Oil Rallies to Two-Month High After US Crude Stockpile Decline

(Bloomberg) -- Oil closed at the highest in more than two months after a government report showed US crude inventories shrinking by the most in almost a year.

Most Read from Bloomberg

Biden Struggles to Contain Mounting Pressure to Drop Out of Race

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

West Texas Intermediate advanced 1.3% to settle near $84 a barrel — the highest closing price since mid-April — after the Energy Information Administration reported a 12.2 million-barrel decline in US oil stockpiles, the biggest drop since late July 2023. Crude is up about 14% since early June.

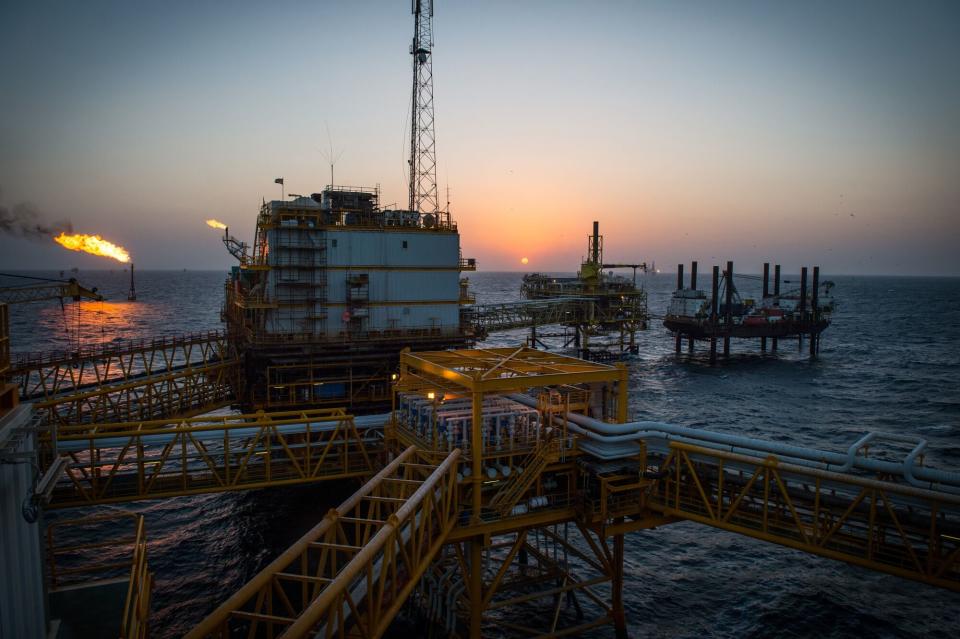

Crude remains solidly higher this year as OPEC+ restrains supplies, with futures also helped by a risk-on mood in equity markets. Geopolitical risks are contributing to the gains as well, as investors monitor elections in France and the UK, as well as Iran. In the Middle East, escalations between Israel and Hezbollah have threatened to spill over into a wider conflict.

More recently, anxieties over a potentially active hurricane season have supported prices as Hurricane Beryl churns through the Caribbean toward Jamaica.

Still, the macroeconomic environment in the US has added headwinds. Federal Reserve Chair Jerome Powell said on Tuesday that the latest economic data suggest inflation is getting back on a downward path, but he emphasized officials need more evidence before lowering interest rates.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance