Obsidian Energy (TSE:OBE) shareholder returns have been enviable, earning 430% in 1 year

Obsidian Energy Ltd. (TSE:OBE) shareholders have seen the share price descend 11% over the month. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In that time, shareholders have had the pleasure of a 430% boost to the share price. So we wouldn't blame sellers for taking some profits. The real question is whether the fundamental business performance can justify the strong increase over the long term.

The past week has proven to be lucrative for Obsidian Energy investors, so let's see if fundamentals drove the company's one-year performance.

View our latest analysis for Obsidian Energy

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

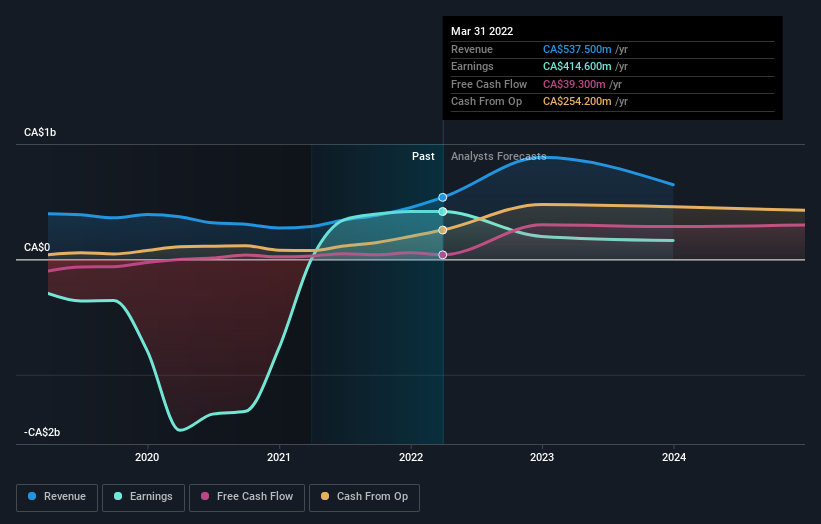

Obsidian Energy went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We think that the revenue growth of 88% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Obsidian Energy will earn in the future (free profit forecasts).

A Different Perspective

It's good to see that Obsidian Energy has rewarded shareholders with a total shareholder return of 430% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 5% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Obsidian Energy has 5 warning signs (and 2 which are concerning) we think you should know about.

Obsidian Energy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance