OPEC cuts, while the U.S. turns on the oil taps

It's been a few weeks since members of OPEC started cutting production. Saudi Arabia said last Wednesday that its production is the lowest it's been in two years, Iraq said that it had made cuts, as did Kuwait.

While there are no firm numbers for Organization of the Petroleum Exporting Countries production, optimism is growing that the majority of members will actually make cuts as promised in its November meeting.

However, that might not matter much to the worldwide glut of oil, because as OPEC members ramp down, U.S. producers, who are governed by nothing but the market, are ramping up.

U.S. production nears 9 million barrels per day

The U.S. Energy Information Administration forecast that U.S. oil production would rise through 2017 to nine million barrels per day. The very first week of January, production rose to 8.95 million barrels per day. So, the EIA is looking just a little conservative with that number.

"U.S. production over the course of the year is likely to increase by about as much as Saudi Arabia has cut production," said Jim Burkhart, an analyst with IHS Markit. The Saudis pledged to cut 486,000 barrels a day, out of a 1.2 million barrels cut for all of OPEC.

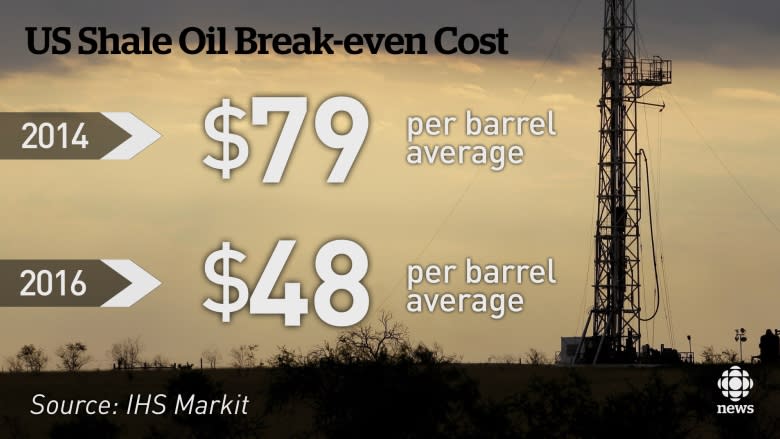

Burkhart pointed out that the U.S. industry learned some hard lessons as it weathered low oil prices over the past two years, and fracking costs have gone way down.

With oil in the $50 to $55 US a barrel range, fracking is now profitable.

Since the OPEC deal was first floated, crude oil production in the United States has increased by nearly half a million barrels per day, with no signs of slowing down. Exports of crude out of the U.S. are also rising and the amount of oil in storage jumped last week.

You would expect oil prices to fall off a cliff in reaction to the U.S. production increases, but they didn't. Bad news from the U.S. was offset by more positive news from the Mideast.

OPEC talking up oil prices

OPEC is well aware that the increase in crude prices will cause U.S. production to increase, according to Martin Pelletier, a portfolio manager with Trivest Wealth Management in Calgary.

"I've been saying this for a while now," said Pelletier. "The Saudis are very much intent on inflating oil prices and they will do whatever they can to provide a floor on it and provide support."

Pelletier points out that Saudi Aramco, the Saudi state-owned energy company, is preparing to go public on the markets. In order to raise as much money as possible in its Initial Public Offering, Saudi needs oil prices to stay high.

"I think we are going to see a price range," said Pelletier, predicting a range protected on the downside by the Saudis and limited on the upside by U.S. shale. "They are going to be fighting that onslaught of oil production coming out of the U.S."

That Saudi strategy was in play this week. As U.S. inventory and production numbers were released, news filtered out of OPEC countries about production cuts. OPEC was essentially talking up the price.

Where does Canada fit?

Pelletier expects the floor of oil prices to remain between $50 and $55 US per barrel, which is right where oil is trading now. That provides a solid rate of return for shale producers, but less so for the Canadian oilsands where break-even prices tend to be higher. However, most oilsands operations are cash flow positive at current prices. It just doesn't leave much motivation for large-scale growth.

Without oilsands growth, Canada will not be adding to the production problem at least. It remains in its traditional position of taking whatever price the market has to offer.

Yahoo Finance

Yahoo Finance