Northrop (NOC) Wins Contract to Support E-2D Hawkeye Aircraft

Northrop Grumman Corp. NOC recently clinched a contract involving the E-2D Hawkeye aircraft. The award has been offered by the Naval Air Warfare Center Aircraft Division, Lakehurst, NJ.

Details of the Deal

Valued at $11.1 million, the contract is projected to be completed by February 2026. Per the terms of the deal, Northrop will offer maintenance support equipment for the E-2D Hawkeye aircraft system.

Majority of the work related to this deal will be carried out in Bethpage, NY.

Importance of E-2D Advanced Hawkeye

Northrop’s E-2D Advanced Hawkeye aircraft boasts battle management, theater air, missile defense and multiple sensor fusion capabilities in an airborne system. These offer the warfighter expanded battlespace awareness, especially in the area of information operations.

Through its effective radar sensor and robust network-enabled capability, Advanced Hawkeye provides critical, actionable data to joint forces and first responders. Such features of the aircraft make it attractive for the military, thus resulting in NOC winning multiple orders for the same, like the latest one. The new orders are likely to boost the revenue-generation prospects of Northrop from the military aircraft business arena.

Growth Prospects

Countries globally have been reinforcing their military resources due to intense geopolitical tensions and amplified terrorist threats. To this end, a military aircraft that forms an integral part of any air defense system is likely to witness pent-up demand.

Per a report from Mordor Intelligence, the global military aviation market is projected to witness a CAGR of 7.4% over the 2023-2028 period. Such growth prospects should benefit Northrop as its military aviation system offers a wide range of manned and unmanned aircraft that already enjoys an established position in the military aircraft market.

The abounding growth prospects should benefit defense majors that have forayed into the military aircraft market. These include Lockheed Martin LMT, Boeing BA and Textron TXT.

Lockheed’s Aeronautics segment is engaged in the research, design, development, manufacture, integration, sustainment, support and upgrade of advanced military aircraft, including combat and air mobility aircraft, unmanned air vehicles and related technologies. Its major programs include the F-35 Lightning II Joint Strike Fighter jet, the C-130 Hercules airlifter, the F-16 Fighting Falcon jet and the F-22 Raptor jet.

LMT has a long-term earnings growth rate of 6.5%. The Zacks Consensus Estimate for LMT’s 2023 sales indicates growth of 0.9% from the prior-year reported figure.

Boeing’s Defense, Space & Security segment’s primary products include fixed-wing military aircraft, F/A-18E/F Super Hornet, F-15 programs, P-8 programs, KC-46A Tanker and T-7A Red Hawk. The segment also produces rotorcraft and rotary-wing programs, such as CH-47 Chinook, AH-64 Apache and V-22 Osprey.

BA has a long-term earnings growth rate of 4%. The Zacks Consensus Estimate for BA’s 2023 sales implies growth of 19.3% from the prior-year reported figure.

Textron’s business unit, Textron Aviation Defense designs, builds and supports versatile and globally-known military aircraft preferred for training and attack missions. Some of Textron’s renowned products include the Beechcraft T-6C trainer and the AT-6 Wolverine.

TXT boasts a long-term earnings growth rate of 11.7%. The Zacks Consensus Estimate for TXT’s 2023 sales indicates an improvement of 7.7% from the prior-year reported figure.

Price Movement

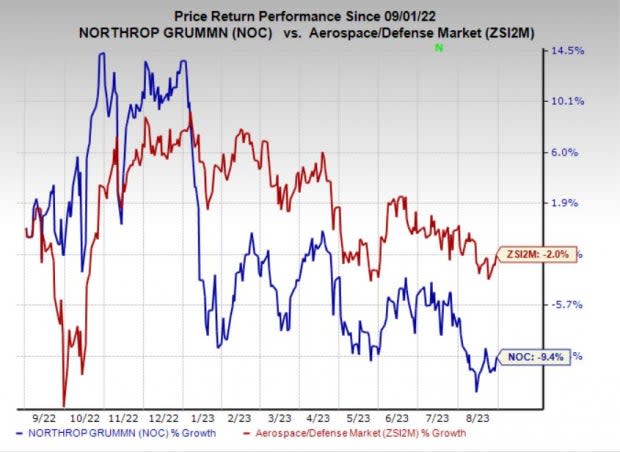

In the past year, shares of Northrop have lost 9.4% compared with the industry’s decline of 2%.

Image Source: Zacks Investment Research

Zacks Rank

Northrop currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance