Old Dominion Freight Line (NASDAQ:ODFL) Reports Q2 In Line With Expectations

Freight carrier Old Dominion (NASDAQGS:ODFL) reported results in line with analysts' expectations in Q2 CY2024, with revenue up 6.1% year on year to $1.50 billion. It made a GAAP profit of $1.48 per share, improving from its profit of $1.33 per share in the same quarter last year.

Is now the time to buy Old Dominion Freight Line? Find out in our full research report.

Old Dominion Freight Line (ODFL) Q2 CY2024 Highlights:

Revenue: $1.50 billion vs analyst estimates of $1.50 billion (small miss)

EPS: $1.48 vs analyst estimates of $1.45 (1.9% beat)

Gross Margin (GAAP): 40.8%, up from 40% in the same quarter last year

Sales Volumes rose 3.1% year on year (-11.5% in the same quarter last year)

Market Capitalization: $42.12 billion

Marty Freeman, President and Chief Executive Officer of Old Dominion, commented, “Old Dominion produced another quarter of profitable growth despite continued softness in the domestic economy. This was our third consecutive quarter with growth in both revenue and earnings per diluted share, and it was the first time in over a year where our earnings increased by double digits. These results were made possible by the dedication of the OD Family of employees, who continue to execute on our long-term strategic plan that is centered on our ability to provide our customers with superior service at a fair price. Consistently delivering best-in-class service also continues to support our yield-management strategy and ongoing ability to win market share."

With its name deriving from the Commonwealth of Virginia’s nickname, Old Dominion (NASDAQGS:ODFL) delivers less-than-truckload (LTL) and full-container load freight.

Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

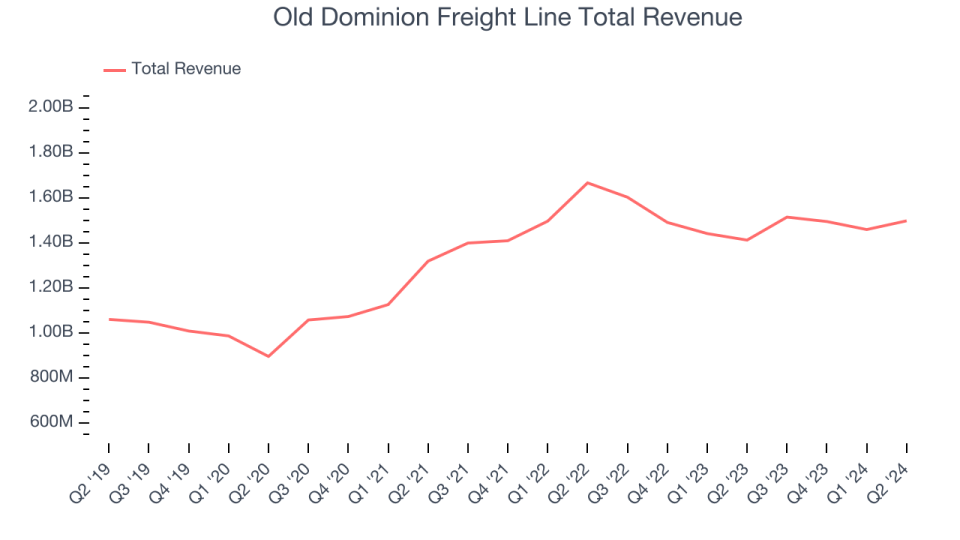

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Over the last five years, Old Dominion Freight Line grew its sales at a decent 7.6% compounded annual growth rate. This shows it was successful in expanding, a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Old Dominion Freight Line's recent history shows its demand slowed as its revenue was flat over the last two years. We also note many other Ground Transportation businesses have faced declining sales because of cyclical headwinds. While Old Dominion Freight Line's growth wasn't the best, it did perform better than its peers.

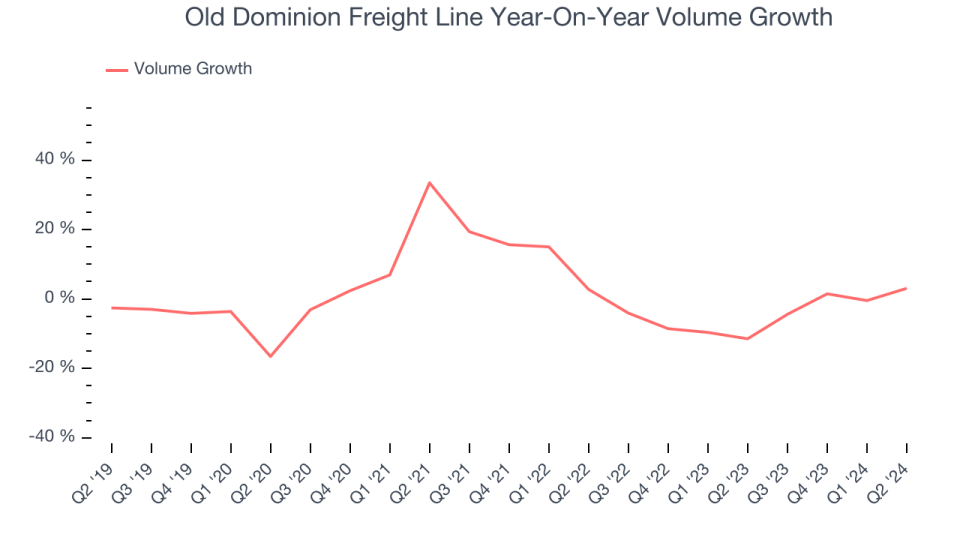

Old Dominion Freight Line also reports its sales volumes, which reached 3.1 million in the latest quarter. Over the last two years, Old Dominion Freight Line's sales volumes averaged 4.3% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Old Dominion Freight Line grew its revenue by 6.1% year on year, and its $1.50 billion of revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 6.8% over the next 12 months.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

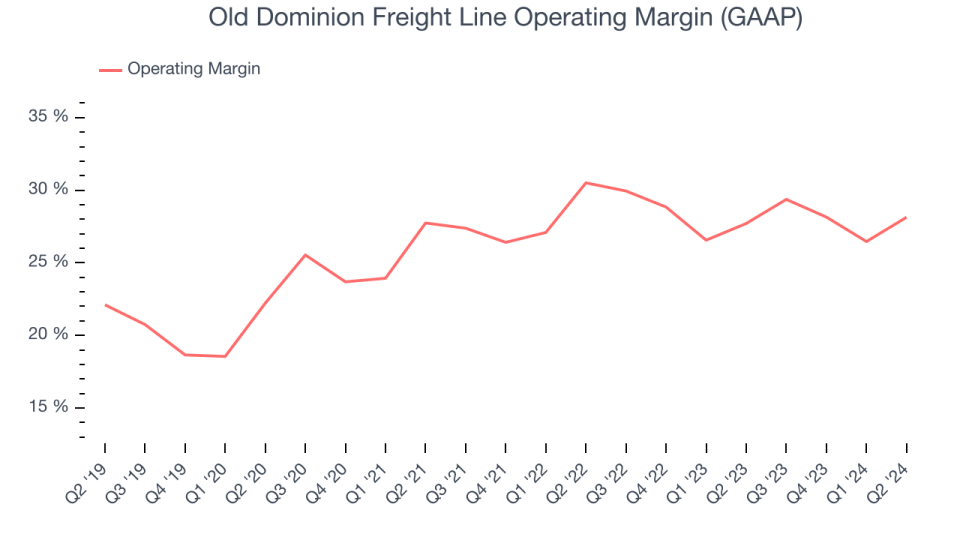

Old Dominion Freight Line has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 26.4%. This isn't surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Old Dominion Freight Line's annual operating margin rose by 8 percentage points over the last five years, showing its efficiency has significantly improved.

In Q2, Old Dominion Freight Line generated an operating profit margin of 28.1%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

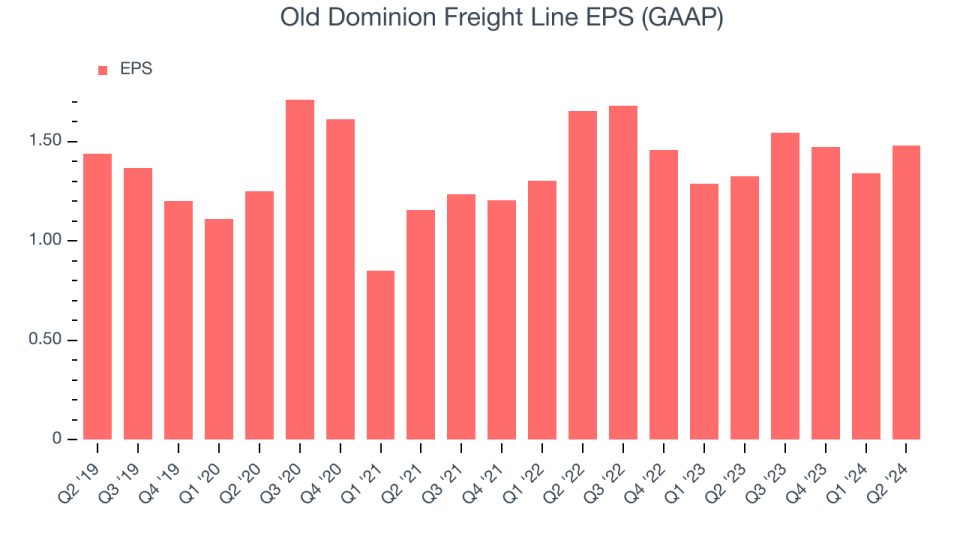

Old Dominion Freight Line's EPS grew at a weak 2.1% compounded annual growth rate over the last five years, lower than its 7.6% annualized revenue growth. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. Although it wasn't great, Old Dominion Freight Line's two-year annual EPS growth of 4% topped its flat revenue.

In Q2, Old Dominion Freight Line reported EPS at $1.48, up from $1.33 in the same quarter last year. This print beat analysts' estimates by 1.9%. Over the next 12 months, Wall Street expects Old Dominion Freight Line to grow its earnings. Analysts are projecting its EPS of $5.84 in the last year to climb by 7.1% to $6.25.

Key Takeaways from Old Dominion Freight Line's Q2 Results

It was encouraging to see Old Dominion Freight Line beat analysts' volume and EPS expectations this quarter. On the other hand, its revenue unfortunately missed, showing it had to lower prices. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on track. The stock traded up 2.3% to $198.50 immediately following the results.

So should you invest in Old Dominion Freight Line right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance