Nvidia has shed $431 billion in market cap in just 4 days after briefly becoming the world's most valuable company

Nvidia stock has plunged 16% in the past week, erasing $431 billion in market value.

With no fundamental news, some analysts say the decline in the stock is simply profit-taking.

Some Wall Street experts see the swift drop as a buy-the-dip opportunity.

Nvidia stock has suffered a painful four-day decline that has erased $431 billion in market value.

The AI tech giant, which was the world's most valuable company just last week, is now worth $2.9 trillion, making it once again the third largest company behind Microsoft and Apple.

The pain for Nvidia started on Thursday, when the stock soared to a record high of $140.76 per share. But by the end of the day, it was back down to around $130, representing an intraday decline of 7%.

From there, the stock continued to fall, declining 3% on Friday and an additional 7% on Monday.

Altogether, Nvidia stock is down 16% from its record high.

A lack of fundamental news driving the sell-off suggests investors are taking profits in Nvidia stock after its year-to-date rise of 139%, its one-year rise of 175%, and its two-year gain of 589%.

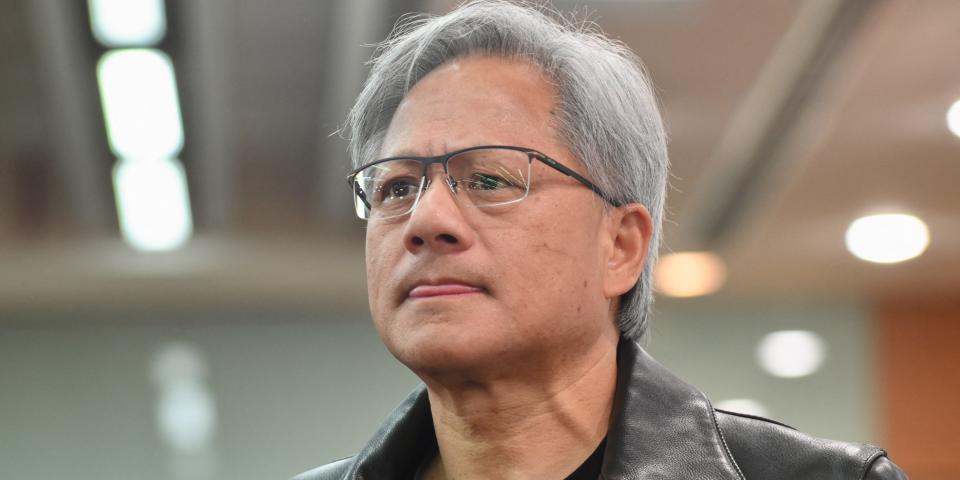

"The surge in Nvidia share price has been so remarkable throughout 2024 that most investors are still in the black. Indeed, profit-taking looks to be a key factor for the adjustment; even Nvidia CEO Jensen Huang has been selling stock," Stocklytics analyst Neil Roarty told Business Insider on Tuesday.

Huang has sold 720,000 shares since June 13 via scheduled 10b5-1 stock sales, according to SEC filings. The co-founder of Nvidia still owns nearly 81 million shares of the company.

Constellation Research founder R "Ray" Wang also believes profit-taking is driving the recent decline in Nvidia stock and argued in an interview on Monday that the move down is a buy-the-dip opportunity.

"The pullback is coming at a macro level. People are worried about the consumer side, people worried about where the economy is going to head, and they're doing some profit-taking before the summer, so I think it's a good time to buy the dip," Wang told CNBC.

Wang has a $200 price target on Nvidia, driven by what he sees are seven moats the company has to defend and grow its business amid the ongoing AI boom.

Bank of America analyst Vivek Arya also sees the sell-off in Nvidia as being short-lived, and offered five reasons why investors should stay bullish on the company.

Nvidia stock rebounded about 3% in Tuesday's trading session.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance