Owens-Corning Inc (OC) Q1 Earnings: Surpasses EPS Estimates, Faces Revenue Decline

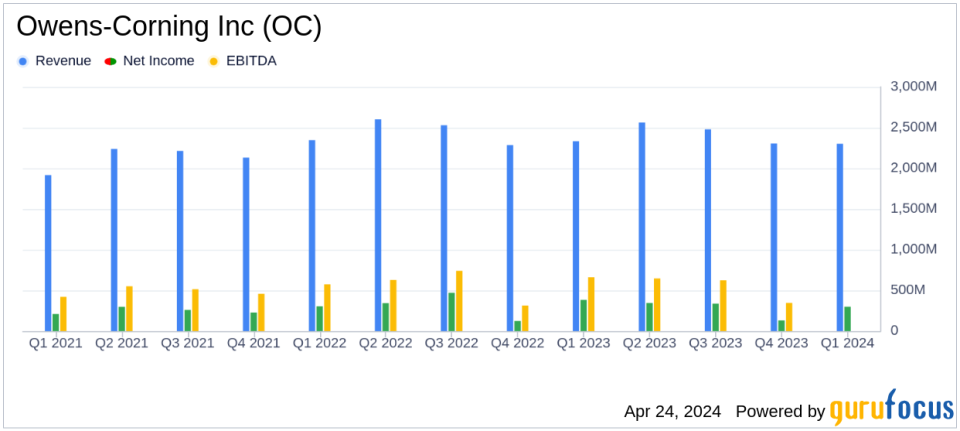

Reported Revenue: $2.3 billion, matching the prior year's performance and slightly exceeding estimates of $2279.19 million.

Net Earnings: $299 million, down 22% year-over-year, falling short of estimates of $273.40 million.

Diluted EPS: $3.40, surpassing the estimated $3.08 per share.

Adjusted EBIT: Increased by 21% to $438 million, highlighting operational efficiency and margin expansion.

Free Cash Outflow: Reported at $128 million, an improvement from the previous year's outflow of $322 million.

Capital Return to Shareholders: $182 million returned through dividends and share repurchases, emphasizing a strong commitment to shareholder value.

Forward Outlook: Anticipates net sales in line with Q2 2023 and targeting approximately 20% EBIT margins for existing businesses.

Owens-Corning Inc (NYSE:OC) released its 8-K filing on April 24, 2024, revealing a mixed financial performance for the first quarter of the year. Despite a slight decline in net sales, the company outperformed expectations in earnings per share (EPS).

Owens-Corning, a key player in the building and construction materials industry, reported net sales of $2.3 billion, aligning closely with the previous year but slightly below analyst expectations of $2.279 billion. The company's net earnings were $299 million, resulting in a diluted EPS of $3.40, which notably exceeded the estimated EPS of $3.08. Adjusted EBIT and EBITDA margins also saw improvements, indicating efficient operational management and robust profitability.

Company Overview

Owens-Corning operates through three main segments: Composites, Insulation, and Roofing, with the latter being the most significant revenue contributor. The company is renowned for its innovative building solutions and a commitment to sustainability, holding a strong market position primarily in the United States.

Financial Highlights and Challenges

The financial results reflect a resilient performance amidst challenging market conditions. The Roofing segment showed a notable increase in net sales by 7% to $957 million, driven by strong demand for premium laminate shingles. However, the Composites segment experienced an 11% decline in net sales, impacted by lower volumes and price pressures in the glass reinforcements market.

Despite these mixed segment performances, Owens-Corning's strategic initiatives, such as the acquisition of Masonite International Corporation and ongoing product innovations, are pivotal in maintaining its market leadership and responding to evolving industry demands.

Strategic and Operational Developments

Owens-Corning's strategic focus remains on enhancing its product offerings and operational efficiency. The company launched 13 new or improved products during the quarter, underscoring its commitment to innovation. Additionally, the acquisition of Masonite International is set to further expand its product portfolio and market reach, pending closure in mid-2024.

The company also continues to prioritize shareholder returns, having distributed $182 million through dividends and share repurchases in the quarter. This aligns with its capital allocation strategy to deliver consistent shareholder value.

Outlook and Forward-Looking Statements

Looking ahead, Owens-Corning anticipates stable performance with net sales and EBIT margins expected to align with the previous year's levels. The company remains cautiously optimistic about the North American market, despite potential headwinds from global economic pressures and geopolitical tensions.

In conclusion, Owens-Corning's first-quarter results demonstrate a solid start to 2024, with strategic acquisitions and product innovations poised to drive future growth. Investors and stakeholders may look forward to continued operational excellence and strategic execution from the company in the coming months.

For more detailed financial analysis and future updates on Owens-Corning Inc (NYSE:OC), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Owens-Corning Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance