A Neutral View of Altria Despite High Dividends

Altria Group Inc. (NYSE:MO) stands out as a robust dividend payer, not only maintaining a dividend yield of 9.25%, but also having increased its dividend per share for more than 50 years. It is worth noting the 9% dividend yield reflects its status as a good dividend payer and cash generator and directly reflects how undervalued the stock is currently.

On the other hand, Altria faces significant challenges with its primary market in decline, which could threaten its earnings growth and, consequently, lead it to lose its "Dividend King" status, thus justifying its low multiples.

To ensure a rating above neutral for Altria, we must delve into two main points. The first is how fast the decline of its legacy products will be and how this will affect the results. The second is how likely the company is to balance these results with its new initiatives.

Smokable products have poor public perception

In 2023, smokable products still accounted for 88% of the company's revenue. This underscores how dependent Altria's earnings (and consequently, its dividends) are on these operations.

As is well-known, there is a clear trend of declining smokers in society (especially observed in the U.S.), a natural generational trend driven by regulatory and health organizations - affecting Altria's revenue.

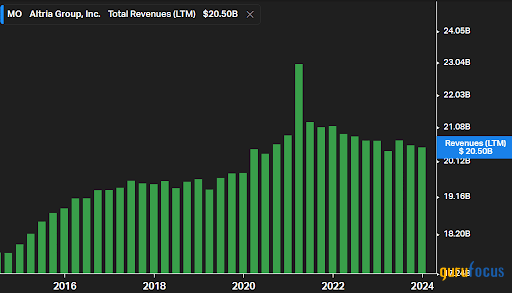

On the other hand, a significant impact on this indicator has not yet been observed in a long-term analysis even though this revenue has been showing slight reductions since 2021. Furthermore, I believe most of this growth stems from price increases (and inflation pass-throughs) as the demand for these products exhibits greater inelasticity.

Source: Koyfin

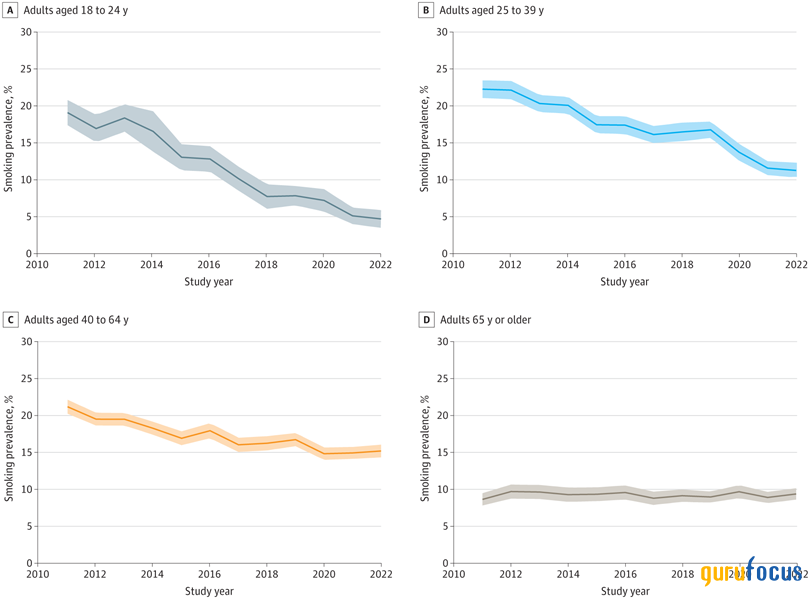

When examining only the smokable products segment, it experienced a 3% decline in 2023, but this matters little. What drives the thesis is how this revenue will behave in the coming years and decades. As previously mentioned, the historical trend observed has been a significant decline. According to the JAMA Health Forum, in 2022, smoking prevalence had already reached 5% among the age group of 18 to 24 years, accompanied by strong reductions up to 39 years, despite slow declines among those aged 40 to 64 years and no decrease among those 65 years or older.

Source: Jama Health Forum

The U.S. national cigarette smoking prevalence was 15.50% in 2020, with goals to reach 5% by 2030 through a series of initiatives, which may even include cigarette tax increases. In this scenario, there would be additional pressure on Altria's margin if there is no room for higher price increases.

In summary, the prospects for this revenue line are among the worst. There is media, governmental and non-governmental pressure to encourage smoking reduction, and while this directly affects the tobacco company's revenue, it is also extremely challenging to forecast how much it could balance sales declines with constant price increases.

As a counterpoint, it is possible this challenging scenario becomes a competitive advantage for Altria as it serves as a significant barrier to entry. With well-established brands (such as Marlboro with over 40% market share), the company has a certain stability for exploiting such a market.

Other products are also difficult to predict

In 2023, oral tobacco products accounted for approximately 10.90% of the group's revenue, while "all other" accounted for about 0.25%. While the smokable segment experienced a 3.20% decline, oral tobacco recorded a 3.40% gain. Although the growth percentage was reasonable given its lower relevance, even more accelerated growth will be necessary to compensate for potential long-term decelerations.

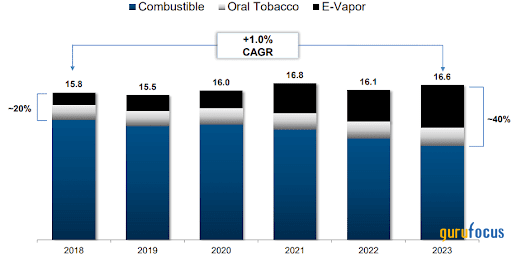

It is necessary to mention that Altria has interesting enterprise goals for 2028, such as achieving smoke-free revenue of $5 billion by 2028, which would represent about 20% of the total revenue.

Source: Altria's IR

One highlight for oral tobacco is its operational margin; due to lower taxes, the company can operate the segment very profitably, having achieved an operating income margin of 65%, while the smokable products segment reached 49%.

In addition to this segment, it is also necessary to mention the e-vapor market, in which Altria has exposure through NJOY. This market has been gaining traction among nicotine volumes, offsetting the decline in combustible products in recent years. Moreover, with its extensive distribution channel, Altria reached the milestone of 75,000 stores receiving NJOY's products in fourth quarter.

Source: Altria's fourth-quarter 2023 earnings presentation

Finally, the company is also invested in alcoholic beverages through its stake in Anheuser-Busch InBev (NYSE:BUD) (which it is reducing its exposure to), with dividends received totaling $163 million in 2023, representing approximately 2% of net earnings.

Source: Altria's 10-K

Once again, what matters for the thesis here is the probability of the company being able to grow these revenue lines in such a way as to mitigate the decline in contracted sales on the smokable side.

From my standpoint, despite their huge moats (cash for mergers and acquistitions, research and distribution), it is still not so clear that these segments will ever become as relevant as smokeables.

I do not believe this is impossible, but it certainly will not be an easy task, not only considering the necessary growth but also the obstacles ahead, ranging from initiatives against tobacco (even smoke-free ones) and regulations to competition in parallel markets.

The brighter side of the thesis

Among the factors that stand out in the thesis, I emphasize its dividend distribution bias allowed through its strong cash generation. The company not only has a dividend yield close to 9.20% but also managed to achieve 54 consecutive years of dividend growth.

This makes holding the thesis not a challenging task. For instance, while the company seeks ways to maintain its long-term growth and profitability, shareholders will probably be remunerated at a rate close to 9% in the coming years.

To illustrate this, the company's earnings per share guidance for 2024 is between $5 and $5.15, resulting in 1% growth compared to 2023 at the bottom end of the guidance, which with a similar payout will still result in a very high dividend yield.

However, for the thesis to be attractive, it is necessary for at least reasonable stability prospects to be maintained. It is not worth receiving a 9% dividend yield if, at some future point, the market believes revenue will decline rapidly, which in this pessimistic scenario could lead to even lower multiples (and dividend returns would not compensate for the falling stock or the opportunity cost of being invested in other theses).

This is just an assumption of what could happen in a "disastrous" scenario. In summary, the thesis for me relies on how slow the revenue decline will appear versus whether the company can figure out a way to mitigate it.

The bottom line

Using a Reverse DCF method on GuruFocus, you can see that the assumptions built into the current stock price are already pessimistic and something close to a discount rate of 11%, 1% per year free cash flow growth for 10 years and 0% at the terminal stage. Even with such pessimistic assumptions, I still have no confidence the company will be able to maintain its current level of free cash flow over the coming decades.

Despite being undervalued (forward price-earnings ratio of 8.60) and with a very attractive dividend yield, I have little confidence in the perpetuity of the business. As a long-term investor looking not only for cheap businesses with competitive advantages, but also for long-term sustainability, my view is neutral - reflecting my more cautious stance toward the company and how I do not find it attractive enough to add to the portfolio.

Nevertheless, I highlight that Altria has good fundamentals and operates with a relevant market share, high margins and high cash generation, as well as optionalities that may become relevant. The perception could change if the visibility of its alternative products improves in the coming quarters and years.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance