Oil is crashing again

Oil prices are crashing again Tuesday after a short-lived spike on Monday.

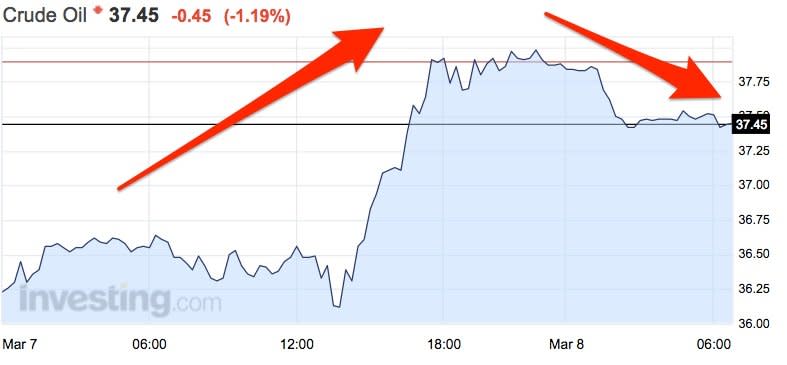

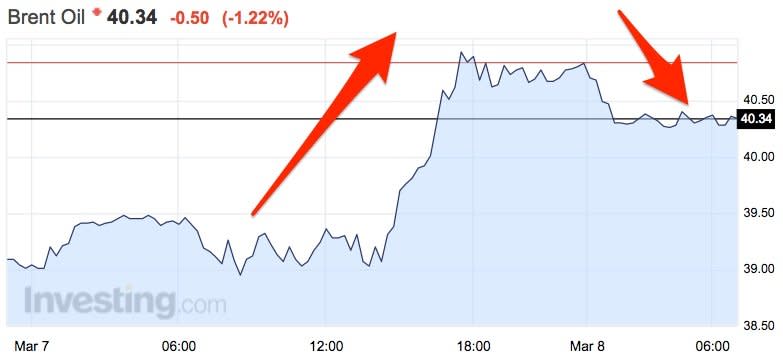

Crude oil fell by 1.19% by 7 a.m. GMT to around $37.50 a barrel, while Brent crude, the European benchmark, fell by 1.22% to hover just above $40 a barrel.

If this price trend continues, it will eradicate the 3.5% gains that oil experienced on Monday.

Here are the charts:

Investing.com

Investing.com

Oil started to recover two weeks ago, with some analysts saying the commodity had finally bottomed out after a near-constant 18-month slide.

Oil prices were in the triple digits in the summer of 2014 but are now about 60% lower because of a glut of oversupply by the OPEC cartel of oil-producing countries.

OPEC's bid to push Western counterparts out of business seems to be working, with Juan Prada from Barclays writing in a note on Tuesday: "Data showed that active US oil rigs fell last week to the lowest level since December 2009. Sentiment was further supported by expectations of policy stimulus in China."

But after initial concern that OPEC's pledge to freeze its production wouldn't make a difference — because of oil-rich countries such as Iran starting to pump huge amounts of oil — the oil price was given a boost by improving market sentiment.

OPEC also said it would be seeking a higher anchor price for oil.

The slide in oil prices, however, supports some analysts' view that the rally is and will be short-lived.

Norbert Ruecker, the head of commodities research at the Swiss private bank Julius Baer, said this week that there would be no "long-term recovery" in the price of oil:

Shale's cost deflation, Iran's return, and Mexico's market opening suggest that supplies remain ample for longer, overshadowing the industry's investment cuts for the time being.

Supply glut fears have taken a backseat as of late with the oil market's focus shifting from pessimism over ample inventories to optimism over declining US production. We still believe that oil prices experience a short-term bounce but no long-term recovery but see further upside in the near term.

NOW WATCH: This is how rapper 50 Cent made millions and then lost it

See Also:

The actor who played Borat just nailed this Apple product launch parody

Chevron plans to cut capital spending and still produce more oil

SEE ALSO: Oil is back above $40 — but don't expect the recovery to last

Yahoo Finance

Yahoo Finance