NVIDIA (NVDA) Gets China's Approval for Mellanox Acquisition

NVIDIA Corporation NVDA stock gained nearly 5% on Apr 16 after the chip maker announced receiving China’s antitrust authority for its year-long pending acquisition of Mellanox Technologies MLNX. This is a major achievement for NVIDIA as it was feared that China’s antitrust regulatory body might block the Mellanox buyout deal.

Notably, both companies generate significant revenues from China, the biggest market for semiconductors. Additionally, Baidu BIDU and Alibaba BABA are two big Chinese customers of Mellanox. Nonetheless, it was being believed that the long-standing U.S.-Sino trade tiff might jeopardize the NVIDIA-Mellanox deal.

Moreover, protectionist policies followed by both countries were expected to go against the acquisition deal. For instance, Qualcomm failed to seal the NXP Semiconductors NV acquisition deal, after it didn’t receive China’s approval. The United States also vetoed Broadcom’s acquisition offer for Qualcomm in 2018.

With China’s nod, the graphics chip maker has received approval from all concerned authorities, globally, including the European Commission and Mexico, for the Mellanox acquisition. Additionally, the waiting period under the U.S. antitrust laws has already expired. Therefore, the company now projects to finally complete Mellanox acquisition on or around Apr 27.

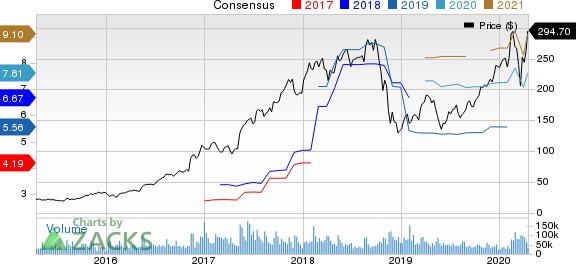

NVIDIA Corporation Price and Consensus

NVIDIA Corporation price-consensus-chart | NVIDIA Corporation Quote

Rationale Behind the Acquisition

NVIDIA had revealed about the transaction on Mar 11, 2019. Per the terms of the deal, NVIDIA had agreed to pay $125 per share in cash to Mellanox shareholders, representing a total enterprise value worth $6.9 billion.

Israel-based Mellanox is one of the major suppliers of 25, 40, 50 and 100GB Ethernet adapters, switches and cables. Mellanox’s customers include data-center owners and also the companies that build data centers. Apart from Alibaba and Baidu, other notable clients include JD.com, Dell Technologies and Hewlett Packard Enterprise HPE.

Therefore, NVIDIA’s takeover of Mellanox will expand its market share in the data-center space. The Mellanox combination now also makes the company a preferable choice for hyperscale customers. Further, the deal will help reduce NVIDIA’s overdependence on the gaming industry.

Also, the deal will strengthen NVIDIA’s competitive position against the likes of Intel INTC and Advanced Micro Devices AMD, particularly in the data-center space.

Additionally, the acquisition expands NVIDIA’s total addressable market by more than $60 billion (includes $50 billion in computing and $11 billion in high-speed networking).

NVIDIA currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance