Oldies Are Goldies: Buy These 5 Surging Old Economy Stocks

U.S. stock markets have maintained their northward journey in 2024 after an astonishing rally in 2023. The bull run has gained further thrust as major stock indexes have posted multiple all-time highs on both intraday and closing basis so far this year. Year to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have advanced 2.8%, 14.8% and 20.9%.

However, the major driver of last year’s and this year’s rally was globally booming artificial intelligence (AI), especially generative AI. Companies that have extensive application of AI in their final products have become multi-baggers in the past 18 months. Stock prices of some of these companies have skyrocketed 200-300% during this period.

Meanwhile, market participants have other sectors to look into. Several old economy stocks from sectors such as industrials, finance, auto, materials and consumer defensive have popped year to date.

Investing in these untapped stocks with a favorable Zacks Rank should lead to profits. These old economy stocks have transformed the ongoing rally into a broad-based one with huge opportunities for portfolio diversification.

Our Top Picks

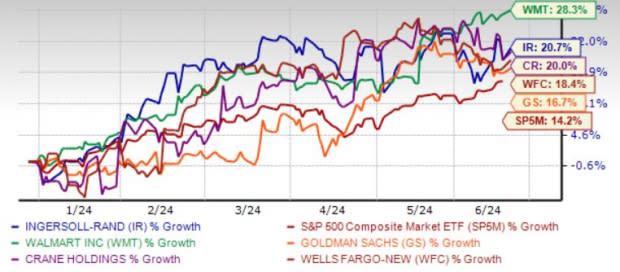

We have narrowed our search to five old economy stocks that have provided more returns than the market’s benchmark — the S&P 500 Index — year to date, and have further upside left.

These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

The Goldman Sachs Group Inc. GS intends to refocus on the core strengths of investment banking (IB) and trading businesses. Improvement in global deal-making and underwriting activities and GS’ leading position are likely to offer leverage and drive IB fees. We expect the metric to grow 8.8% in 2024. Also, the decent liquidity of GS aids sustainable capital distribution.

Zacks Rank #1 The Goldman Sachs Group has an expected revenue and earnings growth rate of 11.8% and 59.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 11.5% over the last 60 days. The stock price of GS has advanced 16.7% year to date.

Wells Fargo & Co.’s WFC first-quarter 2024 results show improvement in non-interest income and a decline in provisions. Progress on efficiency initiatives, such as branch footprint reduction, will continue to support expense reduction and drive WFC’s bottom line.

A decent deposit balance will keep supporting WFC’s financials, given the strength in the consumer banking and lending segment and will aid its liquid profile. Additionally, WFC’s strong liquidity position will support its capital distribution activities.

Zacks Rank #2 Wells Fargo has an expected revenue and earnings growth rate of 1.4% and 9.6%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 0.2% over the last seven days. The stock price of WFC has appreciated 18.4% year to date.

Walmart Inc. WMT has been gaining from its highly diversified business with contributions from various segments, channels and formats. WMT has been benefiting from an increase in in-store and digital channel traffic due to its robust omnichannel initiatives. Store-fulfilled delivery sales jumped 50% in the first quarter of fiscal 2025.

Walmart’s strategic focus on enhancing delivery services has also been rewarding, as evidenced by the constant increase in the market share for groceries. Upsides like these, along with growth in the advertising business, fueled WMT’s first-quarter results and led to an encouraging fiscal 2025 view.

Zacks Rank #2 Walmart has an expected revenue and earnings growth rate of 4.2% and 9%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 2.5% over the last 30 days. The stock price of WMT has jumped 28.3% year to date.

Crane Co. CR manufactures and sells engineered industrial products in the Americas, Europe, the Middle East, Asia, and Australia. CR has three segments: Aerospace & Electronics, Process Flow Technologies, and Engineered Materials.

Zacks Rank#2 Crane has an expected revenue and earnings growth rate of 9.9% and 16.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.8% over the last 30 days. The stock price of CR has surged 20% year to date.

Ingersoll Rand Inc. IR is set to gain from a healthy demand environment, solid product portfolio and innovation capabilities. Higher orders for industrial vacuums and blowers are driving the growth of IR’s Industrial Technologies & Services unit.

Benefits from acquired assets are driving the segment’s performance, of late. IR’s ability to generate strong cash flows supports its measures to reward shareholders through dividends and share buybacks.

Zacks Rank #2 Ingersoll Rand has an expected revenue and earnings growth rate of 5.4% and 10.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last 30 days. The stock price of IR has climbed 20.7% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance