loss of $(0.29). The adjusted net income rose significantly to $14.9 million from $3.6 million year-over-year, and adjusted EBITDA increased to $116.3 million from $108.7 million.

Edward A. Pesicka, President & CEO, highlighted the effective execution of the companys strategic initiatives, stating,

Our solid performance in the first quarter was in line with our expectations, as we delivered top-line growth in both segments, adjusted operating margin expansion, and improved year-over-year profitability."

Challenges and Strategic Moves

Despite the positive growth, the company faced pressures from inflation and ongoing economic challenges affecting the healthcare sector. The Patient Direct segment navigated through unique market challenges, achieving mid-single digit top-line growth. Strategic investments, as outlined during the 2023 Investor Day, are reportedly ahead of plan, positioning the company for sustained long-term growth.

The financial outlook for 2024 remains cautiously optimistic, with expectations of continued pressure on pricing and demand in the Products & Healthcare Services segment. The company's guidance includes assumptions about the general economic conditions, including inflation, which could impact performance.

Investor and Analyst Engagement

Owens & Minor executives will further discuss the quarterly results and provide more insights during an investor conference call. This engagement will offer analysts and investors a deeper understanding of the companys strategies and financial health.

In conclusion, Owens & Minor Inc's Q1 2024 results reflect a resilient performance amidst economic pressures, with strategic investments beginning to yield tangible benefits. The companys ability to exceed revenue expectations and significantly boost adjusted EPS highlights its operational efficiency and strategic foresight in navigating a complex healthcare market.

Explore the complete 8-K earnings release (here) from Owens & Minor Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance