Oil Prices on the Rise: 3 Top Ranked Energy Stocks Breaking Out Now

After selling off nearly 25% over the last six weeks, the price of crude oil has staged a powerful reversal, which I believe signals a bottom in the market. Based on the economic readings of a strong economy, and persistently tight supply in oil supply I think the prices of oil rallies into year end.

However, while oil price momentum is a bullish catalyst for the sector, energy stocks are also trading at historically low valuations, minimizing the downside risk.

Additionally, many oil stocks enjoy top Zacks ranks, and technical trade setups, making them extremely compelling considerations for any investor’s portfolio.

Here, I will share three such stocks, that offer very appealing risk reward opportunities for discerning investors.

Image Source: TradingView

Liberty Energy

Liberty Energy LBRT is a North American oilfield services company offering services and technology to onshore oil and natural gas exploration and production companies.

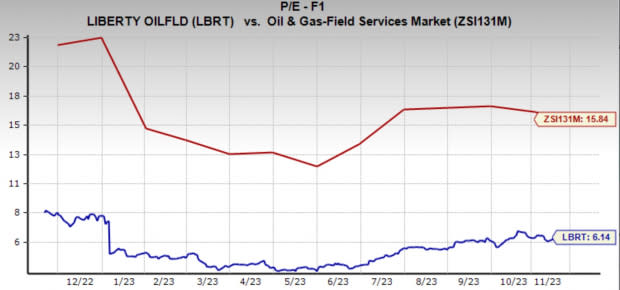

In addition to a Zacks Rank #1 (Strong Buy) rating, Liberty energy also has a historically depressed valuation. Today it is trading at a one year forward earnings multiple of 6.1x, which is well below the industry average of 15.8x, and below its six-year median of 8.3x. The company also pays a 1% dividend yield.

Image Source: Zacks Investment Research

Liberty Energy stock has been building out a convincing technical bull flag over the last month. If the stock can trade and close above the $20 level, it would signal a breakout. Alternatively, if the stock moves below the $18.50 the setup is invalid, and investors may want to wait for another opportunity.

Image Source: TradingView

Petroleo Brasileiro

Petroleo Brasileiro PBR, commonly known as Petrobras, is a Brazilian multinational energy company and one of the largest integrated oil and gas companies in the world. It is also one of the most compelling oil stock investments currently in the market.

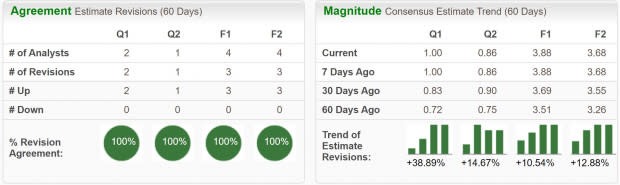

In addition to a historically low relative valuation, Petroleo Brasileiro also enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions.

Petroleo Brasileiro is trading at a one year forward earnings multiple of 4.1x, below the industry average 4.3x, and well below its 10-year median of 8.8x. Additionally, current quarter earnings have been revised higher by 39% over the last month and FY23 earnings estimates have been raised by 10.5% over the same period.

Image Source: Zacks Investment Research

Just last week, PBR stock broke out from a bull flag. From the look of this chart, the stock looks ready to take on the yearly highs very soon. So long as the price doesn’t move back below the breakout level of $15.50, I think it should move higher through year end.

Image Source: TradingView

Ecopetrol

Ecopetrol EC is a Colombia-based petroleum company. The Company is focused on identifying opportunities primarily within the eastern Llanos Basin of Colombia, as well as in other areas in Colombia and northern Peru.

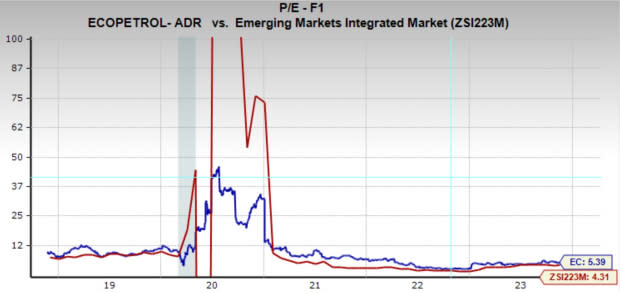

Ecopetrol is a part of the Integrated – Oil and Gas – Emerging Markets industry, which is currently the Top 1% (1 out of 251) of the Zacks Industry Rank. Additionally, the stock has a Zacks Rank #1 (Strong Buy) rating, and bargain valuation, well below its historical average.

EC is trading at a one year forward earnings multiple of 5.4x, which is above the industry average of 4.3x, and below its five-year median of 8x. The company also pays an almost unbelievable 19.5% dividend yield!

Image Source: Zacks Investment Research

Like the other two stocks, Ecopetrol has a powerful technical chart pattern building. Just today, the stock broke out from a massive bullish pennant, indicating higher prices are likely in the near future. So long as the stock doesn’t reverse back below $12.25, its should push to yearly highs.

Image Source: TradingView

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Petroleo Brasileiro S.A.- Petrobras (PBR) : Free Stock Analysis Report

Ecopetrol S.A. (EC) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance