Novartis Reports Additional Data on Spondylitis Drug Cosentyx

Novartis AG NVS announced additional positive data from the ongoing PREVENT study on spondylitis drug, Cosentyx (secukinumab).

PREVENT is an ongoing two-year randomized, double-blind, placebo-controlled phase III study (with a two-year extension phase) investigating the efficacy and safety of Cosentyx in patients with active non-radiographic axial spondyloarthritis (nr-axSpA).

The study met its primary endpoint of ASAS40 at week 52, showing a significant and clinically meaningful reduction in disease activity in patients treated with Cosentyx versus placebo. The study demonstrated a sustained response and a safety profile consistent with previous clinical trials. No new safety signals were detected.

In September, Novartis had released positive 16-week PREVENT data. The study met its primary endpoint at week 16 as the data showed a significant and clinically meaningful reduction in disease activity in patients treated with Cosentyx compared to those on placebo. The study also met all secondary endpoints. Additionally, the data demonstrated a favorable safety profile, consistent with previous clinical studies.

Notably, axial spondyloarthritis (axSpA) is a spectrum of long-term inflammatory disease characterized by chronic inflammatory back pain. nr-axSpA forms part of the axSpA spectrum and is characterized by chronic inflammatory back pain and symptoms such as nocturnal pain, morning stiffness and impaired quality of life. The spectrum includes ankylosing spondylitis (AS), in which joint damage is visible on x-ray, and nr-axSpA, in which joint damage is not visible on x-ray.

Per estimates, approximately 1.7 million patients with nr-axSpA are living in the European Union and the United States.

Cosentyx is the first and only fully-human biologic that directly inhibits interleukin-17A (IL-17A). Novartis has already submitted its application to the EMA for the approval of the same in the nr-axSpA indication. If approved, this will be the fourth indication, for which the drug will be approved in this region. The 52-week data from the PREVENT study should support a potential label expansion of the drug in the United States for this indication.

Novartis’ shares have lost 1.7% in the year so far compared with the industry’s decline of 2.8%.

We remind investors that Cosentyx is already approved in the United States and Europe for the treatment of moderate-to-severe plaque psoriasis, AS and psoriatic arthritis. Sales of the drug came in at $1.6 billion in the first half of 2019.

However, the drug faces stiff competition from the likes of Johnson & Johnson's JNJ Stelara and Tremfya, and AbbVie’s ABBV Skyrizi in various indications.

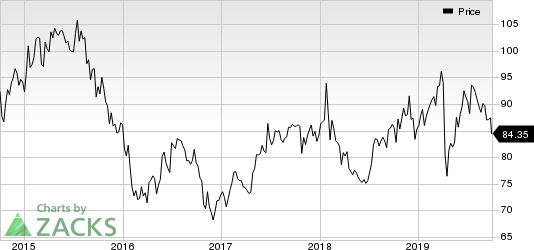

Novartis AG Price

Novartis AG price | Novartis AG Quote

Zacks Rank & Another Stock to Consider

Novartis currently carries a Zacks Rank #2 (Buy).

Another similar-ranked stock in the large-cap pharmaceutical sector is Eli Lilly & Co. LLY. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Lilly’s earnings per share estimates have increased from $5.70 to $5.73 for 2019 and from $6.59 to $6.61 for 2020 over the past 60 days. The company delivered a positive earnings surprise in three of the trailing four quarters, the average beat being 0.69%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity. A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance