IT'S OFFICIAL: Americans Have Already Forgotten One Of The Biggest Lessons Of The Financial Crisis

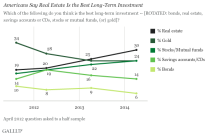

This week, Gallup released the latest edition of an annual survey asking Americans what they considered to be the best long-term investment.

The No. 1 answer? Real estate!

Gallup

This chart doesn't go back that far, sadly, but you can see that just a few years ago, the percentage of Americans who thought real estate was the best investment was MUCH lower, a fact obviously attributable to the trauma of the housing crash.

After the housing crash, numerous pundits predicted that America's love affair with homeownership would be doomed for good and that it might take generations for people to be into the idea of owning real estate again.

Nope.

One problem here is that Americans are wrong: Crash aside, real estate isn't historically that great of an investment.

Cullen Roche, who brought the survey to our attention, writes that the long-term performance of real estate as an investment is actually quite pathetic:

According to the U.S. Census Bureau Survey of Construction single family real estate generates a 0.74% annual return over the last 30 years (this includes multiple housing booms, mind you, so the data is probably much lower if we go further back in time). So there appears to be some recency bias here despite the housing bust.

And this doesn’t even account for many of the miscellaneous costs involved in real estate. As I’ve shown previously, a house is basically a depreciating asset that comes with an appreciating piece of land. But that depreciating asset is extremely expensive over its lifetime. When you calculate the total costs that go into maintaining this asset the returns are very likely to be negative over long periods of time. So that 0.74% figure is probably higher than you should really expect. In fact, the returns from stocks and bonds trump real estate by a healthy margin so Americans have this one totally backwards – the American Dream isn’t quite the dream we have been sold.

People may have excellent reasons for buyin a home, as opposed to renting. And right now in many cities, the math indicates that buying is preferable. But as a long-term investment, it's wild to see real estate retain its perch as the clear favorite among Americans.

More From Business Insider

Yahoo Finance

Yahoo Finance