Oil prices will average $100 a barrel next year as demand rebounds in China and falling Russian output keeps global supplies tight, Bank of America says

Oil will average $100 a barrel in 2023 as demand in Asia bounces back and Russian output eases, BofA says.

Further Russian supply disruptions could push prices higher, but a global recession could cap them.

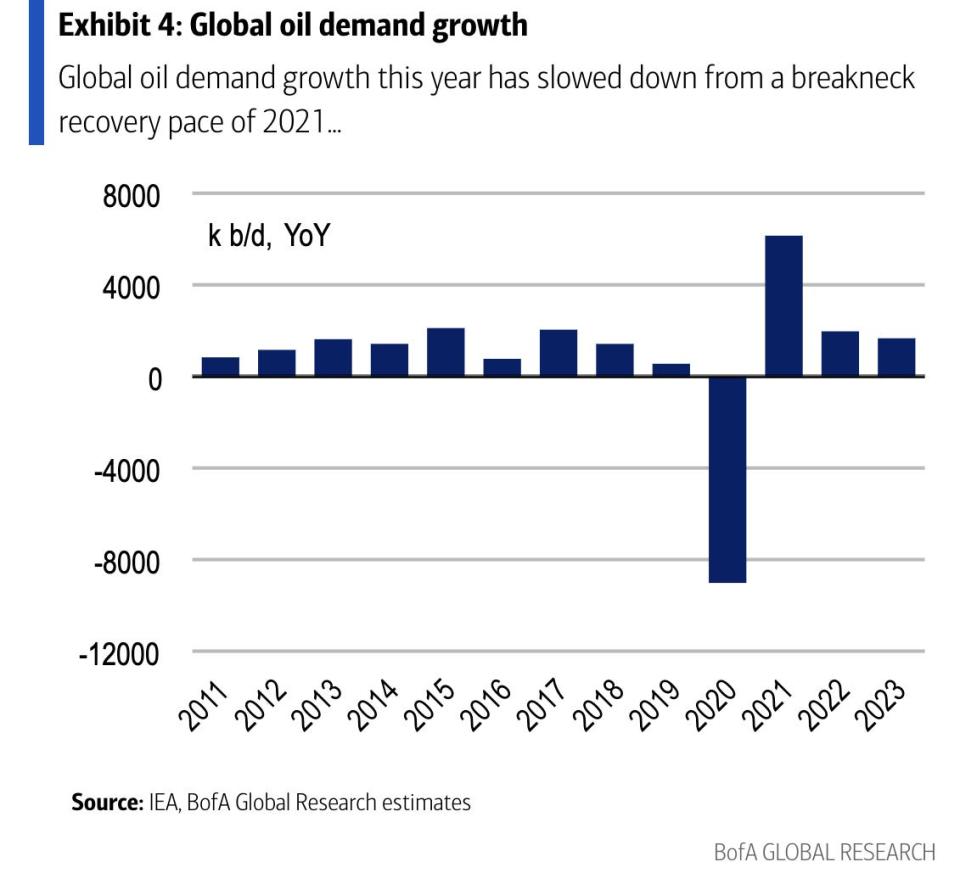

A slowdown in oil demand this year stems from expectations of weaker growth in the US, Europe, and Asia.

Bank of America forecasts oil prices to average $100 a barrel in 2023 as demand rebounds in China and Russian crude comes off the market.

Beijing's stringent COVID-19 lockdowns have capped oil use in the world's second largest economy throughout this year, but analysts expect those to ease as 2023 gets closer.

"On the global oil demand side, we now forecast that the Asian region will deliver 86% of the 1.7mn b/d of oil consumption growth that we project for next year, compared to just 19% of the 2mn b/d that we expect for 2022," BofA strategists said in a Monday note to clients.

So far this year, oil demand has slowed to 2 million barrels per day thanks to weaker expectations of economic growth in the US, Europe, and Asia, paired with higher crude prices. That follows the rapid recovery seen in 2021 of 6.2 million barrels per day.

For 2023, BofA expects oil demand growth to average 1.7 million barrels per day, which is below what the IEA, EIA, and OPEC are forecasting.

The looming threat of a global recession could drag prices lower than the $100 target average, though a Russian oil price cap presents could result in some upside. Should more barrels from Russia disappear from the global market — and experts already anticipate the warring nation to see a diminishing energy advantage — prices could climb.

Other output disruptions could occur in Iraq, Nigeria, and Libya as well, BofA analysts explained.

The firm added that global oil inventories, ultimately, remain limited, and spare production capacity is very low.

"Net, we project a small surplus of 0.1mn b/d next year that OPEC+ will likely mop up with a modest cut," BofA maintained. "Moreover, we expect some gas-to-oil switching to lend support to Brent oil and we continue to forecast an average price of $100/bbl in 2023 (and $94 for WTI), with a 12 month target of $110/bbl."

Dollar headwinds

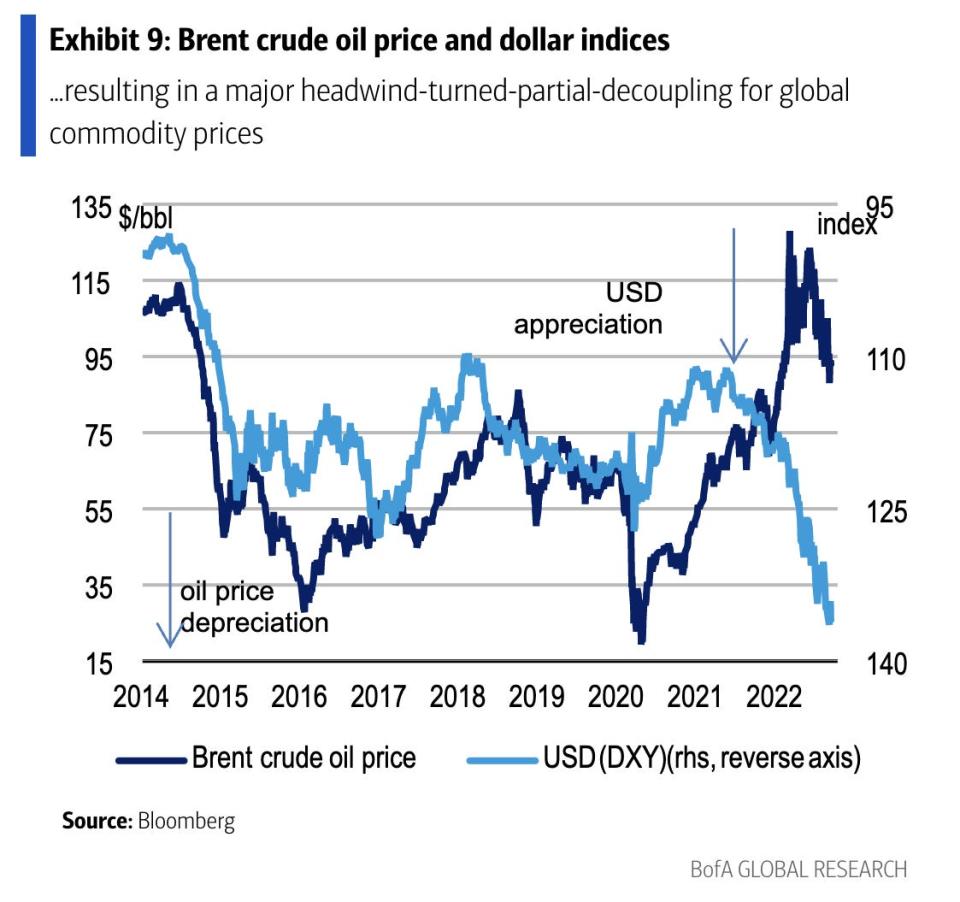

All the while, an aggressive Federal Reserve has pushed the US dollar to 20-year highs, and Bank of America said the currency could still climb further to new records if the economy sees a hard-landing.

"A strong dollar has been a major headwind for global oil prices, even if commodities and FX have partially decoupled," BofA said.

The dollar's rally against rival currencies, notably, has made fuel more expensive for other nations to purchase in local currencies. That strength contributed to the dramatic slowdown of oil demand growth, though some of it also stemmed from the spike in global energy prices, according to Bank of America.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance