Oil tumbles off 3-year highs after Trump takes a jab at OPEC

Markets Insider

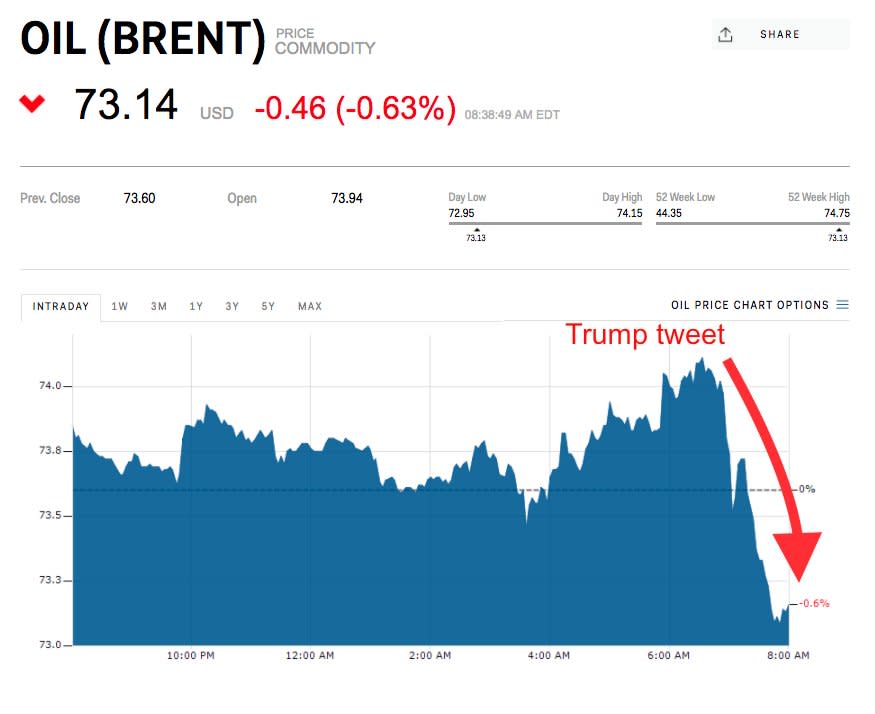

Oil has been rallying this week, but it slipped Friday following President Donald Trump's criticism of the OPEC cartel of oil producers.

Crude fell more than 1% by 8 a.m. ET, an hour after the tweet.

Oil prices retreated from multiyear highs Friday after President Donald Trump took a swipe at the OPEC cartel of oil producers in an early-morning tweet.

"Looks like OPEC is at it again," Trump tweeted just before 7 a.m. ET. "With record amounts of Oil all over the place, including the fully loaded ships at sea, Oil prices are artificially Very High! No good and will not be accepted!"

Brent, the international benchmark, sank more than 1% to $72.79 a barrel by 8 a.m. ET. West Texas Intermediate was also down, falling below $68. Both had hit three-year highs earlier this week on the back of supply concerns.

Trump could be reacting to reports that Saudi Arabia — OPEC's biggest producer — is targeting a crude price of $80 or $100. That has been viewed as a hint that OPEC will extend production caps after they expire in December.

Responding to Trump's tweet, Saudi Arabia's energy minister, Khalid al-Falih, told CNBC, "Markets should set prices."

NOW WATCH: Wall Street's biggest bull explains why trade war fears are way overblown

See Also:

SEE ALSO: Oil is closing in on $70 for first time in over 3 years

Yahoo Finance

Yahoo Finance