A tale of two streamers: Netflix hits a rough patch as Peacock spreads its wings

This week saw two media giants embark into unfamiliar territory, as Comcast’s (CMCSA) Peacock streaming platform launched, while Netflix (NFLX) hit sudden turbulence after a lackluster second quarter earnings report.

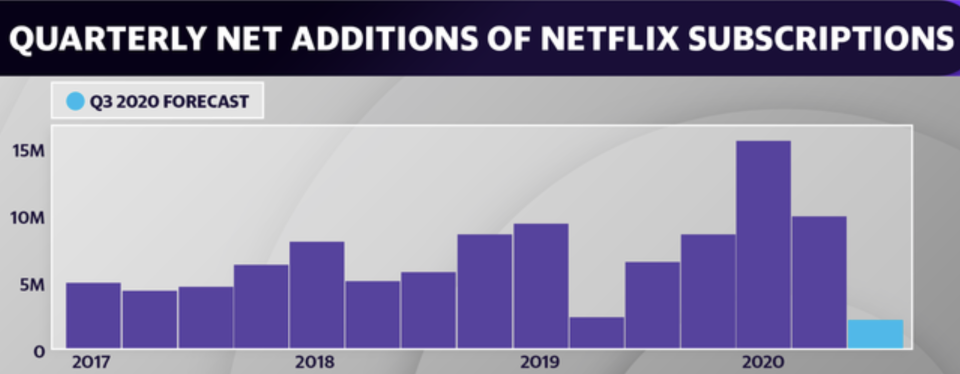

The streaming giant missed on earnings estimates, but did beat on both revenue and global paid net subscribers. It also added over 10 million users last quarter (compared to the 8 million expected.)

But what seems to be spooking investors is the disappointing subscriber growth guidance the company issued for Q3 — with executives explaining in the shareholder letter that “growth is slowing as consumers get through the initial shock of Covid and social restrictions.” Investors pilloried the stock on the news, sending shares down nearly 7% at Friday’s close.

Historically, Netflix has provided conservative forecasts, with Manhattan Venture Partners analyst Santosh Rao telling Yahoo Finance that investors “really have to look long-term” when it comes to the platform giant’s place in the streaming wars.

“The whole secular trend is toward streaming, and these guys are in the right spot,” Rao added.

Simultaneously, Netflix also revealed that Chief Content Officer Ted Sarandos will be promoted to co-CEO, serving alongside current CEO Reed Hastings.

The move is an interesting one for the company, but it underscores the importance of original content in an overly-saturated streaming world.

Sarandos, who frequently strikes up partnerships with TV studios and production houses, is known as the behind-the-scenes dealmaker for the platform. He is largely seen as the unofficial face of Netflix — especially in Hollywood.

But despite the change, Hastings has doubled down on the fact that this isn’t a sign he’ll be departing the company any time soon, explaining in a letter to shareholders that “Ted has been my partner for decades. This change makes formal what was already informal — that Ted and I share the leadership of Netflix.”

Meanwhile, the platform is eager to restart production after coronavirus delays. For 2021, Netflix said the pandemic will “lead to a more second half weighted content slate in terms of our big titles, although we anticipate the total number of originals for the full year will still be higher than 2020.”

It’s an encouraging sign as more competitors enter the space — with NBC’s Peacock officially making its streaming debut earlier this week.

The new platform, which is relying on a three-tier pricing strategy, is hoping its premium ad-supported offering will help drive growth. With Peacock’s pricing, you can choose one totally free tier with access to most of the content with ads; or pay $5 per month for access to the full catalog (also with ads), or $10 per month for no ads.

According to a recent survey by The Trade Desk, it’s a tactic that just might work, as more Americans seem to prefer watching ads rather than paying high subscription costs.

The survey found that 35% of millennial consumers would rather watch a free streaming service with advertising for a cheaper subscription, versus 31% who would prefer to pay for a subscription with no ads.

Additionally, 2 in 3 millennials would increase ads to cut monthly streaming costs, the survey found.

Alexandra is a Producer & Entertainment Correspondent at Yahoo Finance. Follow her on Twitter @alliecanal8193

Read more:

Disney+'s 'Hamilton' gambit pays off, giving platform a big boost: Data

Why Kim Kardashian's $200M Coty deal might not make her a billionaire (yet)

'Gone with the Wind' returns to HBO Max as Disney revamps Splash Mountain

Hollywood plans post-coronavirus restart, but normal won't return 'for a long time'

AMC on why it reversed course on face masks: 'We did not go far enough'

Yahoo Finance

Yahoo Finance