NextEra Energy (NEE) Q1 Earnings Beat Estimates, Sales Lag

NextEra Energy, Inc. NEE reported first-quarter 2024 adjusted earnings of 91 cents per share, which beat the Zacks Consensus Estimate of 80 cents by 13.8%. The bottom line was also up nearly 8.3% year over year. The uptick was driven by solid performance of Florida Power & Light Company and NextEra Energy Resources.

GAAP earnings per share for the first quarter were $1.10 compared with $1.04 in the year-ago period.

Total Revenues

In the first quarter, NextEra’s operating revenues were $5.73 billion, which lagged the Zacks Consensus Estimate of $6.46 billion by 11.4%. The top line plunged 14.7% year over year.

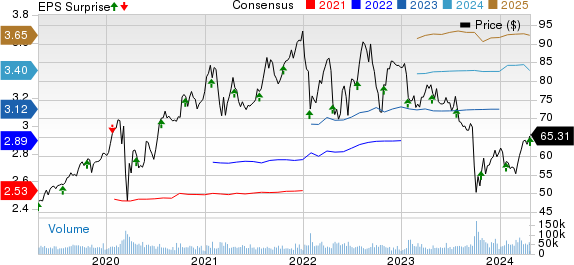

NextEra Energy, Inc. Price, Consensus and EPS Surprise

NextEra Energy, Inc. price-consensus-eps-surprise-chart | NextEra Energy, Inc. Quote

Segment Results

Florida Power & Light Company (“FPL”): The segment’s revenues amounted to nearly $3.8 billion, down 2.2% from the prior-year figure of $3.92 billion. Its earnings came in at 57 cents per share compared with 53 cents recorded a year ago.

NextEra Energy Resources: Its revenues amounted to $1.86 billion, down 33.2% from the prior-year figure of $2.79 billion. The segment’s earnings came in at 40 cents per share in comparison with 36 cents in the year-ago quarter.

Corporate and Other: Operating revenues for the reported quarter were $33 million. The operating loss in the first-quarter was 6 cents per share, wider than year-ago loss of 5 cents.

Highlights of the Release

Courtesy of Florida’s ongoing economic improvement, FPL's average number of customers in first-quarter 2024 increased by nearly 100,000 from the prior-year period. During the quarter, FPL placed into service nearly 1,640 megawatts (MW) of new, cost-effective solar projects in operation.

NextEra Energy Resources expanded its contracted renewables backlog by adding 2,765 MW of renewable projects during the quarter under discussion. Its backlog additions include nearly 145 MW of wind projects, 1,545 MW of solar projects, 1,025 MW of battery storage projects and 50 MW of wind repowering. The company’s renewables backlog is now nearly 21.5 gigawatts.

Financial Update

NEE had cash and cash equivalents of nearly $1.6 billion as of Mar 31, 2024, compared with $2.7 billion on Dec 31, 2023.

Long-term debt, as of Mar 31, 2024, was $65.9 billion, up from $61.4 billion on Dec 31, 2023.

Cash flow from operating activities in first-quarter of 2024 was $3 billion compared with $1.7 billion in the prior-year quarter.

Guidance

NextEra Energy reaffirmed 2024 earnings in the range of $3.23-$3.43 per share. The midpoint of the guided range is $3.33 per share, lower than the Zacks Consensus Estimate of $3.4.

For 2025, the company expects earnings per share of $3.45-$3.70. Through 2026, NextEra Energy expects earnings per share to grow 6-8% per year, taking the 2024 adjusted earnings per share as the base. This translates to earnings per share of $3.63-$4.00 for 2026.

The company’s unit, Energy Resources, currently aims to add 32,700-41,800 MW of renewable power projects to its portfolio in the 2023-2026 span.

Zacks Rank

Currently, NextEra Energy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

FirstEnergy Corporation FE is set to release first-quarter 2024 results on Apr 25. The Zacks Consensus Estimate for earnings per share is pegged at 54 cents.

The Zacks Consensus Estimate for earnings per share indicates a decline of 10% from the year-ago levels. FirstEnergy delivered an earnings surprise of 3.3% in the last reported quarter.

Alliant Energy Corporation LNT is scheduled to announce first-quarter 2024 results on May 2. The Zacks Consensus Estimate for earnings per share is pegged at 66 cents.

Alliant Energy’s long-term (three-to-five years) earnings growth rate is 6.1%. The Zacks Consensus Estimate for earnings per share indicates an increase of 1.5% from the prior-year actuals.

Dominion Energy D is scheduled to announce first-quarter 2024 results on May 2. The Zacks Consensus Estimate for earnings is pegged at 52 cents per share.

Dominion’s long-term earnings growth rate is projected at 8.9%. The Zacks Consensus Estimate for earnings per share suggests a decline of 47.5% from the year-earlier levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance