NRG Energy's (NRG) Investments, Clean Energy Goals Bode Well

NRG Energy NRG is likely to benefit from the Direct Energy acquisition and its completed three-year Transformation Plan. Also, focus on cleaner energy generation is likely to enhance its existing operations.

The Zacks Consensus Estimate for 2021 earnings per share is pegged at $5.18, indicating a 115.8% rise from the year-ago reported figure while that of 2022 stands at $5.95, suggesting 14.8% growth from the prior-year reported number. Also, the Zacks Consensus Estimate for 2021 revenues is pegged at $18.16 billion, implying a 99.76% surge from the year-earlier reported figure while that of 2022 is pegged at $13.62 billion, hinting at a 25.02% drop from the year-ago reported figure.

Tailwinds

NRG Energy continues to benefit from its three-year Transformation Plan, which was designed to strengthen earnings, increase cost savings and boost shareholder value. Also, in January this year, the utility closed the buyout of Direct Energy for a net value of $3.42 billion. This deal will advance its customer-focused strategy and enhance data and analytics besides creating recurring synergies worth $300 million and reducing integration costs by $202 million.

The company does not depend on a single customer as none of its customers contributed more than 10% to revenues as of Dec 31, 2020. Thus, the loss of any particular customer will not significantly impact its earnings.

Though the company’s debt is higher than the industry average, its transformational activities are generating enough funds to meet its current-debt obligations. Plus, it is making efforts to slowly lower the proportion of debt in its capital mix.

NRG Energy is focusing on clean generation to lower greenhouse gas emissions. It targets a 50% emission cut by 2025 and net-zero emissions within 2050 from the 2014 baseline. Apart from the company, utilities like Duke Energy DUK, DTE Energy DTE and Avista Corporation AVA have plans in place to curb the carbon footprint for a pollution-free environment.

Woes

Intense competition in the wholesale power markets along with stringent government regulations might hurt the margins. Moreover, NRG Energy’s operations are subject to cyber-based security and integrity risks. Unplanned outages in old facilities might impede growth as well.

Price Performance

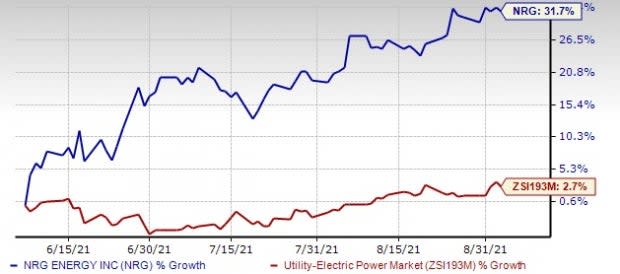

Shares of the company have gained 31.7%, outperforming the industry’s increase of 2.7% in the past thtee months.

Three Months' Price Performance

Image Source: Zacks Investment Research

Zacks Rank

The utility carries a Zacks Rank#3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Avista Corporation (AVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance