Northrop Grumman (NOC) Q4 Earnings Top Estimates, Sales Dip

Northrop Grumman Corporation NOC reported fourth-quarter 2021 adjusted earnings of $6 per share, which surpassed the Zacks Consensus Estimate of $5.95 by 0.8%. The bottom line decreased 8.9% from $6.59 reported in the year-ago quarter.

The company reported adjusted earnings per share of $25.63 for full-year 2021, which improved 8.4% from 2020. Full-year earnings exceeded the Zacks Consensus Estimate of $25.59 per share by 0.2%.

Total Sales

In the fourth quarter of 2021, Northrop Grumman reported total sales of $8.64 billion, which missed the Zacks Consensus Estimate of $8.97 billion by 3.7%. Sales decreased 15% from the year-ago quarter’s $10.21 billion.

The downside was primarily due to a reduction in sales related to the IT services divestiture.

During full-year 2021, Northrop Grumman generated sales worth $35.67 billion, down 3% from the year-ago figure. Full-year sales missed the Zacks Consensus Estimate of $35.96 billion by a whisker.

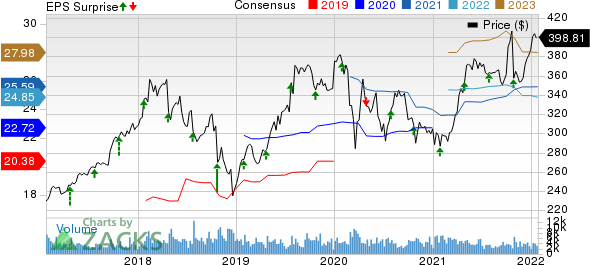

Northrop Grumman Corporation Price, Consensus and EPS Surprise

Northrop Grumman Corporation price-consensus-eps-surprise-chart | Northrop Grumman Corporation Quote

Backlog Count

Northrop Grumman’s total backlog stood at $76 billion at the end of 2021 compared with $81 billion at the 2020 end.

Segmental Details

Aeronautics Systems:Segment sales of $2,631 million declined 25% year over year due to a lower volume in both Manned Aircraft and Autonomous Systems.

Operating income declined 35% to $220 million, whereas operating margin contracted 130 basis points (bps) to 8.4%.

Mission Systems:Segment sales decreased 8% to $2,521 million due to a $133 million reduction in sales related to the IT services divestiture.

Operating income rose 3% to $402 million, with operating margin expanding 170 bps to 15.9%.

Defense Systems:Sales at this segment declined 28% to $1,378 million due to a reduction in sales related to the IT services divestiture.

Operating income declined 22% to $167 million, while operating margin expanded 90 bps to 12.1%.

Space Systems:Space Systems’ fourth-quarter 2021 sales rose 4% to $2,658 million due to higher sales from the Space and Launch & Strategic Missiles businesses.

The segment’s operating income declined 1% to $256 million, while operating margin contracted 50 bps to 9.6%.

Operational Update

Operating income during the quarter declined 36% to $742 million, primarily due to lower segment income.

Financial Condition

Northrop Grumman’s cash and cash equivalents at the end of 2021 were $3,530 million, down from $4,907 million as of Dec 31, 2020.

Long-term debt (net of the current portion) at the end of 2021 was $12,777 million, down from $14,261 million as of Dec 31, 2020.

Net cash inflow from operating activities at the end of 2021 was $3,567 million compared with $4,305 million as of Dec 31, 2020.

2022 Guidance

Northrop Grumman issued its financial guidance for 2022.

The company currently expects to generate revenues in the range of approximately $36.2-36.6 billion for 2022. The Zacks Consensus Estimate of $37.12 billion lies above the company’s guided range.

The company’s 2022 earnings are currently projected in the range of $24.50-$25.10 per share. The Zacks Consensus Estimate of $24.85 per share is slightly above the mid-point of the guided range.

The company expects its adjusted free cash flow in the range of $2.50-$2.80 billion in 2022.

Zacks Rank

Northrop Grumman currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

General Dynamics GD reported fourth-quarter 2021 earnings from continuing operations of $3.39 per share, which beat the Zacks Consensus Estimate of $3.37 by 0.6%.

General Dynamics’ long-term earnings growth is projected at 9%. The Zacks Consensus Estimate for GD’s 2022 earnings per share indicates year-over-year growth of 8.1%.

Raytheon Technologies Corporation’s RTX fourth-quarter 2021 adjusted earnings per share of $1.08 outpaced the Zacks Consensus Estimate of $1.01 by 6.9%.

Raytheon Technologies’ long-term earnings growth is projected at 13.2%. The Zacks Consensus Estimate for RTX’s 2022 earnings per share indicates year-over-year growth of 14.5%.

Lockheed Martin Corporation LMT reported fourth-quarter 2021 adjusted earnings of $7.24 per share, which surpassed the Zacks Consensus Estimate of $7.23 by 0.1%.

Lockheed Martin’s long-term earnings growth is projected at 3.6%. The Zacks Consensus Estimate for LMT’s 2022 earnings per share indicates year-over-year growth of 16.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance