The next phase of the oil crash will be bad for everybody: economist

“We are now approaching what will be a very dark part of the global commodity price crash,” High Frequency Economics’ Carl Weinberg said.

In a note to clients on Monday, Weinberg warns that the consequences of low oil prices will go from ambiguous to unambiguously bad. Specifically, he argues that the initial beneficiaries of low oil prices will themselves become losers economically.

“Regardless of whether the drop in oil prices has been good or bad for the global economy on balance, what happens next is sure to be bad,” he said.

A one-time windfall for importers

To understand his argument, you must first understand that falling oil prices (CLV16.NYM) are initially good for consumers and importers but very bad for producers and exporters.

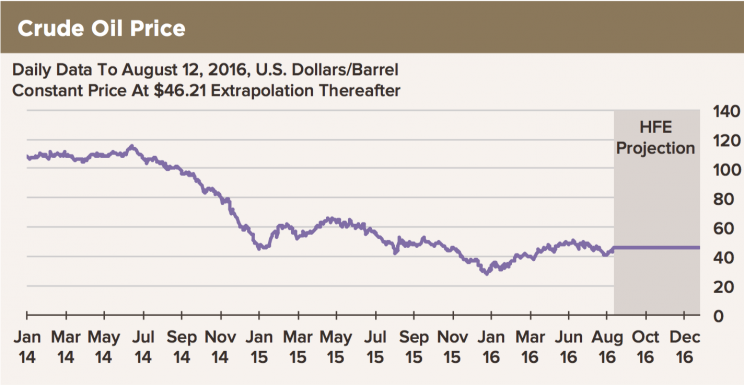

When oil prices topped out and began to fall during the summer of 2014, oil consumers like the US benefitted from the extra cash that they were saving on gasoline and other petroleum-based products.

But with oil prices now going sideways at low levels, the folks using that oil are not seeing any incremental gains.

“Flat but depressed oil prices will leave the oil-exporting countries impoverished, while the importing countries will lose their one-time windfall from falling prices,” Weinberg argued.

A catastrophe for exporters

Oil prices have halved in the past two years, which is incredibly painful for economies that rely on oil revenue to fund their government budgets. These economies include countries in OPEC. They even include places like Texas, which is heavily dependent on oil production.

This matters to energy importers because these oil producing economies are themselves importers and consumers of the world’s goods.

“For oil-exporting countries, the oil price crash has triggered a catastrophic decline of income, leading to economic contraction and fiscal imbalance,” Weinberg wrote. “These countries are impoverished when the price of their exports falls by three quarters. As a result, they import less from the rest of the world.”

Weinberg’s note comes as oil prices have been rallying. In fact, last week was the best week for oil bulls since April. But even with these rallies, prices would have to more than double to revisit levels we saw two years ago.

“In short, stable oil prices at depressed levels will prolong the agony of the exporting countries while wiping out any possible fillip to growth of the importing economies, starting as soon as next quarter,” he said.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Companies are increasingly buying back stock with borrowed money

What Wall St. is saying about the all-time-high stock market

David Rosenberg nails the stock market in a perfect sentence

The gloomy profits narrative underlying the stock market just got worse

Yahoo Finance

Yahoo Finance