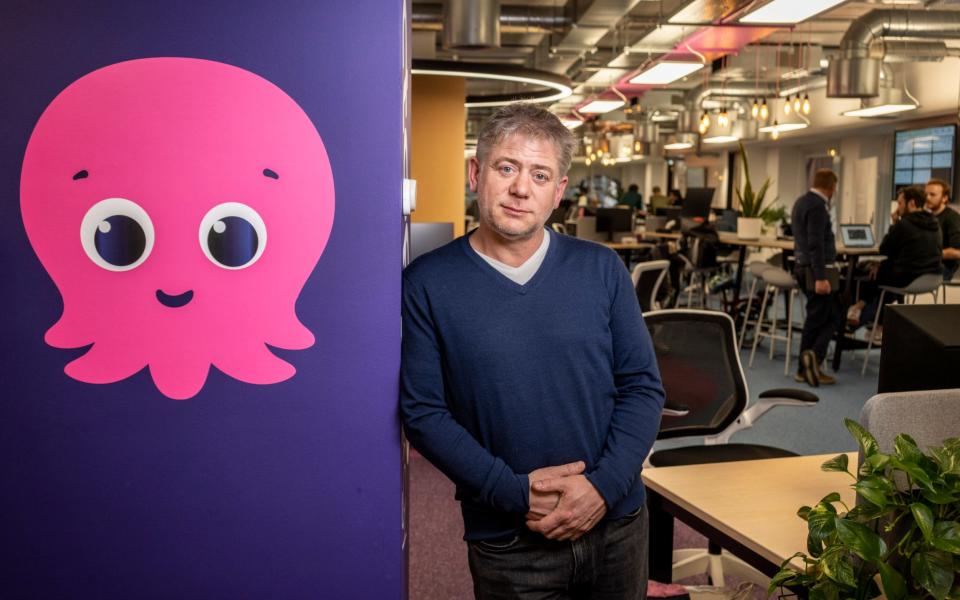

Octopus Energy achieves £6.2bn valuation after raising £625m from investors

Octopus Energy has boosted its valuation to $8bn (£6.3bn) after raising $800m from investors.

Britain’s second-largest gas and electricity supplier said it plans to use the cash to fuel its global expansion and grow its heat pump business, as it aims to capitalise on the Government’s push for net zero.

In its latest round of fundraising, the Canada Pension Plan Investment Board has pledged $326m, while Australia’s Origin Energy added $305m.

Two other investors are contributing to maintain their existing percentage stake: Tokyo Gas, the largest natural gas utility company in Japan; and Generation Investment Management, which was founded by the former US vice-president Al Gore and positions itself as a net-zero investor.

In a previous fundraising round two years ago, the company was valued at £4bn.

By comparison, British Gas owner Centrica is currently valued at £7.7bn on the London Stock Exchange.

An industry source told The Telegraph that Octopus had already overtaken Centrica as the biggest supplier of electricity in the UK, but that it was not interested in becoming market leader in gas because it saw heat pumps as the future.

Greg Jackson, the Octopus chief executive, said: “We will invest to accelerate our growth and create a truly global clean energy giant.”

Frank Calabria, the chief executive of Origin Energy, said that since its initial investment in May 2020, Octopus had “exceeded all expectations and cemented our belief in its unique capabilities and strong platform for future growth”.

The company has started to install heat pumps in the UK this year, while also manufacturing its own models. This comes as the Government plans to ban traditional gas boilers from new-built houses from 2025 and looks for ways to hit net zero emissions by 2050.

Octopus says the investment will help create 3,000 “green jobs” in the UK next year, including 2,000 engineers installing heat pumps, with the remainder in sales and administration.

The business was founded in 2015 but has grown rapidly to serve more than 5m UK households.

At the start of December it completed its acquisition of 1.3m Shell Energy customers in the UK and Germany. It has also been appointed by Ofgem to be the “supplier of last resort” for customers served by a string of energy companies that have become insolvent over the past three years.

The company’s tentacles have expanded into rival domestic energy companies, with its Kraken computer system being adopted by E.On, EDF and Good Energy.

Earlier this month, it secured a £550m funding facility from Lloyds Bank for its electric vehicle leasing business, which works with 4,000 companies.

Octopus now operates in 18 countries.

Read the latest updates below.

06:41 PM GMT

Signing off

Thanks for joining us today. Chris Price will be back tomorrow morning but, in the meantime, I’ll leave you with some of the latest business stories on The Telegraph website:

British Airways apologises for ‘hurt and upset’ over Jewish sitcom decision

Microlight pilots blast plans to use drones for NHS medicine deliveries

05:42 PM GMT

Brent crude rises amid mounting attacks in the Red Sea

Brent crude, the benchmark world oil price, has risen 1.53pc today as mounting attacks by the Yemeni Houthis on ships in the Red Sea have disrupted maritime trade and raised concern of continued disruptions.

The share price of oil companies have risen on both sides of the Atlantic. In US trading, Chevron climbed 0.93pc and ExxonMobil added 2.1pc.

The S&P 500 energy sub-index climbed 1.49%, but is still the only major sector in the S&P 500 on course for losses quarter-to-date, down nearly 7pc.

Alex McGrath, chief investment officer for NorthEnd Private Wealth, told Reuters:

Commodities in general have sold off a good bit this year, which has helped the CPI [consumer price index] number continue to move down.

But if you get a sustained rise in energy prices, it just keeps that CPI number stickier than the Fed would want it to be, and that could put (interest rate) cuts down the road further away.

04:54 PM GMT

Footsie closes up

The FTSE 100 closed up 0.55pc. The biggest risers were gambling group Entain, up 4.69pc, and Vodafone, up 3.75pc. The biggest fallers were mining company Fresnillo, down 4.58pc, and housebuilder Berkeley, down 3.64pc.

The FTSE 250 rose 0.06pc. Science investment firm IP Group was the biggest riser, by 5.93pc, while mortgage lender OSB Group rose 4.43pc. The biggest fallers were Moonpig, down 3.82pc, and PPHE Hotel Group, down 3.32pc.

Michael Hewson chief market analyst at CMC Markets UK, said:

We’ve seen a negative start to the last trading week before Christmas with the FTSE100 bucking the negative tone due to a strong performance from the energy sector, along with telecoms, amid M&A speculation.

This morning’s jump in oil and gas prices has sent BP and Shell higher on the back of the decision by BP to suspend all tanker transits through the Red Sea until further notice due to safety concerns over Houthi rebel attacks.

Given the importance of the Red Sea and Suez Canal as a crucial transit point for both crude oil and natural gas these suspensions mean that cargos face a lengthy diversion around the Horn of Africa which will add significant costs to company supply chains, as well as having significant inflationary impacts.

04:47 PM GMT

Audi hits brakes on EV rollout as enthusiasm wanes

Higher prices of electric cars compared to petrol models has dented demand, writes Howard Mustoe:

Audi will hit the brakes on its rollout of electric car models as consumer enthusiasm wanes in the face of high prices compared to petrol models.

Gernot Döllner, the boss of the Volkswagen-owned brand, said that he wants to avoid flooding dealerships and factories with the vehicles as sales slow.

“The advantage of EVs (electric vehicles) is becoming visible to consumers step by step,” Mr Döllner told Bloomberg News.

Official forecasts for electric car take-up in the UK were slashed by almost half last month. Sales of new battery-powered cars were expected to grow steadily until they accounted for 67pc of the market by 2027, under a prediction issued in March.

04:03 PM GMT

UK shares 'screamingly cheap' says Schroders fund manager

Amid all the concern about the state of the Footsie, Schroders fund manager Matthew Bennison has increased his holdings of UK domestic shares and believes they will benefit from lower interest rates.

He told Bloomberg that their “screamingly cheap” valuations mean that “this area of the market looks poised to perform very well over the next 3-5 years.”

The FTSE All-Share index is up just 13.3pc over the past five years, but this excludes dividends, which would bring the return to around 33pc - or 6.6pc a year.

03:46 PM GMT

Arm axes jobs in China as Biden's sanctions hit sales

Arm is laying off dozens of staff in China as US sanctions on microchip exports squeeze the British semiconductor giant’s business there, writes James Titcomb:

The company is cutting more than 70 jobs in the country, with some roles being moved elsewhere.

Arm’s China business, which it operates through a separate joint venture, has created repeated problems for the Cambridge company. US controls on selling Western semiconductor technology have further affected the business.

China accounted for 20pc of all sales in the last quarter, down from 25pc three months earlier.

The job cuts focus on technical staff who had developed software for Arm’s businesses around the world, rather than working directly on Arm’s Chinese business, according to Bloomberg, which first reported the news

“In order to ensure that the China Software Ecosystem can fully maximise the benefits of Arm performance and features, Arm is restructuring its China software engineering resources to focus on direct support for local developers,” the company said.

Some of the staff will be offered roles focusing on China-specific work, while some jobs will be moved outside of the country.

At the end of March, Arm had 1,173 staff outside of the UK, US and India, where most of its employees are. It is unclear how many were based in China.

China has been a troublesome market for Arm. It set up a joint venture in 2018 with Hopu, a state-backed investor, but the division was thrown into chaos when Allen Wu, its chief executive, attempted to seize control of it.

Arm agreed to sell its stake in the division to its Japanese owner SoftBank last year ahead of a New York flotation in September that valued it at $52bn (£41bn). Arm China handles sales for the company’s technology in the country.

03:37 PM GMT

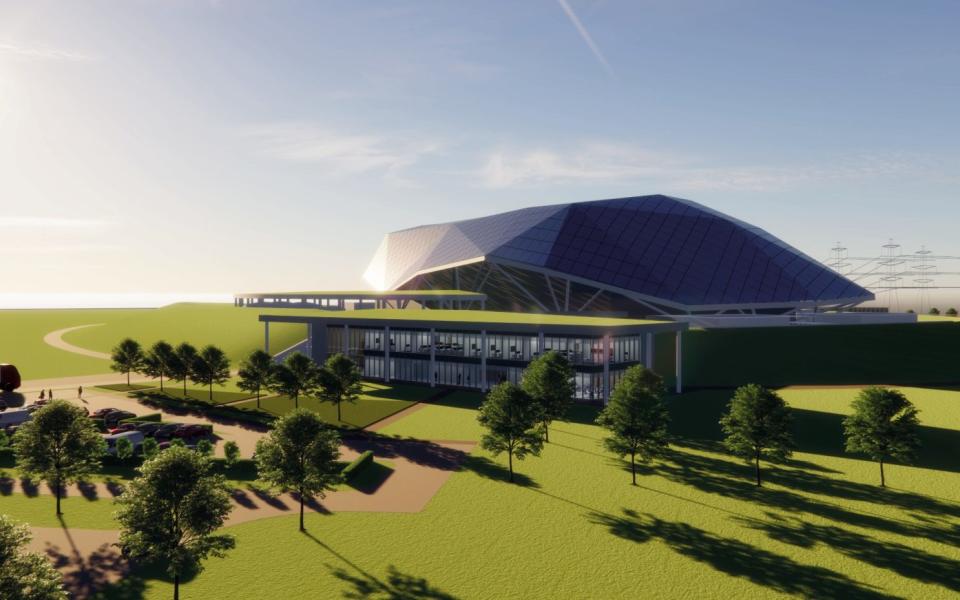

Former permanent secretary appointed chair of Rolls-Royce SMR

The division of Rolls-Royce vying to build small modular nuclear reactors in Britain has appointed the former Permanent Secretary of the Department of Energy & Climate Change as its new chair.

Sir Stephen Lovegrove was the Government’s National Security Adviser until September 2022. He was Permanent Secretary of Ministry of Defence from 2016-2021 and of the Department of Energy & Climate Change from 2013-2016.

In October, Rolls-Royce SMR was one of six companies shortlisted in the Great British Nuclear SMR technology selection process. The companies are bidding for government contracts, with the government planning to announce the successful ones being announced in Spring 2024 and the contracts awarded in Summer.

03:36 PM GMT

Handing over

That’s all from me today. Alex Singleton will keep things updated from here.

Brent crude is still on the march. Oil is now up 3.1pc today and close to $79 after BP announced it would stop all its tankers from travelling through the Red Sea.

Brent was priced below $76 earlier today.

03:16 PM GMT

Farfetch rescued after £4.5bn slump in valuation

The takeover of Farfetch by Coupang marks the end of a turbulent period on the New York Stock Exchange.

In 2018, the British retailer went public, landing a valuation of more than $6bn (£4.7bn).

However, since then, its value has plunged to around $250m (£198m).

The deal will wipe out Farfetch’s shareholders, including founder and chief executive Jose Neves who had held a 15pc stake and 77pc of the voting rights through a dual-class structure.

03:05 PM GMT

GB News campaign to save cash found in breach of impartiality rules

GB News has been found in breach of impartiality rules over a “Don’t Kill Cash” campaign, marking its fifth reprimand by Ofcom this year.

Our media reporter James Warrington has the details:

The regulator today censured GB News over the branded campaign, which lobbied the Government to prevent the UK from becoming a cashless society.

The campaign urged viewers to sign a petition calling for new legislation to protect the status of cash as legal tender and as a widely accepted means of payment until at least 2050.

Ofcom opened six investigations into various GB News programmes relating to the campaign after receiving a number of complaints.

In its first ruling relating to an episode of The Live Desk in July, the regulator concluded that GB News breached two parts of the broadcasting code on due impartiality.

Read a round-up of GB News’s controversies.

02:44 PM GMT

US markets open up

US markets opened up as investors looked forward to economic data later in the week that could offer insights on when the Federal Reserve could start cutting interest rates.

The main Wall Street indexes are looking to end 2023 on a high note as signs of slowing inflation and expectations that the U.S. central bank will soon ease its monetary policy attract buyers.

The S&P 500 was up 0.3pc, while the Dow Jones Industrial Average of 30 leading American companies was up 0.19pc and the tech-heavy Nasdaq Composite index was up 0.2pc.

02:21 PM GMT

Brent crude rises further

Oil is on the march today after BP announced it was halting shipments across the Red Sea in response to attacks by Yemeni militants supporting Hamas in its war against Israel.

Brent crude has risen 2.8pc today to near $79 while US-produced West Texas Intermediate has topped $73 a barrel.

02:00 PM GMT

EU launches investigation into Elon Musk’s X over Hamas propaganda

The European Commission has opened a formal investigation into Elon Musk’s Twitter over its alleged dissemination of misinformation and propaganda related to Hamas.

Our technology editor James Titcomb has the latest:

The Commission announced that it had launched a full probe into Twitter, now known as X, to see whether it had broken new EU rules governing online services.

The investigation is the first under the Digital Services Act (DSA), a sweeping set of laws for social networks and search engines, which came into force in August and can impose massive fines on companies seen to break the law.

It comes two months after EU internal market commissioner Thierry Breton wrote to Mr Musk asking him to crack down on “the spreading of terrorist and violent content and hate speech” on the site. It launched a preliminary investigation in October.

Read what the opening of formal proceedings means for X.

01:47 PM GMT

Adobe cancels £16bn merger after UK competition probe

Adobe has cancelled its plans for a $20bn (£15.8bn) merger with software company Figma after competition investigations by the UK and the EU.

The US software giant will pay a $1bn termination fee to Figma after the companies said they see “no clear path to receive necessary regulatory approvals”.

The Competition and Markets Authority and its European counterpart had been reviewing the proposed deal for more than a year - and made requests which Adobe had called “disproportionate”.

The Photoshop maker had announced the deal in September 2022, which would have been one of the largest takeovers ever of a private software maker.

Adobe chairman and chief executive Shantanu Narayen said: “Adobe and Figma strongly disagree with the recent regulatory findings, but we believe it is in our respective best interests to move forward independently.

“While Adobe and Figma shared a vision to jointly redefine the future of creativity and productivity, we continue to be well positioned to capitalise on our massive market opportunity and mission to change the world through personalised digital experiences.”

01:37 PM GMT

Games Workshop finalises deal with Amazon for Warhammer films and TV series

Games Workshop has finalised a deal with Amazon to make films and TV series based on its Warhammer fantasy games.

The Nottingham company, which creates fantasy miniatures for tabletop games, first reached an agreement in principle with Amazon Content Services.

Games Workshop shares jumped by around 16pc when the deal was first announced and lifted another 4pc today upon confirmation.

The deal will grant Amazon exclusive TV and film rights to the company’s hit franchise Warhammer 40,000.

Amazon also holds an option to license equivalent rights for other productions in the Warhammer Fantasy universe, after the initial release of Warhammer 40,000 titles. In a statement, the company said:

Games Workshop and Amazon will work together for a period of 12 months to agree creative guidelines for the films and television series to be developed by Amazon.

The agreement will only proceed once the creative guidelines are mutually agreed between Games Workshop and Amazon.

Last year, former Superman actor Henry Cavill announced his involvement in the creation of a Warhammer Cinematic Universe.

01:17 PM GMT

Unilever sells beauty brands amid investor pressure over poor performance

Unilever is offloading a handful of its beauty brands as pressure on the Dove and Marmite maker grows over its poor performance.

Our senior business reporter Daniel Woolfson has the latest:

The company said it has agreed to sell its subsidiary Elida Beauty, which includes 20 brands such as Q tips and Timotei, to the American private equity company Yellow Wood Partners for an undisclosed sum.

The move to sell the arm will be seen as an attempt by Unilever to address concerns that its business had become too unfocused. It owns more than 400 brands around the world including Knorr, Bovril and Ben & Jerry’s.

New chief executive Hein Schumacher earlier this year vowed to home in on the 30 main brands which account for the majority of its sales.

The step is part of a wider shake-up amid pressure from investors over the company’s flagging share price and strategy.

Read how Mr Schumacher has been battling to revive the business after a steady decline in its share price.

12:48 PM GMT

Oil company shares rise as BP halts Red Sea transits

Shares in UK oil companies have risen after BP’s decision to halt Red Sea shipping led to a spike in crude prices.

BP has risen as much as 2pc toward the top of the FTSE 100, while rival Shell has gained as much as 1.7pc.

Oil and gas companies across the FTSE 350 have gained as much as 1.8pc following the announcement.

The price of Brent crude is holding above $77 having earlier dropped to a low of $75.76 a barrel.

12:33 PM GMT

Gas prices surge as BP suspends Red Sea shipping

The price of wholesale gas has spiked upwards after BP suspended shipping through the Red Sea.

Dutch front-month futures, which are the benchmark contract for European gas, spiked as much as 7.9pc higher on the day to nearly €36 per megawatt hour. The UK equivalent gained as much as 8.4pc.

However, prices remain down by around a quarter over the last month as the continent has ample storage levels, which have been drawn down less than expected after milder than usual weather.

12:27 PM GMT

Ships diverting around Africa rather than travelling through Red Sea

Even before BP’s suspension of Red Sea shipping, several other ships were opting to avoid the route amid rising tensions.

This picture from Flexport chief executive Ryan Petersen shows vessels in yellow opting to travel around southern Africa rather join the usual faster route being used by ships in green through the Red Sea, which takes them to the Suez Canal.

Suez update: 46 container ships now have diverted around the Cape of Good Hope rather than transiting the Red Sea. pic.twitter.com/4zaTXn3LO1

— Ryan Petersen (@typesfast) December 18, 2023

12:20 PM GMT

BP's statement after halting oil transit through the Red Sea

Here is BP’s full statement after it paused the transit of oil tankers through the Red Sea:

In our trading & shipping business, as in all BP businesses, the safety and security of our people and those working on our behalf is BP’s priority.

In light of the deteriorating security situation for shipping in the Red Sea, BP has decided to temporarily pause all transits through the Red Sea.

We will keep this precautionary pause under ongoing review, subject to circumstances as they evolve in the region.

12:00 PM GMT

Dow Jones poised to rise after record high

US stock indexes edged higher in premarket trading as Treasury yields slipped ahead of the latest US inflation data this week.

The main Wall Street indexes are looking to end 2023 on a high note amid signs of slowing inflation and expectations that the US central bank will soon ease its monetary policy.

The blue-chip Dow Jones Industrial Average notched its third consecutive session of record highs on Friday, while the benchmark S&P 500 marked a seventh straight week of gains in its longest winning run since 2017.

Economic data this week include the Personal Consumption Expenditure index (PCE) - the Fed’s favoured inflation gauge - weekly jobless claims, housing starts and the final reading of the third-quarter GDP.

The PCE data, the final set of inflation figures for this year, are expected to show that prices eased marginally in November on a year-over-year basis.

In premarket trading, the Dow was up 0.1pc, the S&P 500 had gained 0.1pc and the Nasdaq 100 was flat.

11:41 AM GMT

BP to pause all tanker traffic through Red Sea after Yemeni attacks

BP has announced it will temporarily pause all oil tanker transits through the Red Sea in light of attacks by Yemeni militants.

The price of Brent crude has spiked higher after the announcement and is now up 0.5pc on the day and close to $77 a barrel.

Iranian-backed Houthi militants in Yemen have stepped up attacks on vessels in the Red Sea to show their support for Palestinian Islamist group Hamas fighting Israel in Gaza.

The attacks are targeting a route that allows East-West trade, especially of oil, to use the Suez Canal to save the time and expense of circumnavigating Africa.

BP is the latest of several shipping companies to re-route vessels to avoid the area, including Maersk, MSC and Hapag Lloyd.

11:24 AM GMT

Oil weakens despite Red Sea disruption

Oil has edged down following its first weekly gain since late October as major shipping lines suspended transit through the Red Sea.

Brent crude had risen above $77 a barrel in early trading but was last down 0.6pc and heading back toward $76. US-produced West Texas Intermediate was down 0.7pc below $71.

Last week the global benchmark gained 0.9pc to end a seven-week losing streak.

Egypt’s Suez Canal Authority said it is “closely following” tensions in the Red Sea after the US said it shot down 14 drones launched from Iran-backed Houthi-controlled areas of Yemen.

Major shippers MSC Mediterranean Shipping and CMA CGM were the latest to announce over the weekend that they will not send their vessels through the chokepoint in the face of rising threats, while Maersk said it would insist its vessels have the option to avoid the route.

However, continuing concerns about global demand amid growing supplies have limited the impact. Crude has lost about a fifth from a high in late September and is down 10pc for the year as US shale production beat analyst expectations.

10:58 AM GMT

'Volatile' wage data will keep interest rates higher, says Bank of England policymaker

The Bank of England may be forced to keep interest rates higher for a longer period while policymakers deal with “more uncertainty than usual” in official employment data, a deputy governor has said.

The latest figures from the Office for National Statistics on wage growth “have been volatile” according Ben Broadbent.

In a speech at the London Business School, he said that the uncertainty created by the data means “the reaction of policy is likely to be somewhat more delayed than in a world of perfect and complete information”.

High wage growth - which stood at 7.2pc in the three months to October and 8.5pc in the previous three months - is considered a risk to inflation, which stands at more than double the Bank of England’s target at 4.6pc.

Referring to wage growth, Mr Broadbent said: “Given the volatility in the official estimates, and the disparity (such as it is) among the various indicators we have, it will probably require a more protracted and clearer decline in these series before the Monetary Policy Committee can safely conclude that things are on a firmly downward trend.”

10:35 AM GMT

Pound holds firm as interest rates expected to stay higher for longer

The pound held steady against the dollar as investors considered the likelihood of interest rates remaining higher in Britain than in most other major economies next year.

The Bank of England last week pushed back against market pricing that shows investors see a strong chance of a first rate cut by May. A rate cut in June is now fully priced in.

Large speculators have added to their bullish positions in the pound in recent weeks, bringing their net long position - betting on the value of sterling rising - to its largest in about three months, according to the most recent weekly data from the US financial markets regulator.

City Index strategist Matt Simpson said: “Short interest has continued to fall whilst long interest has perked up, which suggests there could be further upside for the British pound in the weeks ahead.”

Sterling was steady at $1.26 but down 0.2pc against the euro at 86p, having risen for two straight trading days.

Markets, meanwhile, are pricing in a good chance of the European Central Bank (ECB) and the US Federal Reserve cutting rates as early as March, with cuts by May fully priced in.

The Bank of England is also expected to cut more slowly. About 80 basis points of cuts are priced in for the UK by money markets for 2024, while 150 basis points are priced into the eurozone and US.

10:21 AM GMT

Vodafone in talks with 'several parties' over Italian business

Vodafone has said it is exploring options with “several parties” about a merger or sale of its Italian business after a French telecoms firm revealed it had made an offer.

The London-listed company said it is “supportive of in-market consolidation in countries where it is not achieving appropriate returns on invested capital”.

Although it confirmed it is seeking a deal in Italy, bosses insisted “there can be no certainty that any transaction will ultimately be agreed”.

French telecoms company Iliad said it has tabled an offer to Vodafone to merge its Italian operations with Vodafone Italia in a deal which values the division at £9bn.

Iliad said joining forces in Italy would “create the most innovative telecom challenger” in the country and accelerate the roll-out of fibre broadband and 5G.

Vodafone shares have gained 6.7pc today to top the FTSE 100 index after the announcement of the offer.

09:55 AM GMT

German recession 'very likely', say economists

Andrew Kenningham, chief Europe economist at the consultancy Capital Economics, said the latest Ifo survey from Germany “unequivocally points to a continued downturn”.

The fall in the Ifo institute’s business climate index to 86.4, compared to estimates of 87.7, comes after the German economy contracted in the third quarter of the year. Two consecutive quarters of contraction are deemed a recession.

He said:

It looks very likely that GDP will contract for a second successive quarter in Q4 and the outlook for 2024 does not look much better.

The outlook for next year has been deteriorating as high interest rates are denting investment in both industry and construction and consumer confidence remains low.

The plan to tighten fiscal policy further next year in order to comply with the constitutional court judgement will not help.

Further ahead, we have pencilled in zero economic growth for 2024, reflecting the impact of higher interest rates on investment in construction and industry, the fiscal tightening and continued consumer caution amid a weakening labour market.

09:48 AM GMT

'Weak' German economy at risk of recession, survey indicates

German business morale unexpectedly worsened in December, according to a closely-watched survey, which also showed a decline in both expectations and current conditions.

The Ifo institute said its business climate index stood at 86.4 versus the 87.7 forecast by analysts, following a revised reading of 87.2 in November.

Ifo president Clemens Fuest said: “As the year draws to a close, the German economy remains weak.”

Companies were less satisfied with their current business, with the current situation index falling to 88.5 from 89.4 in November.

They were also more sceptical about the first half of 2024, with the expectations component showing a decline to 84.3 in December from 85.1 in the previous month.

The German economy had already contracted in the third quarter. Two consecutive quarters of negative growth are considered a technical recession.

OUCH! German business expectations unexpectedly fall (for 1st time since Aug), dampening hope of a rebound. Ifo Expectations Index fell to 84.3 in Dec from 85.1 prev mth. Analysts had expected a slight uptick to 85.6. Ifo Index of Current Assessment also dropped. pic.twitter.com/nMBfp817eE

— Holger Zschaepitz (@Schuldensuehner) December 18, 2023

09:41 AM GMT

Gas prices tick higher amid Red Sea tensions

The price of wholesale gas edged higher in early trading amid rising shipping risks in the Red Sea.

European benchmark contracts rose 0.8pc, with the UK equivalent up 1.1pc, amid tensions in the waterway leading to the Suez Canal after attacks Yemeni militants caused some merchants to suspend transports.

The Suez Canal Authority said it was “closely following” tensions in the area.

However, high stock levels and ample imports have helped to avoid a more significant change in prices.

09:15 AM GMT

'Limping' UK economy 'needs to get mojo back', says economists

Britain’s economy is “limping with a sprained ankle”, according to a report by economists, who expect growth to stay at around 0.5pc next year.

The UK’s gross domestic product will be better than expected this year at 0.5pc, according to the latest KPMG Global Economic Outlook, thanks to falling energy prices. It had predicted a 1pc contraction.

However, growth will be limited to 1pc in 2025 as households feel the impact of higher interest rates and inflation remains above the Bank of England’s 2pc target.

The report said that “around a half of the direct impact of monetary policy on mortgage holders is still to come, which would put downward pressure on housing activity and consumption”.

Around 1.5m fixed-rate mortgages are set to expire in 2024, compared to 1.6m in 2023 and 1.2m in 2022, meaning more households will be exposed to the impact of interest rates, which stand at 15-year highs of 5.25pc.

Yael Selfin, chief economist at KPMG UK, said: “While the UK economy is resilient, it needs to get its mojo back.

“We expect monetary and fiscal policies to act as a headwind to growth over the next two years, and a sudden revival in productivity is not likely to come to the rescue.

“This means that even the expected continuation of positive growth should not be celebrated prematurely, as the outlook is dominated by downside risks.”

08:56 AM GMT

UK bond yields ease to start the week

UK bonds are outperforming European rivals to start the week, with a calmer mood prevailing as markets head into the Christmas period.

The yield on the 10-year UK gilt has fallen two-basis points to 3.65pc, while coupons ticked on bonds higher in Germany, France, Italy and Spain.

It comes after the Bank of England held rates at 15-year highs of 5.25pc on Thursday, while the European Central Bank held rates at a record 4pc.

Investors expect big rate cuts next year, with bond yields having fallen for three weeks in a row as a result.

08:43 AM GMT

Vodafone jumps to top of FTSE 100

The FTSE 100 has moved higher after a shaky start as Vodafone’s shares were boosted by an offer from the telecom firm Iliad to create a joint venture in Italy.

The UK’s blue-chip index was up 0.2pc, while the more domestically-focused FTSE 250 mid-cap index lost 0.3pc.

Mexican precious metals miner Fresnillo lost 5.6pc to fall to the bottom of the FTSE 100 after Morgan Stanley downgraded its rating to “underweight” from “equal-weight”. Precious metal miners more widely were among the top decliners, falling as much as 1.5pc.

Data due this week includes UK, eurozone, and US inflation readings.

Among individual stocks, Vodafone jumped 4.7pc to the top of the FTSE 100 after Iliad said it had submitted a proposal to the telecom company to merge their Italian businesses, adding this project had the unanimous support of its board of directors.

Entain gained 4.2pc after Jefferies upgraded the sports betting company’s rating to “buy” from “hold”.

08:36 AM GMT

Iron and steel imports to face carbon tax to protect UK production

Britain is poised to charge a carbon levy on imported goods under plans announced by the Treasury to help prevent UK firms being undercut by overseas manufacturers.

The Treasury said the proposed new tax will come into effect in 2027, ensuring that imports of products such as iron, steel, aluminium, ceramics and cement from overseas will face a comparable so-called carbon price to those manufactured in Britain.

A carbon price is used by governments to help reduce emissions by charging a fee on carbon pollution to encourage industries to cut their greenhouse gases.

There have been mounting calls for the UK Government to tackle “carbon leakage” over concerns that UK companies are being undercut by cheaper, but higher carbon, imports from countries where they charge a lower or no carbon price.

The Treasury said the plans will help level the playing field and boost UK industry investment in cutting greenhouse gas emissions.

Chancellor Jeremy Hunt said: “This levy will make sure carbon intensive products from overseas - like steel and ceramics - face a comparable carbon price to those produced in the UK, so that our decarbonisation efforts translate into reductions in global emissions.”

08:10 AM GMT

Vodafone made offer to sell stake in Italian business in £7.3bn deal

Vodafone has received an offer to merge its Italian business with a French telecommunications company’s operations in the country for €8.5bn (£7.3bn) as new boss Margherita Della Valle continues to slim down the struggling telecoms giant.

The merger between Vodafone Italia and Iliad’s Italian business would value the two companies at €10.5bn (£9bn) and €4.5bn (£3.8bn) respectively, with the new entity owned 50-50 between the two parent firms.

The London-listed company would receive €6.5bn in cash and €2bn in a shareholder loan under the deal.

In October, Vodafone sold its Spanish business to Zegona Communications for €5bn (£4.4bn).

Vodafone shares jumped 4.6pc as markets opened following the news.

The FTSE 100 has begun the day down 0.1pc at 7,569.40 while the FTSE 250 opened 0.5pc lower at 19,115.71.

07:46 AM GMT

Hollywood Bowl hits record as wet weather strikes

Hollywood Bowl has reported record high revenues as it said unusually wet weather helped lift sales over the summer, and as families look for low-cost entertainment amid the cost-of-living crisis.

The ten-pin bowling operator revealed revenues for the latest year of £215.1m, up by 4.5pc on a like-for-like basis compared with the previous year.

People visiting its bowling alleys and entertainment venues spent more money per visit, including a 10pc jump in spending on food.

It also revealed it had its busiest ever month in the UK in August, with rainy weather encouraging people to seek indoor activities.

Stephen Burns, the group’s chief executive, said:

This is another excellent performance for the group, achieved against an exceptionally strong prior year.

Innovation of our offer has led to growth across all our revenue lines while keeping our prices low, with a family of four able to bowl for £25.

07:39 AM GMT

TfL given £250m to improve Tube and buses

London’s public transport will receive a £250m investment from the Government next year.

The Department for Transport (TfL) said the package will be used by Transport for London (TfL) for projects such as providing new Tube trains for the Piccadilly line.

TfL is not allowed to spend the money on its day-to-day operations.

Rail minister Huw Merriman said:

We’re investing in transport across the country, and today’s agreement will have a tangible, positive impact not just for people travelling in and around the capital but also the millions who visit every year.

It is fair for Londoners and taxpayers, underpinning projects that will support hundreds of skilled manufacturing jobs in our vital rail sector.

We have invested billions into the capital’s transport system in recent years.

This investment must be well managed in a way that doesn’t unfairly burden the pockets of taxpayers and motorists.

07:37 AM GMT

More British firms will move to New York, says Nasdaq chief

More British companies are in discussions about listing in New York rather than the UK, the global head of listings at Nasdaq has said.

Karen Snow said she believes that the growing number of British businesses opting to join stock exchanges in the US over London has become a trend.

Ms Snow, who helped to lure Cambridge-based Arm to list on the Nasdaq with its $4.9bn (£3.8bn) float in September, said a large part of the attraction of New York was the ability to attract larger levels of investment.

This year, the Nasdaq raised $13bn (£10.2bn) from 125 listings, known as initial public offerings or IPOs.

Over the first three quarters of 2023, 23 companies listed in London, raising $1.2bn (£953m) according to EY.

Ms Snow told BBC Radio 4’s Today programme: “We’re having a lot of conversations with companies about listing in the US.

“We get a lot of inbound calls [from the UK] and we also make sure we’re in front of the right CEOs.”

Ms Snow was asked if she considers the growing number of UK companies listing in New York as a trend.

She said: “I do and we are having a lot of conversations with companies about listing in the US.”

She said the reasons for this were access to “liquidity and valuation” and “brand alignment” adding that Nasdaq “has a huge association with innovation and growth”.

“It also is known to be home of healthcare technology and consumer listings. And we now also have a lot of industrial companies.”

07:19 AM GMT

Good morning

Thanks for joining me. The global head of listings at the Nasdaq has fired a warning to the London Stock Exchange this morning.

Karen Snow said she sees the growing number of companies opting to list in the US over the UK as a trend.

She told the BBC that the Nasdaq is “having a lot of conversations” with UK companies about floating their shares in New York.

5 things to start your day

1) Rolls-Royce in talks to build mini-nukes in Ukraine | Kyiv is seeking to decentralise its energy systems amid a continued Russian onslaught

2) FTSE chiefs earning 57 times average salaries as City pushes for higher pay | Square Mile insiders claim pay in Britain is too meagre to attract top talent

3) Facebook hosts adverts with anti-Semitic phrase ‘from the river to the sea’ | Defenders insist phrase is an aspirational call for freedom and coexistence in the region

4) How the Taylor Swift Eras ticketing debacle may upend a whole industry | Surging demand for live experiences fuels calls for an end to Ticketmaster’s domination

5) The world economy has shown itself far more resilient than pessimists feared | Given the turbulent year we’ve had it’s remarkable there weren’t more financial ‘events’

What happened overnight

Asian shares were mostly lower on Monday as the Bank of Japan began a two-day meeting that is being watched for hints of a change to the central bank’s longstanding near-zero interest rate policy.

US futures and oil prices gained. Tokyo’s Nikkei 225 index lost 0.8pc to 32,708.35, while the US dollar edged higher against the Japanese yen, rising to 142.20 from 142.11.

Hong Kong’s Hang Seng dropped 0.9pc to 16,633.98 and the Shanghai Composite index edged 0.1pc lower to 2,938.79.

Elsewhere in Asia, Australia’s S&P/ASX 200 declined 0.3pc to 7,420.30. South Korea’s Kospi added 0.2pc to 2,569.40 and Bangkok’s SET was down 0.2pc.

On Friday, the S&P 500 finished down less than 0.1pc at 4,719.19.

Yahoo Finance

Yahoo Finance