Neuronetics (STIM) Progresses in MRD and TRD With New Deal

In a significant move to enhance mental health care accessibility, Neuronetics, Inc. STIM has entered into an expanded commercial partnership with Transformations Care Network (“TCN”), a mental health care provider. This partnership marks a significant advancement in the field of mental health treatment, particularly for patients suffering from major depressive disorder (MDD) and treatment-resistant depression (TRD).

The financial terms of the deal were not disclosed.

More on the Deal

With Neuronetics designated as the exclusive supplier of new transcranial magnetic stimulation (TMS) equipment to TCN, the agreement significantly amplifies the availability of NeuroStar TMS treatments.

By combining advanced technologies and treatments, TCN aims to elevate the standard of care for individuals grappling with complex mental health conditions.

Significance of the Deal

The collaboration between Neuronetics and TCN holds particular significance in the realm of treatment-resistant depression. MDD, especially when resistant to conventional treatments, presents a substantial challenge in mental health care. NeuroStar TMS therapy offers a non-invasive alternative that has shown effectiveness where traditional pharmacological interventions have fallen short.

Image Source: Zacks Investment Research

Market Prospects

According to an Imarc Group report, the global mental health treatment market is projected to grow from $435.2 billion in 2023 to $567.3 billion by 2032 at a CAGR of 2.9%. Primary growth drivers include increasing demand, digital advancements, corporate focus on mental well-being, and supportive government policies. With applications across various industries and North America leading the charge, competition remains fierce, emphasizing innovation and quality. Despite challenges like stigma, opportunities lie in technology and telehealth solutions, promising a dynamic future with personalized treatment approaches.

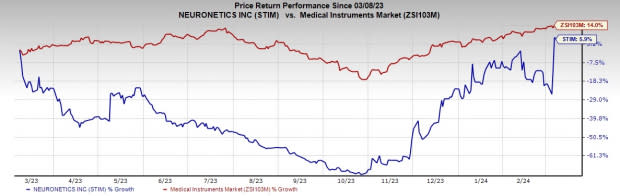

Share Price Performance

Over the past year, shares of STIM have risen 5.9% compared with the industry’s 14% growth.

Zacks Rank and Key Picks

Neuronetics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Cardinal Health CAH, Stryker Corporation SYK and Cencora, Inc. COR.

Cardinal Health, sporting a Zacks Rank #1 (Strong Buy), reported second-quarter fiscal 2024 adjusted earnings per share (EPS) of $1.82, which beat the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion improved 11.6% on a year-over-year basis and also topped the Zacks Consensus Estimate by 1.1%.

CAH has a long-term estimated earnings growth rate of 15.3% compared with the industry’s 11.8% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stryker, carrying a Zacks Rank #2 (Buy), reported fourth-quarter 2023 adjusted EPS of $3.46, beating the Zacks Consensus Estimate by 5.8%. Revenues of $5.8 billion outpaced the consensus estimate by 3.8%.

Stryker has an estimated earnings growth rate of 11.5% for 2025 compared with the S&P 500’s 9.9%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 5.1%.

Cencora, carrying a Zacks Rank #2, reported first-quarter fiscal 2024 adjusted EPS of $3.28, which beat the Zacks Consensus Estimate by 14.7%. Revenues of $72.3 billion outpaced the Zacks Consensus Estimate by 5.1%.

COR has an earnings yield of 5.75% compared with the industry’s 1.85%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 6.7%.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Neuronetics, Inc. (STIM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance