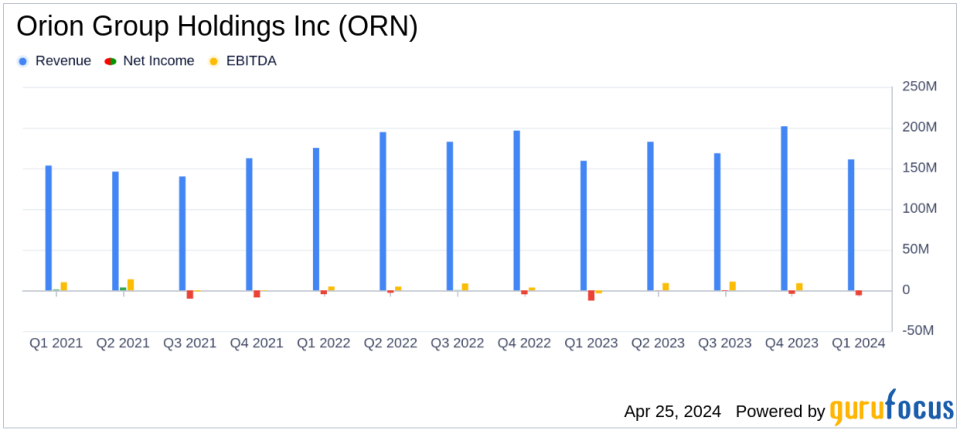

Orion Group Holdings Inc (ORN) Q1 2024 Earnings: Misses Analyst Estimates Amid Seasonal Slowdown

Revenue: Reported $160.7 million, slightly below the estimated $174.75 million.

Net Loss: Recorded a net loss of $6.1 million, exceeding the estimated loss of $5.76 million.

Earnings Per Share (EPS): Reported a loss of $0.19 per diluted share, aligning with the estimated loss of $0.18 per share.

Gross Profit: Increased to $15.5 million or 9.7% of revenue, significantly up from $5.8 million or 3.7% of revenue in the prior year.

Adjusted EBITDA: Improved to $4.1 million, marking a recovery from the previous year's negative $4.1 million.

Backlog: Ended the quarter with a backlog of $756.6 million, showing robust growth from $467.4 million a year earlier.

SG&A Expenses: Rose to $19.0 million or 11.8% of total contract revenues, up from 10.7% in the previous year.

Orion Group Holdings Inc (NYSE:ORN) released its 8-K filing on April 24, 2024, unveiling its financial results for the first quarter ended March 31, 2024. The specialty construction company, known for its marine and concrete segment services, reported a net loss of $6.1 million, or $0.19 per diluted share, falling short of analyst expectations of a $0.18 loss per share. The company's revenue for the quarter stood at $160.7 million, also missing the estimated $174.75 million.

Company Profile

Orion Group Holdings Inc operates in the infrastructure, industrial, and building sectors, providing services both on and off the water across the continental United States, Alaska, Canada, and the Caribbean Basin. Its marine segment offers a range of construction and dredging services, while the concrete segment delivers comprehensive concrete construction services.

Quarterly Financial Highlights

The reported revenue of $160.7 million represents a modest increase of 0.9% from $159.2 million in the same quarter of the previous year. This growth was primarily driven by an increase in Marine segment revenue, particularly from the Pearl Harbor, Hawaii drydock project. However, the Concrete segment saw a decline in revenue due to stringent bidding standards aimed at securing quality work at attractive margins.

Gross profit for the quarter improved significantly to $15.5 million, or 9.7% of revenue, up from $5.8 million or 3.7% of revenue in Q1 2023. This increase in gross profit margin was attributed to better project pricing and execution. Despite these gains, selling, general, and administrative expenses rose to $19.0 million from $17.0 million year-over-year, reflecting increased investment in IT and business development, alongside higher legal costs.

Operational and Strategic Challenges

The first quarter typically represents a seasonally slow period for Orion, compounded this year by scheduling delays on two major projects. Although these delays are not expected to materially impact the annual revenue and margins, they have affected the quarterly results. CEO Travis Boone remains optimistic, citing a strong backlog and a robust pipeline of opportunities expected to drive revenue growth through the year.

Future Outlook and Strategic Initiatives

Orion Group Holdings reconfirmed its full-year 2024 guidance, projecting revenues in the range of $860 million to $950 million and Adjusted EBITDA between $45 million and $50 million. The company's strategic focus includes bidding on diverse marine construction projects funded by various governmental and private sources, and capitalizing on the burgeoning data center market through its concrete segment.

Financial Position and Backlog

As of March 31, 2024, Orion reported total backlog of $756.6 million, slightly down from $762.2 million at the end of 2023 but significantly higher than $467.4 million a year ago. This robust backlog, coupled with $101 million in new project work awarded in April 2024, positions the company well for future revenue generation.

Investor Considerations

While Orion's Q1 performance fell short of analyst estimates, its strong backlog and strategic positioning in growing market segments like marine construction and data center projects provide a positive outlook. Investors should consider the company's potential for margin improvement and revenue growth in line with its full-year guidance, alongside the broader industry trends driving demand for Orion's specialized services.

For detailed financial figures and further information, refer to Orion Group Holdings Inc's full 8-K filing.

Explore the complete 8-K earnings release (here) from Orion Group Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance