Old Dominion's (ODFL) Q3 Earnings & Revenues Top Estimates

Old Dominion Freight Line’s ODFL third-quarter 2020 earnings per share of $1.71 outpaced the Zacks Consensus Estimate by 20 cents. Moreover, the bottom line surged 24.8% year over year. The upside was driven by record improvement in operating ratio (operating expenses as a percentage of revenues) on the back of the company’s cost containment efforts.

Revenues of $1058.2 million surpassed the Zacks Consensus Estimate marginally and increased year over year on a 1.3% rise in LTL (Less-Than-Truckload) tons per day.

Management stated in the press release that all prior-period share and per share data are adjusted to reflect the three-for-two stock split effectuated in earlier this year.

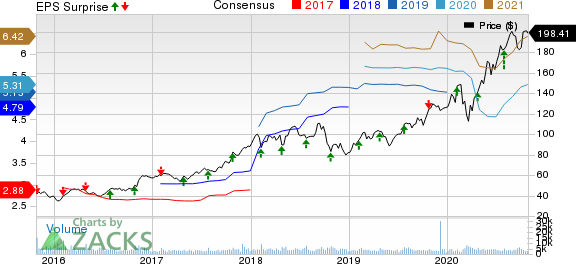

Old Dominion Freight Line, Inc. Price, Consensus and EPS Surprise

Old Dominion Freight Line, Inc. price-consensus-eps-surprise-chart | Old Dominion Freight Line, Inc. Quote

Other Details

In the quarter under review, Old Dominion reported a 1.3% increase in LTL tons. Moreover, LTL revenue per hundredweight, excluding fuel surcharges, inched up 2.6%. LTL weight per shipment and LTL revenue per shipment rose 4.5% and 4%, respectively. However, LTL shipments were down 3.1%.

The company’s major revenue-generating segment, LTL services, logged a total of $1044.6 million, increasing marginally year over year. Revenues from other services increased 1.2% to $13.5 million. Total operating expenses fell 5.2% to $787.9 million, mainly owing to the 1.6% reduction in costs pertaining to salaries, wages & benefits and 23.1% reduction in operating supplies & expenses.

Moreover, operating ratio improved 480 basis points to 74.5%. Notably, the lower the value of this metric, the better.

Old Dominion exited the quarter with cash and cash equivalents worth $420.4 million compared with $403.57 million at the end of 2019. Capital expenditures incurred in the reported quarter were $46.3 million. Old Dominion expects a capex of $240 million for 2020. Of the total, $195 million is anticipated to be invested in real estate and service-center expansion. The company expects to spend $20 million and $25 million on tractors/trailers, and technology and other assets, respectively.

During the third quarter, Old Dominion, currently carrying a Zacks Rank #2 (Buy), rewarded its shareholders with $17.6 million through cash dividends. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sectorial Snapshot

Apart from Old Dominion, let’s take a look at some other Zacks Transportation sector’s third-quarter earnings like Delta Air Lines DAL , J.B. Hunt Transport Services JBHT and United Airlines Holdings, Inc. UAL.

Delta incurred a loss (excluding $5.17 from non-recurring items) of $3.30 per share in the September quarter, wider than the Zacks Consensus Estimate of a loss of $3.14. Meanwhile, Delta reported earnings of $2.32 per share (on an adjusted basis) in the year-ago quarter, driven by high passenger revenues as air-travel demand was buoyant at that time.

J.B. Hunt reported mixed third-quarter 2020 results, with earnings missing estimates and revenues beating the same. Quarterly earnings of $1.18 per share fell short of the Zacks Consensus Estimate of $1.26. Moreover, the bottom line declined 15.7% year over year due to disappointing performance of its intermodal (JBI) unit. Total operating revenues increased 4.6% to $2,472.5 million. Revenues also beat the consensus mark of $2,345.2 million.

United Airlines incurred a loss (excluding $1.83 from non-recurring items) of $8.16 per share, wider than the Zacks Consensus Estimate of a loss of $7.63. Results were hurt by the coronavirus-induced weakness in air-travel demand. Moreover, operating revenues of $2,489 million slumped 78.1% year over year and also lagged the Zacks Consensus Estimate of $2,570.1 million. This year-over-year plunge was due to an 84.3% drop in passenger revenues to $1,649 million.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Old Dominion Freight Line, Inc. (ODFL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance