Is Now The Time To Put Dart Group (LON:DTG) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Dart Group (LON:DTG). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Dart Group

Dart Group's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Dart Group has managed to grow EPS by 18% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

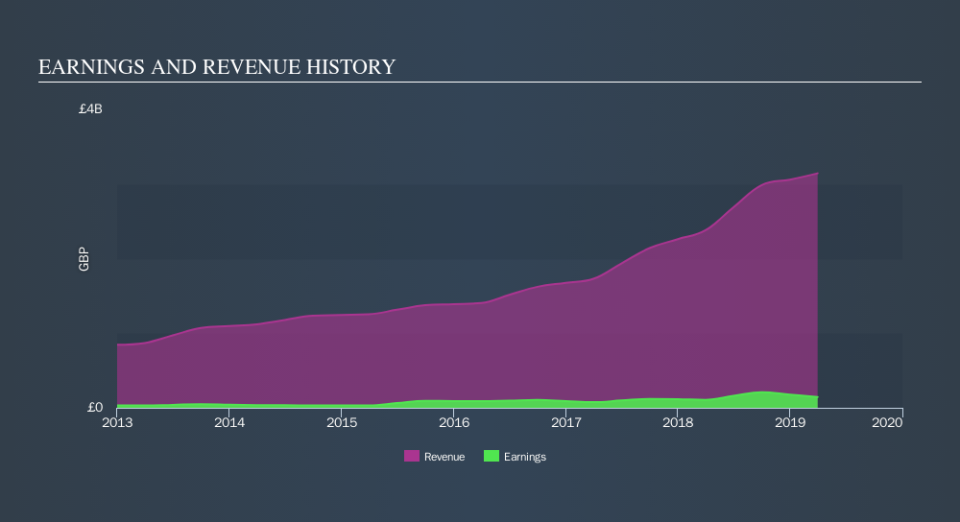

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Dart Group maintained stable EBIT margins over the last year, all while growing revenue 32% to UK£3.1b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Dart Group's future profits.

Are Dart Group Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Dart Group insiders own a significant number of shares certainly appeals to me. Actually, with 37% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. And their holding is extremely valuable at the current share price, totalling UK£695m. That means they have plenty of their own capital riding on the performance of the business!

Does Dart Group Deserve A Spot On Your Watchlist?

You can't deny that Dart Group has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Dart Group is trading on a high P/E or a low P/E, relative to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance