Nicolet Bankshares (NIC) Hikes Quarterly Cash Dividend by 12%

Nicolet Bankshares, Inc. NIC announced a quarterly cash dividend of 28 cents per share. This reflects a 12% hike from the prior payout. The dividend will be paid out on Jun 14, 2024, to shareholders of record as of Jun 3.

The company has increased its dividend payout for the first time since its inception. It announced its first quarterly cash dividend in May 2023. Currently, NIC’s payout ratio is 15% of earnings. This indicates that it retains adequate earnings for reinvestment and future growth initiatives while still delivering decent returns to its shareholders.

Based on its closing price of $82.56 as of May 20, NIC’s current dividend yield is 1.4%.

The company has an ongoing share repurchase program too. The plan, amended in December 2021, increased the authorization to buy back up to shares worth $81 million. The plan has no set expiration date.

In the first quarter of 2024, NIC did not repurchase any shares. As of Mar 31, 2024, $46 million worth of shares remained available under the company’s current repurchase program.

Prior to this, the company announced an amendment to its repurchase plan in February 2019, which was suspended temporarily in March 2020.

Nicolet Bankshares has a strong balance sheet. As of Mar 31, 2024, total cash and cash equivalents were $427.4 million. Total loans were $6.4 billion and long-term borrowings were $162.3 million. This indicates a decent liquidity position.

Further, its common equity Tier-1 capital ratio of 10.2% and total capital ratio of 13.3% are well above regulatory requirements.

Given its decent capital position and liquidity position, NIC is expected to sustain its current capital distribution activities and keep enhancing shareholder value.

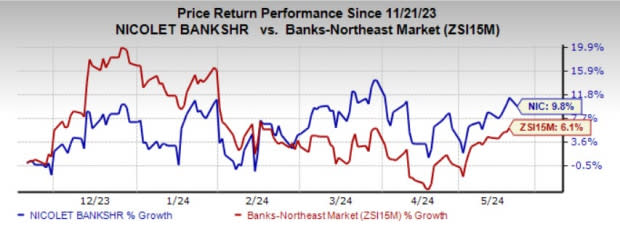

In the past six months, shares of Nicolet Bankshares have risen 9.8% compared with the industry’s growth of 6.1%.

Image Source: Zacks Investment Research

Currently, NIC carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Financial Services Firms That Announced Dividend Hike

Earlier this month, Apollo Global Management, Inc.’s APO board of directors announced a sequential increase in its quarterly dividend. The company declared a quarterly cash dividend of 46 cents per share, marking an increase of 7.6% from the prior payout. The dividend will be paid out on May 31 to shareholders of record as of May 17.

Prior to the recent hike, APO increased its dividend by 7.5% to 43 cents per share in February 2023. The company has increased its dividend eight times during the last five years.

Similarly, last month, Hancock Whitney, Corp. HWC announced an increase in its quarterly dividend. The company declared a quarterly cash dividend of 40 cents per share, marking a jump of 33.3% from the prior payout. The dividend will be paid out on Jun 14 to shareholders of record as of Jun 5.

Prior to the recent hike, HWC increased its dividend by 11.1% to 30 cents per share in January 2023. The company has increased its dividend twice during the last five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apollo Global Management Inc. (APO) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

Nicolet Bankshares Inc. (NIC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance