Nevada Lithium intersects 4,154 ppm Lithium over 680 ft (207 m); Confirms laterally extensive, high-grade mineralization at Bonnie Claire Lithium Project, Nevada

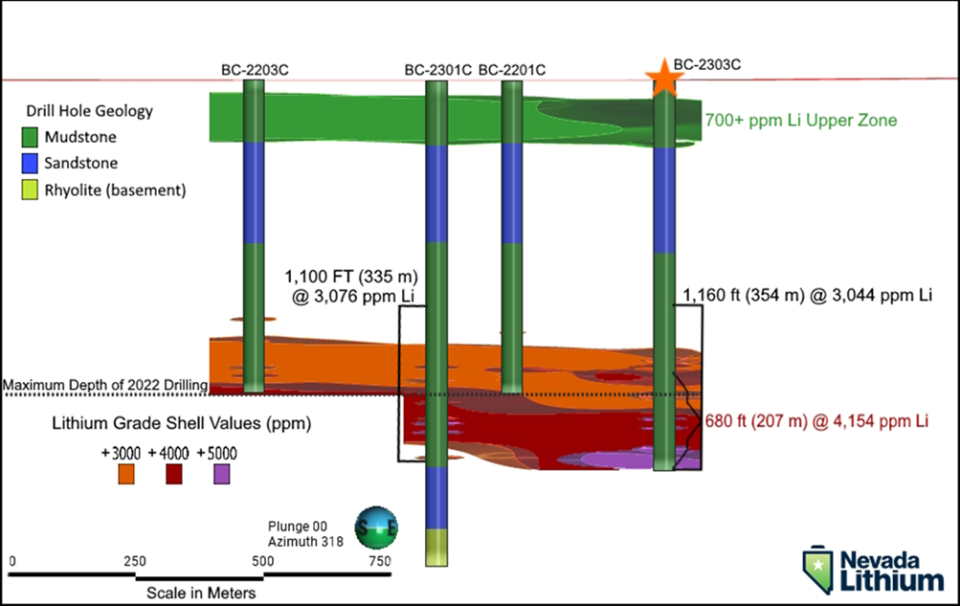

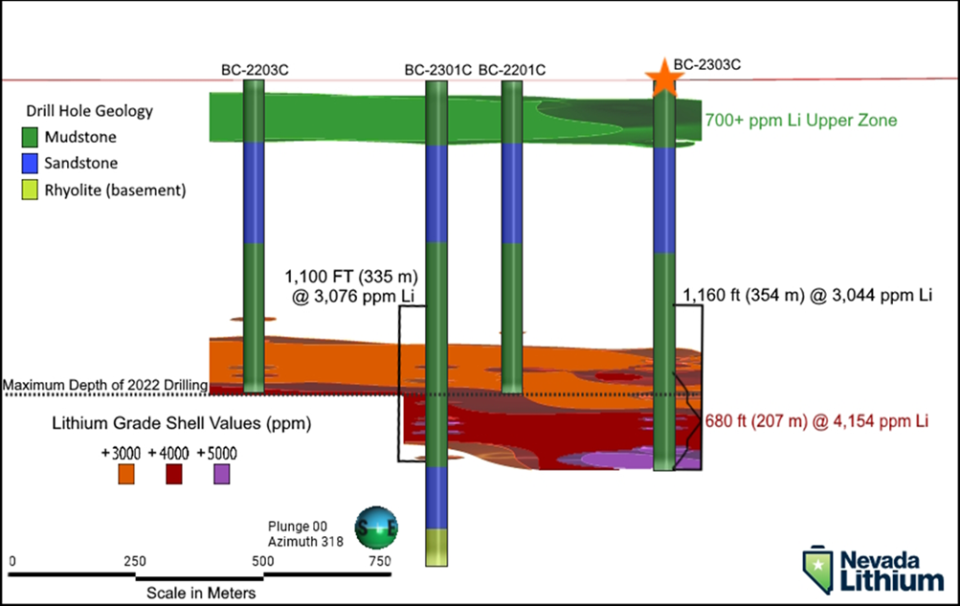

Figure 1

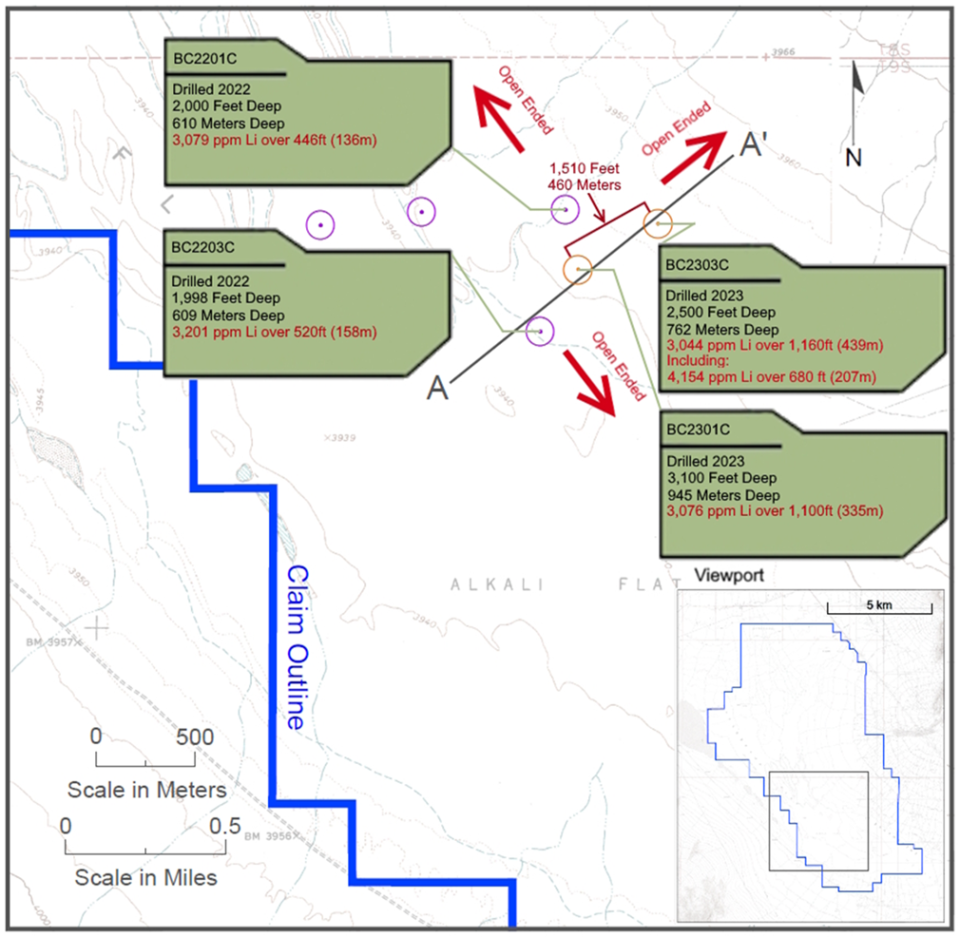

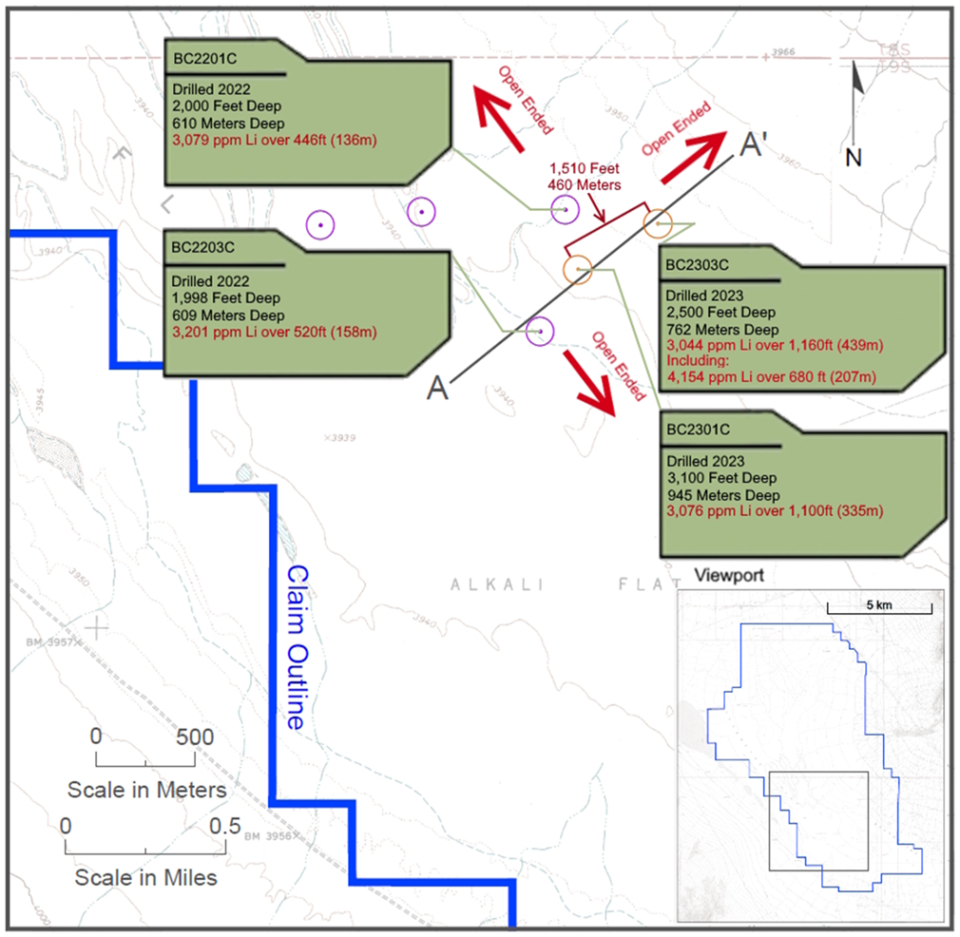

Figure 2

VANCOUVER, British Columbia, Feb. 27, 2024 (GLOBE NEWSWIRE) -- Nevada Lithium Resources Inc. (CSE: NVLH; OTCQB: NVLHF; FSE: 87K) (“Nevada Lithium” or the “Company”) is pleased to provide the core assay results for its second diamond drill hole from the 2023 drill program at its 100% owned Bonnie Claire lithium project (the “Project” or “Bonnie Claire”), located in Nye County, Nevada. BC2303C was drilled to 2,500 feet (762 m) and ended in high-grade lithium mineralization. The 680 ft (207 m) intercept is the thickest +4,000 ppm lithium zone drilled to date.

Nevada Lithium’s CEO, Stephen Rentschler, comments: “The results from BC2303C are tremendous. We have confirmed a +3,000 ppm, and now +4,000 ppm, high-grade mineralized zone that appears to increase in thickness as we move to the east, and the mineralized zone remains open in several directions. BC2303C is a step out of 1,510 ft (460 m) northeast from our previous hole (BC2301C) and is over 1540 feet (470 m) east from hole BC2201C, where the +3,000-ppm mineralized zone was first encountered.”

He continued, “The five holes that have pierced this +3,000-ppm mineralized zone are contained within the PFS resource upgrade area. However, much of this high-grade zone extends beyond the limits of the current resource. The potential for positive impact on the PFS indicates that re-analysis of the 2024 workplan is required to maximize the benefit of this latest set of assays. The Project’s PFS resource upgrade drilling locations and depths, previously adjusted to accommodate the discovery of high-grade mineralization, may need to be adjusted once again. It appears that Bonnie Claire has yet to reveal her best to us, and we believe that this world class asset continues to increase in value.”

Join Stephen Rentschler, CEO of Nevada Lithium for a LIVE virtual event

Learn more about the significance of assay results from Bonnie Claire’s latest core hole and to ask questions during the interactive Q&A.

Date and time: Wednesday, February 28th at 12 pm ET / 9 am PT

Click here to register for the event >

Highlights:

Deeper drilling continues to find higher grade mineralization. The lower mineralized zone averages 2,575 ppm Li over 1440 ft (439 m) at (1060 to 2500 ft / 323 to 762m), including a subinterval of 680 ft (207m) at 4,154 ppm Li (1820 to 2500 ft / 555 to 762m). BC2303C is the first hole to contain over 100 continuous feet (30 meters) averaging over 5,000 ppm lithium.

Hole BC2303C was a 1,510 ft (460m) step out and confirms the deep mineralization discovered by BC-2301C, which remains open in several directions. Five holes have now intersected strata with +3,000 ppm mineralization varying from 60 feet (18 meters) in BC2202C, the furthest west intercept, to 1,340 feet (354 meters) in BC2303C, the furthest east intercept. It is thought that the lateral extent of this +3,000 ppm mineralized zone will be expanded with further drilling.

The upper mineralized zone averages 967 ppm over 420 ft (128 m) from 20 ft (6 m) depth. Work is continuing to evaluate the potential for open-pit mining at the upper mineralized zone at Bonnie Claire. Concurrently, work on the Pre-Feasibility Study will incorporate the most up to date work on the proposed bore-hole mining method.

BC2303C’s 680 ft (207 m) of 4154 ppm lithium is the thickest intercept yet above 4,000 ppm lithium and may indicate higher grades to the north and east. The highest assay in BC2303C is 5840 ppm lithium from 2440 ft (744 m) to 2460 ft (750 m).

In the upper mineralized zone, assays include 1282 ppm Li over 240 ft (73 m) within a broader interval of 967 ppm Li over 420 ft (128 m) from 20 ft (6 m) depth.

Sample assays are announced herein for Hole BC2303C with results presented in Table 1

Table 1: Core assay¹ summary for drill hole BC2303C

Drill Hole | From (ft) * | To (ft) | Interval (ft) | Li (ppm) | Comments |

BC2303C | 20 | 440 | 420 | 967 | Upper Zone |

Including | 140 | 380 | 240 | 1282 |

|

|

|

|

|

|

|

| 1060 | 2500 | 1440 | 2575 | Lower Zone |

Including | 1340 | 2500 | 1160 | 3044 |

|

Including | 1820 | 2500 | 680 | 4154 |

|

Including | 2340 | 2500 | 160 | 5054 |

|

*Results presented in feet (ft).

Drill Hole | From (m) ** | To (m) | Interval (m) | Li (ppm) | Comments |

BC2303C | 6 | 134 | 128 | 967 | Upper Zone |

Including | 43 | 116 | 73 | 1282 |

|

|

|

|

|

|

|

| 323 | 762 | 439 | 2575 | Lower Zone |

Including | 408 | 762 | 354 | 3044 |

|

Including | 555 | 762 | 207 | 4154 |

|

Including | 713 | 762 | 49 | 5054 |

|

** Results presented in meters(m).

¹Intervals presented are core length

Results & Interpretation

Results from BC2303C confirm the potential of laterally extensive high-grade lithium mineralization that was first intersected in BC2203C and examined more fully in hole BC2301C. This lateral continuity is illustrated in cross-section A-A’ (Figure 1). BC2203C finished in mineralization at grades of greater than 3000 ppm lithium (announced in the Company’s News Release December 7, 2022). BC2303C ended in material grading higher than 4,000 ppm lithium.

Highlights include:

BC2303C is perhaps the strongest hole at Bonnie Claire to date, and the first to intersect greater than 100ft width of >5000ppm mineralization.

This hole steps out from and extends lower high-grade zone by some 450m and remains open in several directions.

It is anticipated that the lateral extent of the high-grade lower zone will expand from further step-out drilling.

Work continues towards a planned preliminary feasibility study (PFS). Completion of the PFS is expected by late 2024 or early 2025, according to technical developments and other considerations.

Quality Assurance / Quality Control (QAQC)

A Quality Assurance / Quality Control protocol following industry best practice was incorporated into the program by Nevada Lithium. Drilling was conducted by Major Drilling. Core was transported by Major from the collar location and received by Nevada lithium staff at the Company storage facility in Beatty, NV. The facility is only accessible to Nevada Lithium staff and remains otherwise locked.

Received core was logged and cut at the Facility by Nevada Lithium staff. Logging and sampling included the systematic insertion of blanks, duplicates, and certified reference material (CRM) OREAS 750 into sample batches at an insertion rate of approximately 10%.

All core samples collected were transported by Company staff to ALS USA Inc.’s laboratory in Reno, NV. for sample preparation. Preparation method comprise includes initial weighing (Code WEI-21), disposal of R/B split after analysis (DIS-REJ21), crushing QC Test (PUL-CRU), pulverizing QC Test (PYUL-QC), fine crushing at 70% <2mm (CRU-31), splitting by Boyd rotary splitter (SPL-22Y , pulverizing up to 250g 85% <75 µm (PUL-31) and a final crusher wash between samples (WSH-21). Samples were shipped to ALS Vancouver laboratory in Burnaby BC, where the samples were analyzed using complete characterization method ME-MS61, involving a four-acid digestion followed by ICP-MS measurement.

Standards, duplicates, and blanks in the drill results to date have been approved as acceptable. The standards performed well (90% <2SD), as did duplicates (R2 0.9966) and most blanks. Two blanks inserted into the lower high-grade zone assayed anomalous Li, resulting from a 0.5% potential crushing preparation carryover. While this is within ALS method expectations new samples were prepared with a final crusher wash between samples (WSH-21). Reanalysis brought blank analyses down to <50 ppm Li. The resulting reanalysis had negligible impact on the overall grade, with an R^2 value of 0.9962 between the original and new analyses.

PDAC 2024

The Company will be exhibiting at PDAC 2024 at the Investors Exchange, with full details below. Conference attendees are invited to visit the Company booth to learn more and ask any questions they may have. Management is also participating in the PDAC One on One Meeting Program. Interested parties are encouraged to book a meeting through the conference website.

Booth Number: 3128

Dates: March 3rd to 6th, 2024

Exhibition Hours: 10 a.m. to 5 p.m. ET

One on One Meetings: https://www.precioussummit.com/event/pdac-2024-one-on-one-meeting-program/

Any capitalized terms not defined herein have the meaning given to such term in the Company’s PEA (as defined below) technical report available on the Company’s profile on SEDAR+.

Figure 1: Cross-sectional grade shell comparison from drill holes BC2201C, BC2203C, BC2301C, and BC2303C

Figure 2: Drill collar location map of holes BC2201C, BC2203C, BC2301C, and BC2303C, with section line A-A’

About Nevada Lithium Resources Inc.

Nevada Lithium Resources Inc. is a mineral exploration and development company focused on shareholder value creation through its core asset, the Bonnie Claire Lithium Project, located in Nye County, Nevada, where it holds a 100% interest.

Bonnie Claire has a current NI 43-101 inferred mineral resource of 3,407 million tonnes (Mt) grading 1,013 ppm Li for 18.372 million tonnes (Mt) of contained lithium carbonate equivalent (LCE), at a cut-off grade of 700 ppm Li2.

The PEA for Bonnie Claire indicates a Net Present Value (8%) of $1.5 Billion USD (after tax) using $13,400 USD per tonne LCE and after-tax IRR of 23.8%. With an LCE price of $30,000 USD per tonne, the Net Present Value (8%) of the Project is $5.9 Billion USD (after tax) and an IRR of 60.3% 2.

For further information on Nevada Lithium and to subscribe for updates about Nevada Lithium, please visit its website at: https://nevadalithium.com/

QP Disclosure

The technical information in the above disclosure has been reviewed and approved by the designated Qualified Person under National Instrument 43-101, Dr. Jeff Wilson, PhD, P.Geo, Vice President of Exploration for Nevada Lithium. Dr. Wilson is not independent of Nevada Lithium, as he is Vice President of Exploration for Nevada Lithium.

2See Preliminary Economic Assessment NI 43-101 Technical Report on the Bonnie Claire Lithium Project, Nye Country, Nevada authored by Terre Lane, J. Todd Harvey, MBA, PhD, Hamid Samari, PhD and Rick Moritz (Effective date of August 20, 2021, and Issue date of February 25, 2022) (the “PEA” or the “Preliminary Economic Assessment”) as summarized in Nevada Lithium’s news release dated October 13, 2021, which are available on Nevada Lithium’s SEDAR+ profile at www.sedarplus.ca. Results of the Preliminary Economic Assessment represent forward-looking information. This economic assessment is, by definition, preliminary in nature and includes inferred mineral resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the Preliminary Economic Assessment will be realized. Mineral resources are not mineral reserves as they do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves.

On behalf of the Board of Directors of Nevada Lithium Resources Inc.

“Stephen Rentschler”

Stephen Rentschler, CEO

For further information, please contact:

Nevada Lithium Resources Inc.

Stephen Rentschler

CEO and Director

Phone: (647) 254-9795

E-mail: sr@nevadalithium.com

Media Inquiries

E-mail: email@nevadalithium.com

Find Nevada Lithium on Twitter and LinkedIn

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this news release. The Canadian Securities Exchange has not approved or disapproved of the contents of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. These statements relate to matters that identify future events or future performance. Often, but not always, forward looking information can be identified by words such as “could”, “pro forma”, “plans”, “expects”, “may”, “will”, “should”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved.

The forward-looking statements contained herein include, but are not limited to, statements regarding: the performance and plans of the Project and results of the 2023 Exploration and Development Plan (including, without limitation, its mineral resources, current claims and its ability to utilize global lithium needs); Clayton Valley providing a viable exploration model for lithium bearing brines at Bonnie Claire; the Company’s objectives, goals and exploration activities conducted and proposed to be conducted at the Company’s properties; future exploration plans, including drilling opportunities; relevant technical and economic factors, such as environmental permitting, infrastructure, sociopolitical, marketing and other relevant factors influencing the prospect of economic extraction; and the future use and price of and demand for lithium.

In making the forward looking statements in this news release, Nevada Lithium has applied several material assumptions, including without limitation: the Company’s ability to effectively manage unanticipated costs and expenses; the Company’s ability to generate cash flow from operations; the Company’s ability to successfully compete in the mining industry; the timing and results of exploration and drilling programs; general business and economic conditions; the Company’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; the accuracy of budgeted exploration and development costs and expenditures; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; the Company’s ability to attract and retain skilled personnel; political and regulatory stability; sustained labour stability; stability in financial and capital goods markets; industry trends; actual results of exploration, resource goals, metallurgical testing, economic studies and development activities will continue to be positive and proceed as planned; the market for lithium will continue to strengthen; the Company maintaining the Project; market fundamentals that result in sustained lithium demand and prices; the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of Bonnie Claire in a timely manner; the availability of financing on suitable terms for the development; construction and continued operation of Bonnie Claire; the Project containing mineral resources; Clayton Valley providing a viable exploration model for lithium bearing brines at Bonnie Claire; the Company being able to complete the 2023 Exploration and Development Plan as anticipated; and Nevada Lithium’s ability to comply with all applicable regulations and laws, including environmental, health and safety laws.

Investors are cautioned that forward-looking statements are not based on historical facts but instead reflect Nevada Lithium’s management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of managements considered reasonable at the date the statements are made. Although Nevada Lithium believes that the expectations reflected in such forward- looking statements are reasonable, such information involves risks and uncertainties, and under reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements expressed or implied by Nevada Lithium. Among the key risk factors that could cause actual results to differ materially from those projected in the forward- looking statements are the following: operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Project; the Company’s inability to find a commercially viable deposit at its mineral property; additional financing may not be available to the Company when required or, if available, the terms of such financing may not be favourable to the Company; fluctuations in demand of lithium; the Company may not be able to identify, negotiate or finance any future acquisitions successfully, or to integrate such acquisitions with its current business; the Company’s exploration activities are dependent upon the grant of appropriate licenses, concessions, leases, permits and regulatory consents, which may be withdrawn or not granted; the Company’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; there is no guarantee that title to the Company’s property will not be challenged or impugned; the Company faces various risks associated with mining exploration that are not insurable or may be the subject of insurance which is not commercially feasible for the Company; social and environmental activism can negatively impact exploration, development and mining activities; the success of the Company is largely dependent on the performance of its directors and officers; the Company and/or its directors and officers may be subject to a variety of legal proceedings, the results of which may have a material adverse effect on the Company’s business; the Company may be adversely affected if potential conflicts of interests involving its directors and officers are not resolved in favour of the Company; dilution from future equity financing could negatively impact holders of the Company’s securities; failure to adequately meet infrastructure requirements could have a material adverse effect on the Company’s business; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of funding any exploration programs on the Company’s property; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development; geological factors; estimation or realization of mineral reserves and mineral resources, future prices of precious metals and lithium; changes in general economic, business and political conditions, including changes in the financial markets and in the demand and market price for commodities; possible variations in ore grade or recovery rates; possible failures of plants, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; currency fluctuations, title disputes or claims limitations on insurance coverage; risks relating to epidemics or pandemics, including the impact of COVID-19 on Nevada Lithium’s business; as well as those factors discussed under the heading “Risk Factors” in Nevada Lithium’s latest Management Discussion and Analysis and other filings of Nevada Lithium filed with the Canadian securities authorities, copies of which can be found under Nevada Lithium’s profile on the SEDAR+ at www.sedarplus.ca.

Should one or more of these risks or uncertainties materialized, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Nevada Lithium has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. Nevada Lithium does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Images accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/11eda9bb-a9f3-4347-ab15-c7ee836da896

https://www.globenewswire.com/NewsRoom/AttachmentNg/b7b14146-8dc9-4a43-9282-457a4843a0ec

Yahoo Finance

Yahoo Finance