Oceaneering (OII) Snips 2020 Capex Plan, Sticks to Q1 View

Oceaneering International, Inc. OII has announced that it has withdrawn its 2020 guidance, trimmed its current-year capital spending plan to $60-$80 million and also aims to cut its unallocated costs and expenses in the upper end of $20-million range per quarter after reckoning the ongoing decline in commodity prices.

The unexpected drop in oil prices and a dent in global demand due to the novel coronavirus outbreak are taking a toll on oil and energy companies. The industry players have been forced to delay expansion plans and lower capital expenditures to preserve liquidity.

Notably, West Texas Intermediate began the year with a little above $60 per barrel of oil. However, this upside was short-lived with the WTI price plunging to $20.09 on Monday, marking its lowest settlement since February 2002.

While on one hand, the revised budget is believed to help Oceaneering ride out the tough market landscape and sustain its operations, on the other, the company is determined to retain its first-quarter 2020 guidance. This Houston, TX-based company projects first-quarter EBITDA in the range of $36-$42 million compared with $48.7 million in fourth-quarter 2019 due to less seasonal offshore activity in Subsea Projects unit. Further, Advanced Technologies’ operational performance is estimated to show no change on slightly weak revenues.

Even though Oceaneering hopes to benefit from adopting these key initiatives, it looks to closely monitor the commodity price movement, complying with the capex alteration plans further in response to a mutable price scenario.

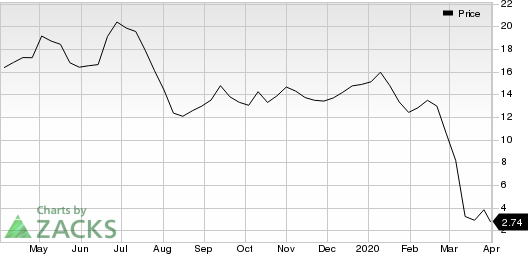

Oceaneering International, Inc. Price

Oceaneering International, Inc. price | Oceaneering International, Inc. Quote

By dint of its strategic capex-cut move, the Zacks Rank #2 (Buy) Oceaneering joins other oilfield service players including Halliburton Company HAL, Schlumberger Limited SLB and ProPetro Holding PUMP. These industry participants intend to overcome the tough times while maintaining financial flexibility and operational excellence. Notably, strengthening the companies’ cash-boxes at a time when oil prices look to yield zero profits to most producers is indeed a judicious step. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Halliburton Company (HAL) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

ProPetro Holding Corp. (PUMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance