Nextracker (NXT) to Report Q3 Earnings: What's in the Cards?

Nextracker Inc. NXT is slated to report third-quarter fiscal 2024 results on Jan 31, after market close.

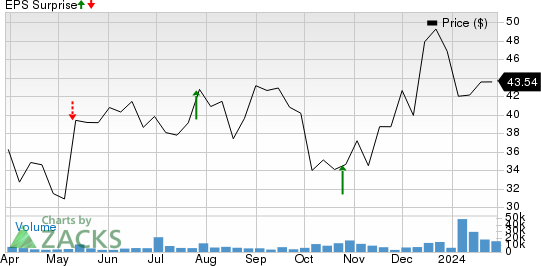

In the last reported quarter, the company delivered an earnings surprise of 91.18%. It also delivered a trailing four-quarter average earnings surprise of 43.04%.

Factors to Note

Solid shipment of NX Horizon XTR, the industry's most deployed all-terrain solar tracker, can be expected to have boosted Nextracker’s top line in the fiscal third quarter.

Also, notable demand for its TrueCapture software as well as NX Navigator control systems may have contributed favorably to NXT’s overall revenue performance.

Nextracker Inc. Price and EPS Surprise

Nextracker Inc. price-eps-surprise | Nextracker Inc. Quote

Further, during the fiscal third quarter, the company launched its next-generation technology suite with three new innovations in the United States. The tech suite provides next-generation functionality and value in Hail Protection, undulating terrain and fast-changing atmosphere conditions. Consecutive sales of this product, following the launch, might have also added impetus to NXT’s fiscal third-quarter top line.

The Zacks Consensus Estimate for revenues is pegged at $615.5 million, indicating a 7.4% improvement from the prior quarter’s reported number.

In November 2023, the company opened its new factory in Las Vegas for manufacturing critical steel components exclusively for Nextracker. The components will be used in ground-mount solar power generation plants to primarily serve projects in Nevada and southwestern states. This must have facilitated production ramp-up for NXT, which can be projected to be reflected in the upcoming results.

The separation of Nextracker from its contract manufacturer Flex Ltd., announced in October 2023, might have had some adverse impact on NXT’s overall earnings performance in the fiscal third quarter. Moreover, higher operating expenses, as the company keeps on enhancing its manufacturing capability to meet the growing demand for its products, can be anticipated to have hurt NXT’s quarterly bottom-line performance amid its cost-saving initiatives. Higher research and development expenses might have also impacted earnings.

The Zacks Consensus Estimate for fiscal third-quarter earnings is pegged at 49 cents per share, implying a decline of 24.6% from the earlier quarter’s reported figure.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Nextracker this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here.

Earnings ESP: NXT’s Earnings ESP is 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Nextracker currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are three companies from the same sector you may want to consider, as these have the right combination of elements to post an earnings beat this reporting cycle.

SolarEdge Technologies SEDG currently has an Earnings ESP of +11.80% and a Zacks Rank #3. The Zacks Consensus Estimate for SolarEdge’s fourth-quarter sales is pegged at $321.5 million, indicating a 63.9% decline from the prior-year quarter’s level.

The consensus estimate for fourth-quarter earnings is pegged at a loss of $1.34 per share. SEDG has a trailing four-quarter average negative earnings surprise of 13.23%.

Energy Transfer ET currently has an Earnings ESP of +15.39% and a Zacks Rank #2. The Zacks Consensus Estimate for Energy Transfer’s fourth-quarter sales is pegged at $23.59 billion, implying an improvement of 15% from the prior-year reported figure.

ET delivered a trailing four-quarter average negative earnings surprise of 5.23%. The consensus estimate for fourth-quarter earnings is pegged at 29 cents per share.

ONEOK OKE currently has an Earnings ESP of +12.04% and a Zacks Rank #3. The Zacks Consensus Estimate for fourth-quarter sales is pegged at $5.55 billion, indicating a rise of 10.3% from the year-ago quarter’s reported number.

The consensus mark for fourth-quarter earnings is pegged at $1.25 per share. The company delivered a trailing four-quarter average earnings surprise of 5.99%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Nextracker Inc. (NXT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance