Northwest Copper Reports 41.20 Metres of 3.20% Copper Equivalent at Stardust From Drilling in the 421 Zone

Figure 1

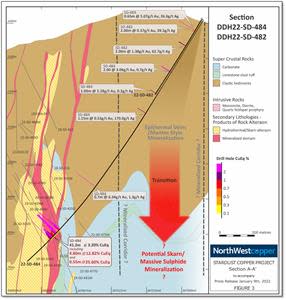

Figure 2

Figure 3

VANCOUVER, British Columbia, Jan. 09, 2023 (GLOBE NEWSWIRE) -- NorthWest Copper (“NorthWest” or “the Company”) (TSX-V: NWST) (OTCQX: NWCCF) is pleased to announce the second set of results from the 2022 Stardust drilling program in the 421 zone. This hole was designed to cut through the 421 zone from a different direction than all previous drilling (Figure 1) and highlights the thickness, grade and continuity of the 421 zone. The 421 zone forms the core of the 100% owned Stardust deposit which is one of the highest-grade Cu-Au deposits in BC. Stardust remains open down plunge and along strike. The combination of Stardust and Kwanika is the subject of our PEA (preliminary economic assessment), the results of which were released on January 5, 20231. Note that these drill results were not included in the PEA. Assay highlights from recent drilling include:

DDH22-SD-484: 41.20 metres2 of 3.20% CuEq3 from 722.00 metres (1.81% Cu, 1.66 g/t Au and 29.6 g/t Ag).

Including 4.80 metres at 12.82% CuEq from 734.40 metres

Including 0.55 metres at 25.60% CuEq from 762.65 metres

Gold-dominant intercepts from DDH22-SD-484 include:

2.00 metres of 3.06 g/t Au, 0.01% Cu and 0.7 g/t Ag from 171.65 metres

0.70 metres of 6.34 g/t Au, 0.2% Cu and 1.3 g/t Ag from 564.30 metres

The upper part of hole DDH22-SD-484 contains four zones ranging from 0.65 to 2.00 metres with gold ranging from 5.07 g/t to 0.53 g/t and silver ranging from 170.0 g/t to 0.2 g/t. These intercepts are separate from and higher in the hole than the main 421 zone. These are not currently modelled and may indicate potential for another mineralized zone parallel and to the east of the 421 trend (Figure 3).

“This hole serves as a reminder that Stardust is not only one of the highest-grade copper deposits in British Columbia but retains a lot of exploration potential,” said President and CEO Peter Bell. “The grades in the main intercept are very high, consistent with what we have seen before in the 421 zone and gives us further confidence in the geometry, grade, continuity of this part of the deposit. We are also highly encouraged by the gold dominant intercepts found away from 421 zone, which provide additional targets within Stardust. Stardust forms a key part of the Kwanika-Stardust project as outlined in our recent PEA, and remains underexplored.”

Drill Results Discussion

Drilling at Stardust for the 2022 season focused on conversion of inferred resources to higher classifications and on expansion of the resource around the 421 zone (Figure 1 & Figure 2). Stardust is the high-grade carbonate replacement deposit (CRD) that is located approximately 7 km from the Kwanika deposit. The Company has now reported all 2022 drill results from Stardust, and 20 of 30 holes from the 2022 drilling at Kwanika. These results have not been incorporated into the updated Stardust and Kwanika resource estimates or the recent PEA4.

DDH22-SD-484 was drilled from east to west which is opposite to all historical drilling at Stardust. This orientation was designed to provide extra understanding of the geometry of the 421 zone and to explore for new mineralization. This hole intersected 41.20 metres of 3.20% CuEq within the 421 zone. This interval includes very high-grade intervals of 4.80 metres at 12.82% CuEq from 734.40 metres depth and 0.55 metres at 25.60% CuEq from 762.65 metres (Figures 1, 2 & 3). Mineralization is chalcopyrite-pyrite as semi-massive sulphide replacements of garnet skarn or, more commonly accompanied by calcite and magnetite/hematite, as infill of vugs and interstices in garnet skarn and is the dominant mineralization style within the 421 zone.

Hole 484 was collared in clastic sedimentary rocks which sit above and to the east of the 421 zone. The gold dominant intercepts in the upper part of the hole have features of epithermal veins, which can be distal expressions of manto style mineralization. Mantos are a more distal expression of a CRD system. These new intercepts could indicate potential for more mineralization below in a hotter part of the hydrothermal system where it potentially transitions to more skarn/massive sulphide mineralization.

DDH22-SD-482 was abandoned at 258.00 metres as the hole deviated excessively and would not be able to test the target accurately if it continued. Completed drilling intersected 2.00 metres at 0.37 g/t Au and 39.5 g/t Ag and 2.00 metres with 1.38 g/t Au and 62.7 g/t from 42.00 and 90.00 metres down hole, respectively (Figure 3). As above, the style and tenor of this mineralization could represent a distal expression of another zone parallel to the main 421 trend.

Table 1: Drill Results from This News Release

Hole | From(m) | To(m) | Interval | Cu (PCT) | Au (g/t) | Ag (g/t) | CuEq |

DDH22-SD-482 | 42.00 | 44.00 | 2.00 | 0.02 | 0.37 | 39.5 | - |

also | 90.00 | 92.00 | 2.00 | 0.07 | 1.38 | 62.7 | - |

DDH22-SD-484 | 35.35 | 36.00 | 0.65 | 0.03 | 5.07 | 26.6 | - |

also | 171.65 | 173.65 | 2.00 | 0.01 | 3.06 | 0.7 | - |

also | 246.30 | 247.30 | 1.00 | 0.01 | 2.28 | 0.2 | - |

also | 309.55 | 310.70 | 1.15 | 0.05 | 0.53 | 170.0 | - |

also | 564.30 | 565.00 | 0.70 | 0.02 | 6.34 | 1.3 | - |

also | 722.00 | 763.20 | 41.20 | 1.81 | 1.66 | 29.6 | 3.20 |

also incl. | 734.40 | 739.20 | 4.80 | 6.59 | 7.61 | 121.5 | 12.82 |

also incl. | 762.65 | 763.20 | 0.55 | 13.80 | 14.70 | 207.0 | 25.60 |

Quality Assurance / Quality Control

Drilling completed at Stardust in 2022 was supervised by on-site NorthWest personnel who collected and tracked samples and implemented a full QA/QC program using blanks, standards, and duplicates to monitor analytical accuracy and precision. The samples were sealed on site and shipped to AGAT Laboratories (AGAT) in Calgary, Alberta. AGAT’s quality control system complies with global certifications for Quality ISO 9001:2015. Core samples were analyzed using a combination of AGAT’s 201-071 process for low-level concentrations (4 Acid digestion/ICP-OES/MS) and the 201-079 process for higher-level concentrations in base metals (Sodium Peroxide Fusion/ICP-OES). Silver overlimits were analyzed with method 201-116, a 3-acid digestion with ICP-OES finish. Gold assaying was completed with 202-055, a 30-gram fire assay with ICP-OES finish.

Technical aspects of this news release have been reviewed, verified, and approved by Tyler Caswell, P.Geo., Vice President Exploration of NorthWest, who is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Minerals Projects.

Annual Grant of Stock Options and Restricted Share Units

The Company has granted 3,540,625 Stock Options to directors and certain employees, and 557,813 Restricted Share Units (“RSUs”) to certain employees pursuant to its Stock Option and RSU Plans.

The Stock Options have an exercise price of $0.20 and have a range of vesting periods over three years and expire January 6, 2028. The RSUs are payable in common shares of the Company on exercise, vest on January 6, 2024, and expire February 6, 2024.

Figure 1: Drillhole Locations

Figure 2: Long Section showing block model 1 and intersection locations from this release and previously released2.

Figure 3: Cross Section

Table 2: 2022 Stardust Drill Results9

Hole | From (m) | To (m) | Interval (m)10 | Cu (PCT) | Au (g/t) | Ag (g/t) | CuEq (PCT)11 |

|

| ||||||||

DDH22-SD-475M | 579.00 | 582.20 | 3.20 | 1.02 | 0.56 | 15.2 | 1.53 |

|

incl. | 580.05 | 581.10 | 1.05 | 2.36 | 1.19 | 35.1 | 3.46 |

|

DDH22-SD-476M | 600.45 | 676.40 | 75.95 | 0.55 | 0.50 | 10.9 | 0.98 |

|

incl. | 616.55 | 617.45 | 0.90 | 6.24 | 3.11 | 113.0 | 9.30 |

|

also incl. | 658.05 | 666.50 | 8.45 | 1.62 | 1.67 | 46.3 | 3.14 |

|

DDH22-SD-477D | 560.85 | 580.50 | 19.65 | 0.32 | 0.29 | 6.1 | 0.57 |

|

incl. | 577.70 | 580.50 | 2.80 | 1.15 | 0.71 | 16.7 | 1.78 |

|

also | 620.00 | 651.80 | 31.80 | 0.63 | 0.44 | 12.4 | 1.03 |

|

also incl. | 647.20 | 651.80 | 4.60 | 3.27 | 2.34 | 64.5 | 5.41 |

|

DDH22-SD-478D | 502.00 | 546.20 | 44.20 | 0.84 | 0.51 | 13.7 | 1.31 |

|

incl. | 523.10 | 544.20 | 21.10 | 1.54 | 0.96 | 26.1 | 2.41 |

|

incl. incl. | 542.65 | 544.20 | 1.55 | 10.91 | 6.07 | 189.9 | 16.64 |

|

DDH22-SD-479M | 602.20 | 629.10 | 26.90 | 0.21 | 0.25 | 3.7 | 0.41 |

|

also | 661.40 | 707.45 | 46.05 | 0.80 | 0.71 | 14.4 | 1.40 |

|

also incl. | 695.00 | 701.40 | 6.40 | 1.63 | 1.67 | 33.4 | 3.05 |

|

DDH22-SD-480M | 444.75 | 478.30 | 33.55 | 0.56 | 0.33 | 14.2 | 0.91 |

|

incl. | 463.80 | 475.00 | 11.20 | 1.37 | 0.75 | 36.8 | 2.19 |

|

DDH22-SD-481D | 703.45 | 722.35 | 18.90 | 0.63 | 0.63 | 9.7 | 1.14 |

|

incl. | 718.50 | 722.35 | 3.85 | 1.71 | 1.53 | 27.4 | 2.98 |

|

DDH22-SD-482 | 42.00 | 44.00 | 2.00 | 0.02 | 0.37 | 39.5 | - |

|

also | 90.00 | 92.00 | 2.00 | 0.07 | 1.38 | 62.7 | - |

|

DDH22-SD-483D | 440.60 | 451.15 | 10.55 | 0.43 | 0.23 | 4.6 | 0.63 |

|

incl. | 445.85 | 446.20 | 0.35 | 2.97 | 1.21 | 22.5 | 3.99 |

|

DDH22-SD-484 | 35.35 | 36.00 | 0.65 | 0.03 | 5.07 | 26.6 | - |

|

also | 171.65 | 173.65 | 2.00 | 0.01 | 3.06 | 0.7 | - |

|

also | 246.30 | 247.30 | 1.00 | 0.01 | 2.28 | 0.2 | - |

|

also | 309.55 | 310.70 | 1.15 | 0.05 | 0.53 | 170.0 | - |

|

also | 564.30 | 565.00 | 0.70 | 0.02 | 6.34 | 1.3 | - |

|

also | 722.00 | 763.20 | 41.20 | 1.81 | 1.66 | 29.6 | 3.20 |

|

also incl. | 734.40 | 739.20 | 4.80 | 6.59 | 7.61 | 121.5 | 12.82 |

|

also incl. | 762.65 | 763.20 | 0.55 | 13.80 | 14.70 | 207.0 | 25.60 |

|

About NorthWest Copper:

NorthWest Copper is a new copper-gold explorer and developer with an exciting pipeline of projects in British Columbia. With a robust portfolio in a tier one jurisdiction, NorthWest Copper is well positioned to participate fully in a strengthening global copper market. We are committed to responsible mineral exploration which involves working collaboratively with First Nations to ensure future development incorporates stewardship best practices and traditional land use. Additional information can be found on the Company’s website at www.northwestcopper.ca.

On Behalf of the Board of Directors of NorthWest Copper Corp.

“Peter Bell”

Director, President and CEO

For further information, please contact:

Peter Lekich, Director Investor Relations |

|

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable securities laws. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to statements with respect to: the development, operational and economic results of the 2023 PEA; the Company’s goals for 2022 and 2023; geological interpretations; the estimation of Mineral Resources; magnitude or quality of mineral deposits; anticipated advancement of mineral properties or programs; future operations; mine plans; future exploration prospects; the completion and timing of technical reports; future growth potential of NorthWest; and future development plans.

All statements, other than statements of historical fact, included herein, constitutes forward-looking information. Although NorthWest believes that the expectations reflected in such forward-looking information and/or information are reasonable, undue reliance should not be placed on forward-looking information since NorthWest can give no assurance that such expectations will prove to be correct. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information, including the risks, uncertainties and other factors identified in NorthWest’s periodic filings with Canadian securities regulators. Forward-looking information are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking information. Important factors that could cause actual results to differ materially from NorthWest’s expectations include risks associated with the business of NorthWest; risks related to reliance on technical information provided by NorthWest; risks related to exploration and potential development of the Company’s mineral properties; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and First Nation groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and additional risks identified in NorthWest’s filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com).

Forward-looking information is based on estimates and opinions of management at the date the information are made. NorthWest does not undertake any obligation to update forward-looking information except as required by applicable securities laws. Investors should not place undue reliance on forward-looking information.

1 See News Release dated January 5th, 2023 available at www.northwestcopper.ca and the Company’s profile at www.sedar.com.

2 True widths of the reported mineralized intervals have not been determined.

3 Assumptions used in USD for the copper equivalent calculation (CuEq) were metal prices of $3.50/lb. Copper, $1,650/oz Gold, $21.50/oz Silver, and recovery is assumed to be 94% for copper, 94% for gold and 86% for silver. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.6875) + (Silver (g/t) x 0.0082)

4 See News Release dated January 5th, 2023 available at www.northwestcopper.ca and the Company’s profile at www.sedar.com.

5 True widths of the reported mineralized intervals have not been determined.

6 Assumptions used in USD for the copper equivalent calculation (CuEq) were metal prices of $3.50/lb. Copper, $1,650/oz Gold, $21.50/oz Silver, and recovery is assumed to be 94% for copper, 94% for gold and 86% for silver. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.6875) + (Silver (g/t) x 0.0082)

7 See NI 43-101 technical report titled “NI 43-101 Technical Report for the Stardust Project Updated Mineral Resource Estimate” dated May 17, 2021, filed under the Company’s SEDAR profile at www.sedar.com.

8 See News Release dated November 16th, 2022 available at www.northwestcopper.ca and the Company’s profile at www.sedar.com.

9 See News Release dated November 16th, 2022 available at www.northwestcopper.ca and the Company’s profile at www.sedar.com.

10 True widths of the reported mineralized intervals have not been determined.

11 Assumptions used in USD for the copper equivalent calculation (CuEq) were metal prices of $3.50/lb. Copper, $1,650/oz Gold, $21.50/oz Silver, and recovery is assumed to be 94% for copper, 94% for gold and 86% for silver. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.6875) + (Silver (g/t) x 0.0082)

Graphics accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a069af05-984c-4c1a-8517-16cb281305f1

https://www.globenewswire.com/NewsRoom/AttachmentNg/341f7d53-59a7-4615-b062-31178e8d7a57

https://www.globenewswire.com/NewsRoom/AttachmentNg/fd174814-a830-4d4f-a7f4-772a9455d701

Yahoo Finance

Yahoo Finance