Nvidia Is Not in a Bubble, but Its Valuation Might Be Overstretched

The best way to describe the hype Nvidia Corp. (NASDAQ:NVDA) represents in people's minds is through a recent quote from company's own founder and CEO, Jensen Huang:

The next industrial revolution has begun companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center AI factories to produce a new commodity: artificial intelligence."

In a world where artificial intelligence has turned into a commodity and become the new gold, and where every business will be searching for its share of the treasure, Nvidia will be selling the shovels. And Huang made it clear: the new shovels are the data centers.

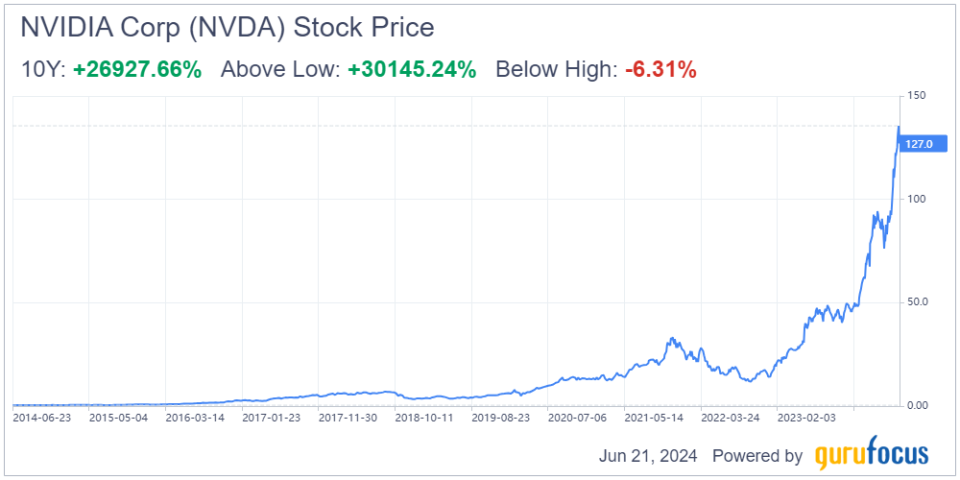

To illustrate this point further, Nvidia's stock price reflects the AI rush it has been benefiting from.

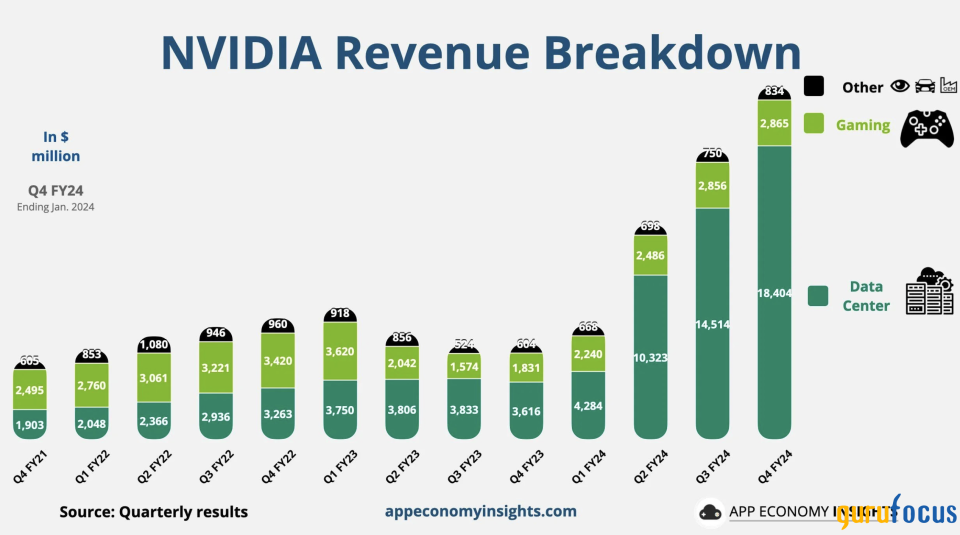

The tech company operates through four business segments, all of which support its growth: Data Center (the largest one), Gaming and AI PC (the second largest), Professional Visualization and Automotive and Robotics.

First, we will look at the financials with a focus on these four pillars of the company's growth.

A multi-faceted growth story that powers its financials

The reason Nvidia is so attractive as a growth stock is not only its recent high growth rates, but the fact it is supported by all four business segments. All four divisions saw sales grow by at least double digits from a year ago.

The first-quarter financial results, which were released on May 22, reveal impressive growth rates. Nvidia broke the record of quarterly revenue with a $26 billion figure, up 18% from the fourth quarter and 262% from a year ago.

In the Data Center business, revenue hit a record $22.60 billion, up 23% from the previous quarter and 427% from a year ago. In the Gaming and AI PC business segment, sales were $2.60 billion, down 8% from the previous quarter but still up 18% from a year ago. In the Professional Visualization division, revenue was $427 million, down 8% from the previous quarter but up 45% from a year ago. Last but not least, sales in the Automotive and Robotics unit hit $329 million, up 17% from the previous quarter and up 11% from a year ago.

Every single business segment had at least double-digit growth. Given that there are four solid pillars supporting Nvidia's growth, it is unlikely that all of them will crash at the same time.

Despite high growth, there are risks ahead and Nvidia's valuation may already be stretched

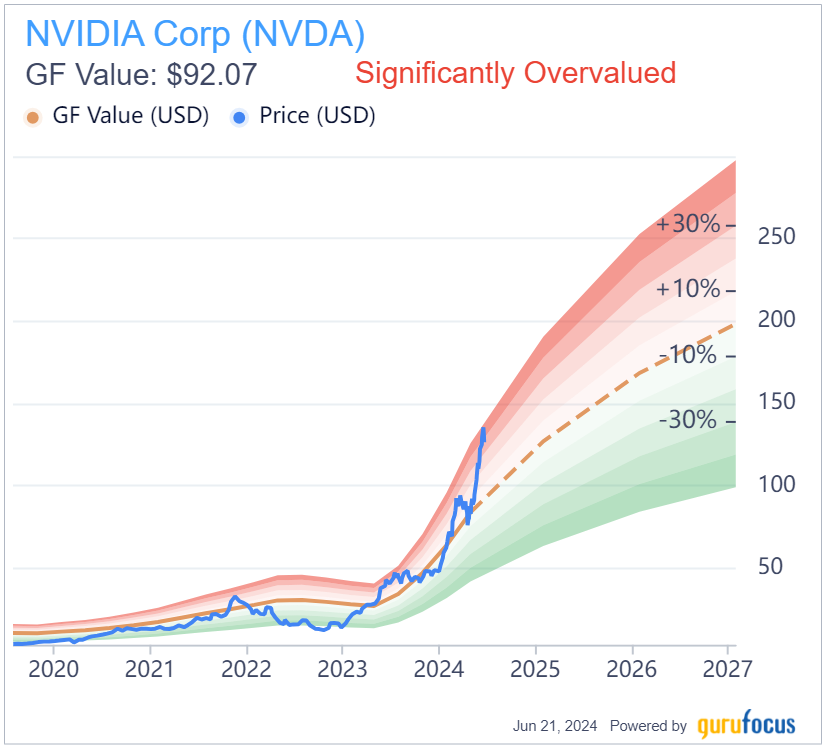

Nvidia is clearly valued like a high-growth stock would be. Using trailing metrics, the stock is trading at 40 times last 12-month revenue, around 65 times Ebitda and 76 times earnings per share, both in the highest range of the historical valuation of the stock.

Looking ahead, the stock is trading at about 25 times forward revenue and 38 times forward Ebitda, which, despite being cheaper than a year ago, remains in the higher range of the historical valuation as well. A fairer valuation brings it closer to the GF Value of around $90 (on a post-split basis), which is a 30% to 40% discount to the current price and the price it was trading at toward the end of the first quarter of the year. It seems the excitement around the stock caused the market to overbuy, ignoring the slowing growth trend that is starting from this quarter onward.

Indeed, the key risk here is that Nvidia is trading with an assumption of high growth, while the company's growth is expected to significantly slow down, which could cause a sharp contraction to its valuation, as is typically the case for growth stocks with fading growth.

The year-over-year revenue growth rate peaked in the fourth quarter, reaching 265%, and pulled back slightly to 262% in the first quarter. However, the stock is expected to only gain 109% in the second quarter, 72% in the third quarter, 55% in the fourth quarter and 36% in the first quarter of 2025. The downtrend is evident as the AI boom slows down, global economies potentially fall into a recession after a long tight monetary cycle and as competitors like Advanced Micro Devices Inc. (NASDAQ:AMD) and Intel Corp. (NASDAQ:INTC) come after Nvidia's market share.

There is a second risk, however, which is what fueled the growth of Nvidia over the last several quarters: its exposure and overconcentration to a few companies, namely the Magnificent Seven. Indeed, Bloomberg data estimates that Microsoft Corp. (NASDAQ:MSFT) makes up 15% of Nvidia's revenue, followed by Meta Platforms Inc. (NASDAQ:META) at 13%, Amazon Inc. (NASDAQ:AMZN) at 6% and Alphabet Inc. (NASDAQ:GOOG)(NASDAQ:GOOGL) at about 6%. This means that 40% of the company's revenue comes from four companies, which in turns means the latter have significant leverage in negotiating contracts with Nvidia while its competitors continue to catch up.

Hence, despite the company being high growth, its stretched valuation and customer concentration warrant caution.

An impressive pipeline to fuel continued growth and mitigate risks

Nvidia is selling the shovels to the gold miners, and there is an increasing number of them. Indeed, numerous partnerships announced during the last earnings release fuel optimism of renewed growth in the coming quarters.

In the Data Center segment, Nvidia announced Taiwan Semiconductor Manufacturing (NYSE:TSM) and Synopsys (NASDAQ:SNPS) are going into production with Nvidia cuLitho to accelerate computational lithography, the semiconductor manufacturing industry's most compute-intensive workload. The company also expanded collaborations with Amazon's AWS, Alphabet's Google Cloud, Microsoft and Oracle (NYSE:ORCL) to advance generative AI innovation.

Additionally, the Data Center business partnered with Johnson & Johnson (NYSE:JNJ) MedTech to implement AI into surgery. For the Professional Visualization unit, Nvidia announced an expansion of the Siemens partnership and a new framework for the Apple Vision Pro.

Last but not least, in the Automotive and Robotics division, Nvidia announced exciting partnerships with Chinese automakers BYD (BYDDY) and Xpeng (NYSE:XPEV) and American EV producer Lucid (NASDAQ:LUCD) to power their next-generation vehicle fleets.

This impressive pipeline shows Nvidia might have new growth catalysts up its sleeve that could help the stock outperform the broader market in the coming quarters.

The bottom line

Nvidia's astonishing ability to grow year after year and to find new sources and catalysts of growth makes the stock an attractive one to own in a growth-oriented portfolio. However, given the slowing growth and sales overconcentration risks, caution is advised.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance