Nvidia’s Historic Stock Split: Will Investors See Bigger Gains?

Written by Brian Paradza, CFA at The Motley Fool Canada

Capping a record quarterly earnings report released on May 22, Nvidia (NASDAQ:NVDA), the biggest winner in the artificial intelligence (AI) trade, announced a historic 10:1 stock split, sparking widespread interest among investors. This move, effective June 10, 2024, marks Nvidia’s sixth share split over the past 24 years, and it comes amidst a period of significant growth and record performance for the semiconductor designer.

Although market players anticipated an Nvidia stock split, the company exceeded most investors’ expectations. The most recent NVDA share split was a 4:1 split in July 2021. A forward split ratio in the double digits range breaks records for the company (although it falls short of Chipotle Mexican Grill’s record 50:1 split approved in March this year). For many retail investors, Nvidia’s historic split raises questions: What does it mean, and will it lead to bigger gains?

Understanding the Nvidia stock split

A forward stock split divides a company’s existing shares into multiple smaller ones. Each existing Nvidia stock investor will receive nine additional shares for every share held as of market close on Thursday, June 6, 2024.

Consequently, the number of listed NVDA shares will increase 10-fold at market opening on Monday, June 10, 2024. However, the share price will adjust accordingly, such that if Nvidia stock closes at US$1,000 before the split, it will trade at US$100 afterward. Investors’ position sizes will stay the same.

Most noteworthy, splits don’t alter a company’s fundamental attributes and intrinsic value. Nvidia’s market capitalization should remain the same.

That said, all per-share metrics, including sales per share, earnings per share, and cash flow per share, will drop after Nvidia’s share count balloons post-split. However, fundamental valuation ratios, which include popular metrics like price-to-sales (P/S) and price-to-earnings (P/E) ratios will stay the same.

Therefore, the Nvidia stock split won’t make shares any “cheaper” in a fundamental sense. Nonetheless, the split will make the top-flight AI stock more accessible to a broader range of investors, especially retail investors with small accounts who couldn’t afford to buy a single NVDA share without sacrificing their portfolios’ diversification.

Why is Nvidia splitting its stock?

The artificial intelligence stock’s price has rallied by more than 450% since its most recent split in July 2021. Driven by robust demand for its AI computing chips, the sustained rally in Nvidia stock beyond US$1,000 per share has arguably made shares increasingly “expensive” for retail investors with small trading accounts.

Nvidia stock has risen substantially, and beyond affordability for small account holders. An individual investor with $500 in cash will afford to buy some NVDA stock after the split. However, the same investor can’t buy a single share today (unless their broker offers fractional share trading capabilities).

The move should increase accessibility and increase liquidity in the shares as new traders gain access to a stock that has been the face of the AI boom.

Will investors see bigger gains?

Share splits don’t technically change a company’s value. Investors shouldn’t expect capital gains based solely on a split; otherwise, every ailing company would announce stock splits to support its poorly performing shares. But splits do carry a strong signaling effect to some market watchers, and this matters.

Forward stock splits are usually synonymous with successful companies whose share prices have risen substantially. Management’s announcement of one may be perceived as a strong trading signal confirming a successful business model that positively rewards its shareholders. Some investors may trade stock-split stocks based on this confirmation signal, anticipating positive capital gains afterwards. NVDA stock closed 9.4% higher after announcing a share split — investors were celebrating its huge operating success.

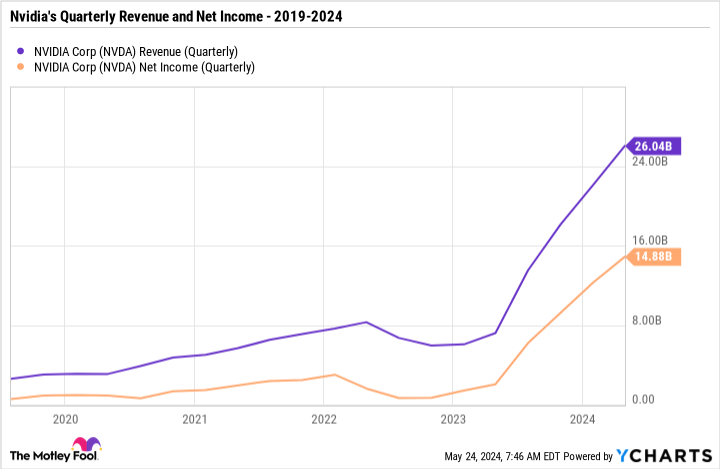

And Nvidia has been a wildly successful AI hardware provider recently. Its revenue and earnings have gone parabolic over the past four consecutive quarters to print record highs. It’s only natural that shares followed suit.

NVDA Revenue (Quarterly) data by YCharts

Looking ahead, how NVDA stock performs after the upcoming share split will depend mostly on the company’s sustained success in innovation and in selling in-demand products while retaining its recently gained market share, among several other fundamental and risk factors.

Historically, the semiconductor giant has been very good at its game.

The post Nvidia’s Historic Stock Split: Will Investors See Bigger Gains? appeared first on The Motley Fool Canada.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $18,271.97!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 5/21/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool recommends Chipotle Mexican Grill and Nvidia. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance