‘Too optimistic’: Backtracking Loonie bullishness post-USMCA

Weaker oil prices and fewer-than-expected rate hikes from the Bank of Canada are among the reasons why one economist decided to walk back his call for the loonie to rally to US$0.78 by year’s end.

Last month, Stephen Brown, senior Canada economist for London-based Capital Economics, saw easing Canada-United States trade tensions and a recovery in summer housing sales as a base case for a more aggressive Bank of Canada, and stronger loonie.

“Despite the trade deal and the Bank’s hawkish tone last month, however, the loonie has actually depreciated towards our old year-end forecast,” Brown wrote in a research note on Monday. “We may have been too eager in revising up our exchange rate forecasts.”

Capital Economics had previously called for a $0.75 loonie at the end of the year, retreating to $0.70 to end 2019.

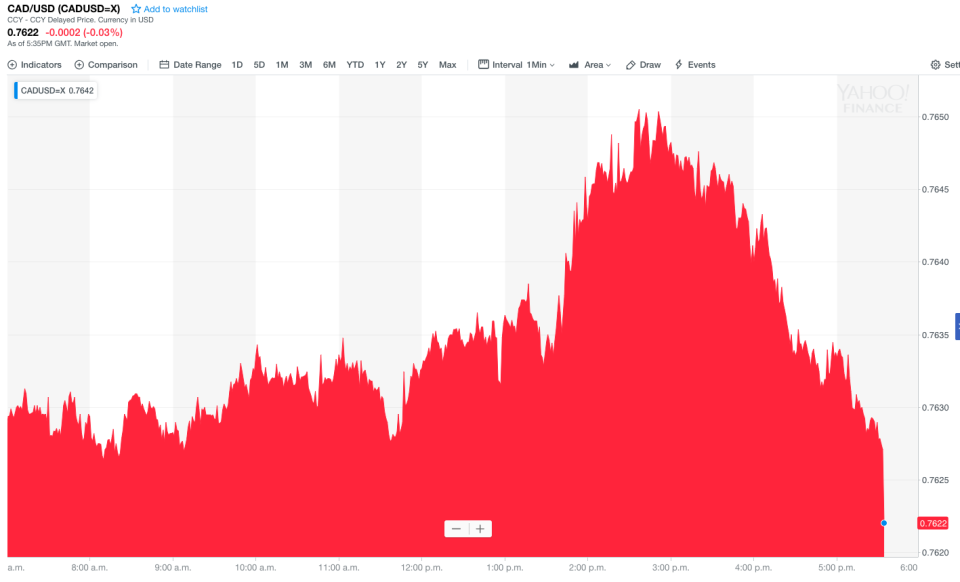

The loonie edged up to $0.7641 at 10:49 a.m. ET on Monday, down about 6.2 per cent from a recent high of $0.8156 on Jan. 28.

Brown notes many investors saw the bilateral agreement between the U.S. and Mexico as a sign that a three-party deal was on the way, pricing that into the loonie before the United States–Mexico–Canada Agreement was firm.

“As there is seemingly little trade-risk premium left, it’s hard to see much support for the consensus view that the loonie will rise by five per cent over the next 12 months,” Brown wrote. “Most importantly for the loonie’s prospects, investors have already raised their expectations for rate hikes, with three more now priced in.”

Brown has a three-pronged thesis for a lower loonie over the next year.

First, he expects Canada’s current account deficit will put downward pressure on the currency.

“Second, we doubt that the Bank of Canada will raise interest rates by as much as investors expect,” he wrote. “Given our view that GDP growth will slow below potential next year, we think that the bank will be forced to the side-lines once the policy rate reaches two per cent, probably in January.”

Brown is also calling for weaker oil prices as Iranian supply proves less vulnerable to new U.S. sanctions, and new pipeline capacity allows U.S. producers to ramp up production.

“We see WTI (West Texas Intermediate) falling to $55 per barrel by the end of 2019, from $63 currently,” he wrote.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance