Oshkosh Corp (OSK) Outperforms Analyst Estimates in Q1 2024, Raises Full-Year Outlook

Diluted Earnings Per Share (EPS): Reported at $2.71, up 102% year-over-year, surpassing the estimate of $2.25.

Adjusted EPS: Reported at $2.89, showing a significant increase of 77% compared to the previous year, indicating robust profit growth.

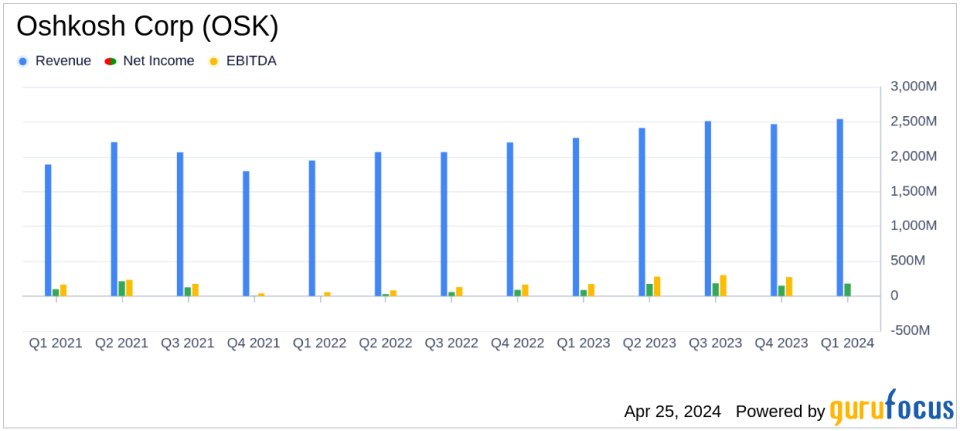

Revenue: Reached $2.54 billion, marking a 12% increase from the previous year, exceeding the estimated $2.483 billion.

Net Income: Reported at $179.4 million, significantly higher than the estimated $148.22 million, reflecting strong profitability.

Operating Income: Increased by 98.5% to $259.7 million, demonstrating improved operational efficiency and profitability.

Dividend: Declared a quarterly cash dividend of $0.46 per share, underscoring the company's commitment to returning value to shareholders.

Full-Year Outlook: Raised EPS expectations to $10.55 and adjusted EPS to $11.25, reflecting confidence in continued strong performance.

Oshkosh Corp (NYSE:OSK) released its 8-K filing on April 25, 2024, revealing a significant outperformance in its first-quarter earnings relative to analyst expectations. The company reported a diluted earnings per share (EPS) of $2.71, surpassing the forecasted $2.25, and adjusted EPS of $2.89. With a net income of $179.4 million, Oshkosh comfortably exceeded the estimated $148.22 million. Revenue also topped expectations at $2.54 billion against an anticipated $2.48 billion.

Oshkosh Corp, a leading manufacturer of specialty vehicles and equipment, has demonstrated resilience and strategic foresight in its operations. The company is renowned for its market-leading positions in North America and its global dominance in access equipment through its JLG brand. Despite losing the JLTV recompete, Oshkosh is focusing on significant contracts like the U.S. Postal Service's vehicle electrification, showcasing its adaptability and innovative capabilities.

Financial and Operational Highlights

The company's robust performance in Q1 2024 is attributed to several factors including the successful integration of AeroTech, contributing $176.1 million in sales, and improved pricing and organic volume across segments. The Access and Vocational segments reported substantial year-over-year earnings growth, with total operating income nearly doubling to $259.7 million from $130.8 million in Q1 2023.

Oshkosh's strategic acquisitions and operational execution have not only enhanced its market position but also led to a raised full-year EPS outlook, now expected to be in the range of $10.55, with adjusted EPS projected at $11.25. The company anticipates 2024 sales to reach approximately $10.7 billion, reflecting confidence in its ongoing and future initiatives.

Detailed Financial Analysis

The first quarter saw Oshkosh achieving a gross income of $470 million, supported by a decrease in operating expenses and a significant reduction in costs associated with sales. The balance sheet remains robust with total assets increasing to $9.47 billion as of March 31, 2024, up from $9.13 billion at the end of 2023. The company's liquidity position is solid, with cash and cash equivalents at $69.9 million despite higher capital expenditures and acquisitions.

Oshkosh's commitment to innovation and market expansion is evident from its increased investments in new product development and the strategic acquisition of AeroTech. These initiatives are crucial as the company continues to navigate market uncertainties and seeks to capitalize on emerging opportunities in electrification and digital technologies.

Market Outlook and Strategic Moves

President and CEO John Pfeifer expressed optimism about the company's trajectory, citing strong market dynamics and healthy backlogs. Oshkosh's focus on electrification, autonomy, and digital product offerings is aligning with global trends towards sustainable and technologically advanced solutions. The initiation of the USPS Next Generation Delivery Vehicle production and the development of the all-electric Volterra ZSL vehicle are pivotal to Oshkosh's growth strategy.

The company's forward-looking approach is supported by a solid financial foundation and strategic market positioning, which should reassure investors of its potential for sustained growth and profitability. As Oshkosh continues to execute its strategic initiatives, it remains a significant player in the specialty vehicles and equipment industry, poised for future successes.

Explore the complete 8-K earnings release (here) from Oshkosh Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance