This Is The Next Battleground For Apple, Google, Facebook, and Microsoft

The next battle between tech giants like Apple and Google may hinge on which one’s technology is better for overlaying silly-looking mustaches on selfies.

Augmented reality (AR), a much-hyped technology that superimposes digital graphics on the physical world, is a major focus for several of the world’s biggest technology companies. Facebook fb , Microsoft msft , Google goog , and Apple aapl all highlighted AR at their annual developer conferences.

The technology has the potential to become an important new avenue for interacting with computers and the world. People could use it to see digital menus of restaurants by waving their phones in front of shopfront windows or see how their new IKEA couch will fit into their living rooms.

The interest by companies is being driven by a huge potential payday. AR-related sales could reach $80 billion in 2022, according to investment bank Woodside Capital.

But there are many challenges before the AR business becomes anything close to lucrative. It was only a year ago that Facebook and Google were trumpeting AR’s cousin, virtual reality, as the next big thing. But slow sales of virtual reality headsets like Facebook’s Oculus Rift show that they are far from being must-haves because of roadblocks like price, a lack of compelling reasons to use them, and isolation from others while wearing bulky VR gear.

In contrast AR doesn’t require people to spend hundreds of dollars on new computing gear. Instead, they can use their current smartphones and their cameras. Examples include Snapchat, which mostly young people use to take pictures and adorn them with fancy graphics on the fly, and Google’s language translation app that people can use to translate text just by pointing their smartphone cameras at a sign.

Get Data Sheet, Fortune’s technology newsletter.

To succeed with their plans, companies like Facebook and Google need the help of outside developers to create compelling AR apps for their products. If they do so, they will reap the benefits of a new generation of apps that keep users glued to their respective platforms.

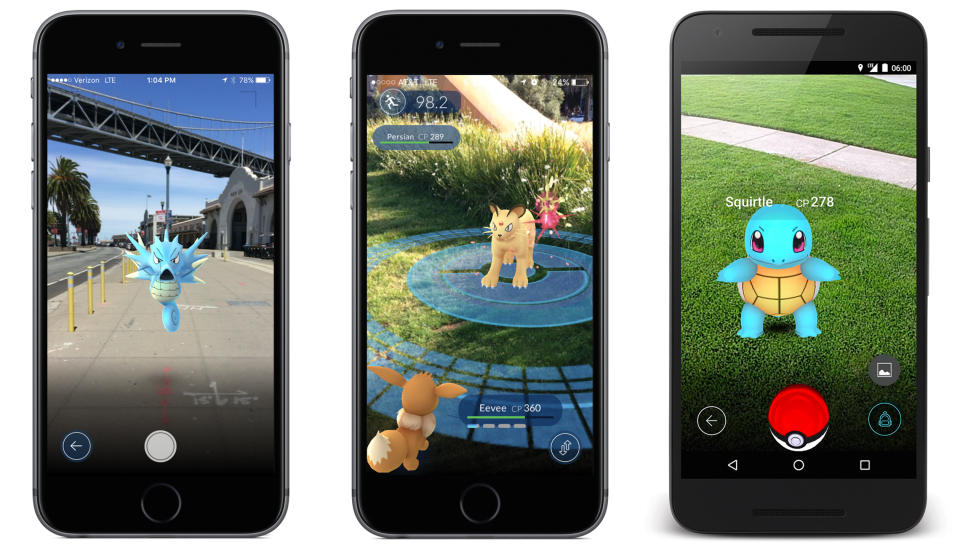

The problem is that AR is still a relatively new to mainstream developers. Unlike with creating websites or smartphone apps, there’s no standardized way to build an AR app like last summer’s blockbuster mobile game Pokémon Go, which let people battle digital monsters overlaid on the real world.

To court developers, Facebook, Google, Apple, and Microsoft have all unveiled their own AR software tools that they each claim will make creating AR apps easier. Each tool kit has it’s own positives, but also drawbacks.

Google, for example, has a head start by debuting its Project Tango AR software kit in 2014, the first among the major tech companies to release such software. The search giant is making some inroads in popularizing the tools with big institutions like the Detroit Institute of Arts, which is using the technology to make its exhibits more interactive. Visitors can use smartphones provided by the museum to look at exhibits and see extras like a digital skeleton inside a mummy’s sarcophagus.

Google’s big challenge, however, is that Project Tango is currently limited to only two compatible smartphones, the Lenovo Phab 2 Pro and the Asus ZenFone AR. Although these phones are powerful, they are hardly mainstream like Samsung phones and Apple iPhones.

In April, Facebook CEO Mark Zuckerberg revealed his company’s own AR tools that he pitched as a way for developers to build compelling AR apps within Facebook, like the ability to leave digital messages for friends at their favorite local bars.

Tim Merel, the managing director for the AR and VR mergers and acquisition advisory firm Digi-Capital, said that Facebook excels at convincing users to use new features soon after they debut, which could make the company a leader in AR. One example he cited was the social network’s success in getting people to use the Stories feature for its photo service Instagram that lets people share videos and photos of events in their daily lives.

Facebook said that its custom software makes it easier for developers to build AR apps that don’t require specialized smartphones. If the technology is as versatile as Facebook claims, developers may be able to make AR apps that work on many different phones.

However, Facebook has work to do convincing developers that it’s committed to its AR tools after suddenly shuttering its Parse toolkit for building mobile apps in 2016. Any doubts could make coders wary of building any AR apps for Facebook.

Meanwhile, this week, Apple debuted its own AR tool kit, ARKit, which is intended to make it easier for coders to build AR apps for iPhones and iPads. Although it is playing catch up to Google and Facebook in focusing on AR, Apple has a long track record of catering to the needs of developers who make games for its iPhones and iPads.

The rise of the iPhone ushered a wave of mobile video games that “essentially tripled the number of regular game players,” said Gartner vice president of research Brian Blau. By Apple pushing into AR, developers may create an AR app market that rivals the current mobile app market.

But “Apple has a much tougher job attracting developers than they have before,” Blau said, citing increased competition from other big tech companies like Google.

Meanwhile, Microsoft seems to be foregoing smartphones altogether when it comes to augmented reality. Instead, it’s pushing its own Windows operating system for personal computers as the preferred platform for AR developers.

Microsoft’s HoloLens AR headset, which sells for over $3,000, is still far from affordable for most customers. It’s currently being marketed to businesses for tasks like helping architects more easily design buildings. Although millions of developers build apps for Windows, it’s unclear if people want to use the cameras on their PCs to see digital images overlaid on the real world.

For more about technology and finance, watch:

“Steve Ballmer’s biggest regret is missing out on mobile,” said Merel. “Hopefully mobile AR won’t become Satya Nadella’s,” referring to Microsoft’s current CEO.

And while each of these big companies may be able to attract developers to build AR apps for their services, it’s no guarantee that people will use them. Since last summer’s Pokémon Go, there has yet to be a big breakthrough AR app, highlighting the still limited appetite for such apps and the years of hard work ahead in refining the technology.

Yahoo Finance

Yahoo Finance