Is Now The Time To Put WesCan Energy (CVE:WCE) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like WesCan Energy (CVE:WCE), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide WesCan Energy with the means to add long-term value to shareholders.

Check out our latest analysis for WesCan Energy

WesCan Energy's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. WesCan Energy's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 45%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

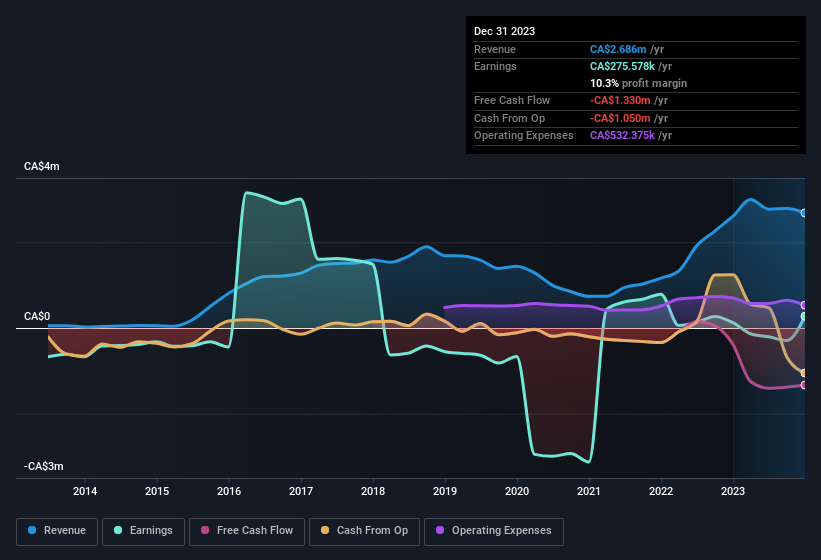

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, WesCan Energy has done well over the past year, growing revenue by 3.0% to CA$2.7m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

WesCan Energy isn't a huge company, given its market capitalisation of CA$2.5m. That makes it extra important to check on its balance sheet strength.

Are WesCan Energy Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But more importantly, Interim CEO & Chairman Leo N. Berezan spent CA$93k acquiring shares, doing so at an average price of CA$0.04. Strong buying like that could be a sign of opportunity.

Does WesCan Energy Deserve A Spot On Your Watchlist?

WesCan Energy's earnings per share have been soaring, with growth rates sky high. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this these factors intrigue you, then an addition of WesCan Energy to your watchlist won't go amiss. However, before you get too excited we've discovered 5 warning signs for WesCan Energy (4 make us uncomfortable!) that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, WesCan Energy isn't the only one. You can see a a curated list of Canadian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance