Omicron Hits Elective MedTechs, 3 Subsectors Likely to Thrive

The elective subsectors of MedTech had started seeing recovery after a rollercoaster ride through 2020 and the initial months of 2021. Although there were disruptions in the form of the emergence of new and more infectious variants of COVID-19, the overall trend of improvement from the previous year was sustained, courtesy of the gradual opening up of the economy following large-scale vaccination.

In the last reported third quarter, the collective business of the MedTech companies showed a sequential decline in terms of the legacy base business. However, thanks to the fiscal and monetary stimulus and mass vaccination drive in the nation and outside, the process of economic reopening never stopped.

Unfortunately, fourth-quarter (ending Dec 31, 2021) earnings (reporting cycle to start from the third week of January) are already apprehended to have been grossly disrupted by the surging Omicron wave. This highly-infectious variant of coronavirus has been seen to potentially infect hospital staff widely and at a much faster rate than the earlier variants.

In view of this, here we discuss three major subsectors of MedTech and three constituent stocks, Option Care Health OPCH, Globus Medical, Inc. GMED and Omnicell, Inc. OMCL, for which the present changing scenario has opened up enormous growth prospects.

The Current Doldrums and Changing Demand

The hospital staffing crisis has taken a severe turn over the past one and a half months following the emergence of Omicron. The COVID-led massive hospitalization has once again stalled elective MedTech procedures.

Going by a MEDTECHDIVE report of Jan 5, hospital administrators expect the surging Omicron wave to affect elective surgeries for up to four weeks, potentially resulting in a 7% revenue hit for “exposed” MedTech companies. By ”exposed” MedTech companies, we mean the medical device subsectors whose procedures can be easily deferred. The report quoted MedTech analysts from BTIG who stated that, “the areas that are being hardest hit are the usual suspects, orthopedics and elective general surgery, while cardiac surgery and non-elective general surgery appear to be least impacted."

Added to this, while specialized medical caregiving is suffering big time as a result of the declining non-COVID hospital admissions, demand for long-term care (LTC) services and home health care reached an all-time high during this period due to increased health concerns among the elderly and the vulnerable population.

3 Sectors to Bet on

Looking at the current COVID wave worldwide, we once again expect an abrupt change in the consumer behavior pattern. The resultant uncertainty will put overall MedTech stock investment in a tight spot. Here we discuss three MedTech subsectors, which are expected to sail through this tough time with flying colors based on the nature of their business.

The first sector that we ask investors to focus on is the prospering home health and hospice. Thanks to COVID-19, this industry has become the new generation’s preferred choice of healthcare now. The pandemic has raised the demand for home-based care beds exponentially over the past few months. Apart from this, the need for remote monitoring and assistance has increased the adoption of remote care settings significantly.

Going by a Market Data Forecast report, the global home healthcare market is set to witness a CAGR of 9.5% by 2026.

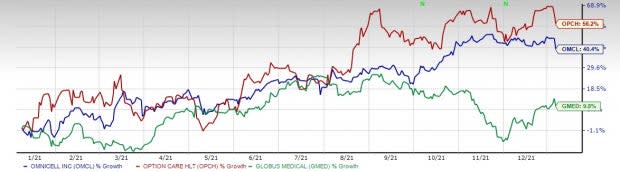

One-Year Price Performance

Image Source: Zacks Investment Research

Option Care Health, a home and alternate site infusion services provider with a Zacks Rank #2 (Buy) is our first pick. Option Care is currently benefiting from momentum in-patient referrals across both acute and chronic therapy portfolios driven by collaborations with health systems.

Also, improved supply chain dynamics for certain therapies and collaborations with manufacturers as a channel partner of choice on newer therapies are adding to the growth of OPCH. Over the past year, Option Care stock has surged 56.2%

The next sector on our list is the surgical robotics space. Among all the orthopedic device sub wings, robotic surgery has been gaining popularity faster. A major advantage of robotic surgery is the lesser utilization of hospital resources along with minimal patient contact and exposure to the virus. This type of surgery not only enhances patient outcomes and minimizes costs but also reduces postoperative recovery time, immediate post-surgical pain, and infection rates as well as lowers complications.

Investors can consider buying the shares of musculoskeletal solutions provider, Globus Medical, Inc., currently carrying a Zacks Rank #2. You can see the complete list of Zacks #1 Rank stocks here.

Following the initial pandemic-led downturn of the Globus Medical business, there has been a visible rebound in the company’s revenue trend. According to the company, its ExcelsiusGPS Robotic Navigation system’s clinical superiority in the operating room continues to be the underlying growth driver. Adoption and utilization remained strong even in the COVID-19-dampened third quarter and prospective surgeon customers routinely acknowledged that ExcelsiusGPS is the best fine robot on the market.

In August 2021, Globus Medical’s Excelsius3D, an intelligent intraoperative 3-in-1 imaging system, was granted 510(k) clearance by the FDA. Over the past year, Globas Medical has gained 9.8%

The next sector on our list is telehealth services driven by its growing prosperity through the pandemic months on demand for contactless services. Consistently robust uptake, consumer preference, and significant strategic investment have been the main contributing factors behind this continued growth. Per a July 2021 Mckinsey & Company report, telehealth use has increased 38 times from the pre-COVID-19 baseline. The report also stated that investment in virtual care and digital health has skyrocketed, fueling further innovation.

Investors can consider betting on Zacks Rank #2 company, Omnicell, a provider of end-to-end automation solutions for the medication-use process. Omnicell’s strong performance in the pandemic months reflects the robust demand for its medication management and adherence automation solutions.

Omnicell recently acquired FDS Amplicare in an effort to strengthen its Advanced Services portfolio, which continues to gain momentum in the market. This is a strategic addition to the company’s Enliven Health solution. FDS has a suite of comprehensive and complementary SaaS technology solutions and a national network of more than 15,000 independent retail pharmacies. Over the past year, Omnicell has rallied 40.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicell, Inc. (OMCL) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

Option Care Health, Inc. (OPCH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance