Organigram will be ‘doing more with less’ as investors demand frugal spending

Organigram Holdings Inc. (OGI)(OGI.V) is talking up its penny-pinching strategy as investors ramp up pressure on cannabis producers to deliver stronger financial results.

The comments followed a surprise $10.2-million net loss in its fiscal third quarter report on Monday.

“When we meet with investors what is attracting them to Organigram is a more disciplined approach, more focused on achieving results now,” chief executive officer Greg Engel told Yahoo Finance Canada. “I think there are lots of ways to make strategic investments and enter new markets in a meaningful fashion without having to buy the entire company.”

Speaking on a conference call with analysts, chief financial officer Paolo De Luca also boasted about the Moncton, N.B.-based pot producer’s disciplined spending compared to rivals in the space.

Their remarks come on the heels of a major shake-up at Canopy Growth Corp. (WEED.TO)(CGC) earlier this month that saw co-CEO Bruce Linton ousted by a controlling shareholder, U.S. liquor giant Constellation Brands Inc. (STZ). Many industry observers linked Linton’s firing to Canopy Growth’s $323.4-million loss reported in its most recent quarter.

“We believe that many other industry participants have assumed that access to capital is never-ending, and have been funding operating losses with continued dilution to shareholders,” De Luca said on the call.

“What we are trying to do at Organigram is build a company with a sustainable business model which is capable of doing more with less.”

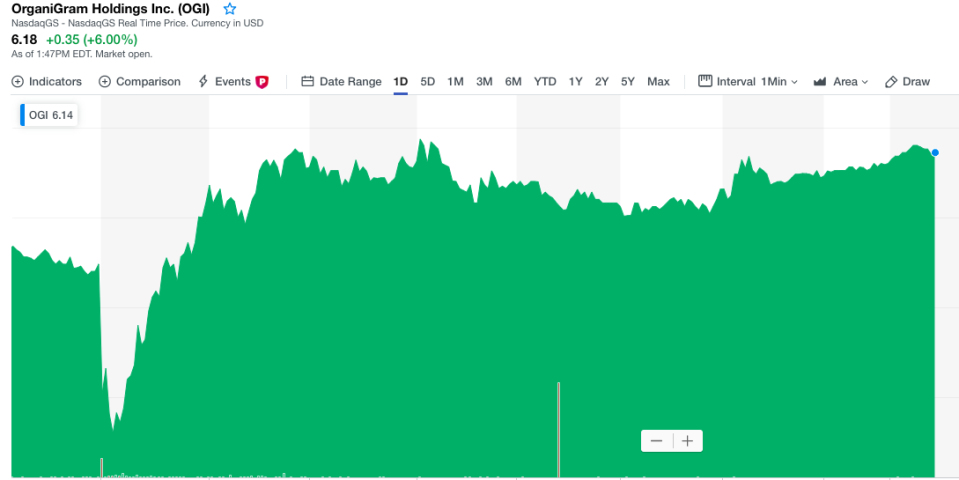

NASDAQ-listed shares climbed 5.83 per cent to $6.17 at 1:33 p.m. ET, after falling sharply in pre-market trading.

Organigram’s growing costs are among the lowest of the large licensed producers in Canada. The company blamed a "temporary" drop in yield per plant for increasing cash and “all in” costs from $0.95 and $1.29 per gram of dried flower, respectively, from $0.65 and $0.95 per gram in the previous quarter.

De Luca said Organigram is also keeping its purse strings tighter than its peers when it comes to SG&A costs and executive compensation, while realizing savings from operating a single facility in New Brunswick where labour and power are less expensive.

Greg Taylor, chief investment officer at Purpose Investments Inc. manages the firm’s Marijuana Opportunities Fund (MRJOF). He applauds Organigram for focusing on efficiency.

“Certainly the changes at Canopy Growth would show the whole sector needs to go that way,” he told Yahoo Finance Canada. “I think Organigram is one company that is well down that path. They have been one of the more disciplined growers.”

Taylor said De Luca comments on more restrained spending helped the company’s shares turn positive Monday afternoon.

Organigram reported a $10.2-million net loss in its fiscal third quarter, or negative $0.07 per share, after a profit of $2.8 million, or $0.03 cents a share in the same period last year. Analysts polled by FactSet expected the company to report earnings of $0.03 a share, up from two cents a share in the year-ago period.

Organigram booked $24.8 million in net revenue in the period ended on May 31, versus $3.4 million year-over-year. FactSet analysts called for revenue of $29.7 million. Adjusted EBITDA was positive for the fourth consecutive quarter at $7.7 million.

The company highlighted sales strength in Atlantic Canada and Alberta, which was offset by delayed shipments to Quebec.

Speaking to analysts on a conference call on Monday morning, chief executive officer Greg Engel said he expects “lumpiness” from the Ontario market, given it’s staggered roll-out of brick-and-mortar retail. The company expects a “large pipeline fill” order from Canada’s largest province to supply the 50 new retail stores announced in early July.

The company said it sold approximately 3,926 kilograms of dried cannabis flower and approximately 5,090 litres of cannabis oil in its most recent quarter.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance