Olin Corp (OLN) Q1 2024 Earnings: Beats EPS Estimates, Reports Decline in Revenue

Net Income: Reported at $48.6 million for Q1 2024, surpassing the estimated $45.78 million.

Earnings Per Share (EPS): Achieved $0.40 per diluted share, exceeding the estimate of $0.38.

Revenue: Totaled $1,635.3 million in Q1 2024, slightly below the estimated $1,649.68 million.

Adjusted EBITDA: Recorded at $242.1 million for the quarter, indicating operational performance excluding non-recurring items.

Share Repurchases: Amounted to $105.4 million during the quarter, reflecting the company's ongoing capital return strategy.

Segment Performance: Winchester segment showed growth with Q1 2024 sales of $409.4 million, driven by higher commercial and military sales.

Debt Metrics: Ended Q1 2024 with net debt of approximately $2.6 billion and a net debt to adjusted EBITDA ratio of 2.3 times.

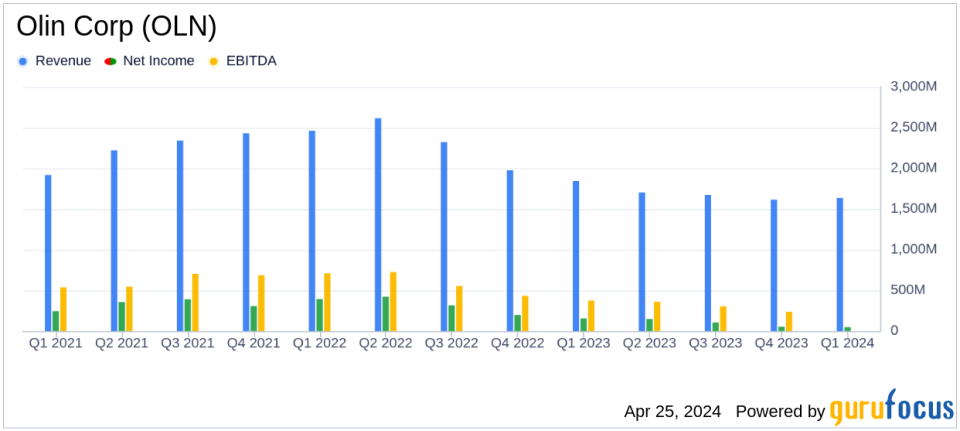

Olin Corporation (NYSE:OLN) disclosed its financial results for the first quarter of 2024 on April 25, 2024, revealing a mixed performance with a beat on earnings per share (EPS) estimates but a decline in revenue year-over-year. The detailed financials can be accessed through Olin Corp's 8-K filing.

Company Overview

Olin Corp, headquartered in Clayton, Missouri, operates primarily in the chemicals industry with a focus on manufacturing and selling chlorine and caustic soda, vinyls, epoxies, chlorinated organics, bleach, hydrogen, and hydrochloric acid. The company is also a leading U.S. manufacturer of ammunition through its Winchester segment. The majority of Olin's revenues are generated within the United States.

Financial Highlights and Analyst Expectations

For Q1 2024, Olin reported net income of $48.6 million, or $0.40 per diluted share, surpassing the analyst's EPS estimate of $0.38. However, the company experienced a decrease in revenue, posting $1,635.3 million compared to $1,844.3 million in Q1 2023, which fell short of the estimated $1,649.68 million. The adjusted EBITDA for the quarter was $242.1 million, a significant reduction from the $434.1 million reported in the same period last year.

Segment Performance

The Chlor Alkali Products and Vinyls segment, which is the largest revenue contributor, saw a decrease in sales to $884.6 million from $1,117.1 million in Q1 2023. This decline was primarily due to lower pricing and volumes, particularly in caustic soda. The Epoxy segment also faced challenges, reporting a loss of $11.8 million compared to earnings of $21.4 million in the previous year, affected by lower pricing despite increased volumes and reduced costs. On a positive note, the Winchester segment, bolstered by the acquisition of the White Flyer business, showed improved performance with sales rising to $409.4 million from $366.5 million, and segment earnings increasing to $72.2 million from $61.0 million.

Operational and Strategic Developments

Olin's President and CEO, Ken Lane, highlighted the sequential improvement across all business segments from Q4 2023 and expressed optimism about the company's recovery trajectory. Olin continues to focus on aligning production with market demand and maintaining a disciplined capital allocation strategy. The company also repurchased approximately 2.0 million shares for $105.4 million during the quarter.

Financial Stability and Outlook

Olin ended the quarter with a cash balance of $150.9 million and a net debt to adjusted EBITDA ratio of 2.3 times. Looking ahead, the company anticipates improved adjusted EBITDA in Q2 2024 compared to Q1 and expects full-year 2024 adjusted EBITDA to be similar to or slightly higher than 2023 levels, driven by expected improvements in demand and pricing for its chemical products.

Olin Corp's first quarter of 2024 reflects a period of strategic adjustments and operational improvements amidst challenging market conditions. The company's ability to exceed EPS expectations while actively managing its portfolio and returning value to shareholders through significant share repurchases speaks to its resilient operational framework and strategic foresight.

Explore the complete 8-K earnings release (here) from Olin Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance