Nova Leap Health Corp. Posts Record Revenues for 3rd Consecutive Quarter

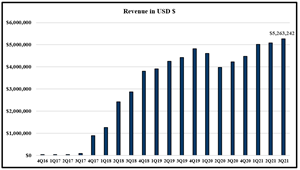

NLH Q3 2021 Revenue in USD

NLH Q3 2021 Revenue in USD

NLH Q3 2021 Adj EBITDA

NLH Q3 2021 Adj EBITDA

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

HALIFAX, Nova Scotia, Nov. 04, 2021 (GLOBE NEWSWIRE) -- NOVA LEAP HEALTH CORP. (TSXV: NLH) (“Nova Leap” or “the Company”), a growing home health care organization, is pleased to announce the release of financial results for the third quarter ended September 30, 2021. All amounts are in United States dollars unless otherwise specified.

Nova Leap Third Quarter of 2021

Highlights for the third quarter ended September 30, 2021 included the following:

Q3 2021 revenues were the highest in the Company’s history;

Q3 2021 was the Company’s fifth consecutive quarter of revenue growth and third consecutive quarter of record revenues;

Q3 2021 revenues of $5,263,242 increased by 3.5% relative to Q2 2021 revenues of $5,085,445 and were 24.4% higher than Q3 2020 revenues of $4,231,326;

The Company had a cash balance of $6,320,266 as of September 30, 2021 as well as full access to the unutilized revolving credit facility of $825,000;

Nova Leap’s U.S. operating segment qualified for the Employee Retention Credit (“ERC”) again in Q3 2021 and has recognized $1,846,969 in Other Income with a corresponding receivable;

Q3 2021 Adjusted EBITDA of $59,100, which excludes government assistance programs, was higher than Q2 2021 Adjusted EBITDA of $42,974 and lower than Q3 2020 Adjusted EBITDA of $119,771 (See reconciliation of Adjusted EBITDA to income (loss) from operating activities in “Segmented Information” section in Q3 2021 MD&A);

Q3 2021 gross margin increased to 34.4% from Q2 2021 gross margin of 34.0%;

The Company reported Net Income of $1,259,384 for Q3 2021 as compared to Net Income of $467,773 for Q3 2020 and Net Income of $345,470 for Q2 2021;

As a result of reported Net Income, Nova Leap exited Q3 2021 with retained earnings for the first time in Company history. Q3 2021 retained earnings of $369,293 marks a substantial year over year improvement from a Q3 2020 deficit of $2,117,750;

The Company reported an Adjusted Net Loss of ($305,638) for Q3 2021 as compared to an Adjusted Net Loss of ($82,913) for Q3 2020 and an Adjusted Net Loss of ($242,804) for Q2 2021 (see reconciliation of adjusted net (loss) income to net (loss) income in “Summary of Quarterly Results” section in the Q3 2021 MD&A);

Subsequent to Q3, the Company announced the signing of definitive agreements with home care companies located in the South Central and Southeastern U.S. regions;

Subsequent to Q3, the Company received authorization to increase it’s existing CAD$1 million revolving facility to CAD$1.5 million. In addition, the Company secured a $1.6 million non-revolving facility, from its Schedule 1 Bank, which may be used for acquisition purposes should funds be required before ERC receivables are collected; and

Subsequent to Q3, the Company received analyst coverage from Echelon Partners.

President & CEO’s Comments

Q3 Summary Comments

“As I reflect on our results for Q3, and as we approach the midpoint of Q4, I believe we are well positioned for accelerated growth.”, said Chris Dobbin, President & CEO of Nova Leap. “I believe that the insider buying that occurred in Q3 is a positive signal to the Company’s investor base of the confidence the Company’s insiders have in our business, as is the growing interest in Nova Leap with additional analyst coverage.”

We closed a small acquisition in Rhode Island mid-quarter Q3 and another acquisition in Oklahoma with ten days remaining in the quarter, both of which will have full period results reflected in Q4. Further to these acquisitions, we announced the signing of definitive agreements for acquisitions in the South Central and Southeastern regions of the U.S., both of which we anticipate closing in Q4.

While gross margins remain stable with a slight increase over Q2, we reported a third consecutive quarter of record revenues and fifth consecutive quarter of revenue growth. While Adjusted EBITDA improved slightly from Q2, we recognize that there remains a significant opportunity for improvement in financial performance, particularly as it relates to the U.S. operating segment. Access to the appropriate level of staffing remains a challenge that we continue to address and expect to continue for the foreseeable future. We continue to work hard in this area with a view to eventually returning to pre-pandemic segment Adjusted EBITDA margins.

With insider ownership at approximately 36%, management executes with a long-term view in positioning the Company for success. The staffing challenge described above also creates opportunities for Nova Leap as home care owners look at succession opportunities for their businesses.

Even with the acquisition announcements noted above, Nova Leap has access to capital between a healthy cash balance and the ERC. We remain active in evaluating additional expansion opportunities and anticipate that Nova Leap will qualify for approximately $2 million of ERC in Q4.

A Path Forward

As a company that started with the premise that it could provide meaningful support to individuals living with dementia and their families, we have been reluctant to provide any forward-looking guidance as we prefer to let our results speak for themselves and let investors react accordingly. However, as we move through the pandemic, it is important for stakeholders to understand the potential path forward that I believe is beginning to take shape. As such, I offer the following comments with underlying assumptions, all of which we believe are reasonable:

Target Financial Metrics

The Company is targeting annualized revenues by the end of Q1 2022 of at least $30 million;

By the end of 2026, the Company is targeting to achieve a minimum of $100 million in annualized revenues combined with consolidated annualized Adjusted EBITDA of at least $10 million.

Underlying Assumptions

An average increase of $15 million per year in annualized revenue by way of acquisitions over the course of the next 5 years;

Continued availability of industry acquisition opportunities;

Continued access to equity and debt financing, as appropriate;

Gross margin percentage in line with historical range of 33-35% of revenues;

Rebound of U.S. operating segment Adjusted EBITDA to pre-pandemic levels;

Reduction in head office costs as a percentage of revenue through operating leverage consistent with 2016-2019 pre-pandemic trend; and

Access to appropriate staffing levels consistent with historical levels of acquired operations.

Further information on the assumptions and risks associated with our target financial metrics is included below under the heading “Forward Looking Information”.

This news release should be read in conjunction with the unaudited condensed interim consolidated financial statements for the three and nine months ended September 30, 2021, notes to the financial statements, and management's discussion and analysis, which have been filed on SEDAR.

About Nova Leap

Nova Leap is an acquisitive home health care services company operating in one of the fastest-growing industries in the U.S. & Canada. The Company performs a vital role within the continuum of care with an individual and family centered focus, particularly those requiring dementia care. Nova Leap achieved the #2 ranking on the 2020 Report on Business ranking of Canada’s Top Growing Companies and the #10 Ranking in the 2019 TSX Venture 50™ in the Clean Technology & Life Sciences sector. The Company is geographically diversified with operations in 7 different U.S. states within the New England, South Central and Midwest regions as well as Nova Scotia, Canada.

NON-IFRS MEASURES:

Gross margin is service revenues less cost of service.

Adjusted Earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”), is calculated as income (loss) from operating activities plus amortization and depreciation and stock-based compensation expense.

Adjusted net income (loss) is net income (loss) adjusted for stock-based compensation expense, acquisition expenses, foreign exchange gains/losses, restructure charges, and severance and other costs.

Annualized revenue and annualized EBITDA are calculated as actual revenue or EBITDA extrapolated from the beginning of the year or date of acquisition over 365 days.

FORWARD LOOKING INFORMATION:

Certain information in this press release may contain forward-looking statements, such as statements regarding future expansions and cost savings, qualification for future ERC amounts, timing of receipt of ERC, and plans regarding future acquisitions and business growth, including the timing of closing recently announced acquisitions, anticipated annualized revenue or annualized recurring revenue run rate growth and anticipated consolidated Adjusted EBITDA margins. This information is based on current expectations and assumptions, including assumptions described elsewhere in this release and those concerning general economic and market conditions, availability of working capital necessary for conducting Nova Leap’s operations, availability of desirable acquisition targets and financing to fund such acquisitions, and Nova Leap’s ability to integrate its acquired businesses and maintain previously achieved service hour and revenue levels, that are subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. Risks that could cause results to differ from those stated in the forward-looking statements in this release include the impact of the COVID-19 pandemic or any recurrence, including government regulations or voluntary measures limiting the Company’s ability to provide care to clients (such as shelter-in-place orders, isolation or quarantine orders, distancing requirements, or closures or restricted access procedures at facilities where clients reside), increased costs associated with personal protective equipment and sanitization supplies, staff and supply shortages, regulatory changes affecting the home care industry or government programs utilized by the Company (such as ERC), other unexpected increases in operating costs and competition from other service providers. All forward-looking statements, including any financial outlook or future-oriented financial information, contained in this press release are made as of the date of this release and included for the purpose of providing information about management's current expectations and plans relating to the future, and these statements may not be appropriate for other purposes. The Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward-looking statements unless and until required by securities laws applicable to the Company. Additional information identifying risks and uncertainties is contained in the Company's filings with the Canadian securities regulators, which filings are available at www.sedar.com.

For further information:

Chris Dobbin, CPA, CA

Director, President and CEO

NOVA LEAP HEALTH CORP.

T: 902 401 9480

E:cdobbin@novaleaphealth.com

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ea4cb3ac-ab66-4cdc-b380-69bd8c91e714

https://www.globenewswire.com/NewsRoom/AttachmentNg/eec12355-e331-40e2-954b-cb8f35b99587

Yahoo Finance

Yahoo Finance